Indices: investors switched to buying on downturns despite extreme fear

Indices: investors switched to buying on downturns despite extreme fear

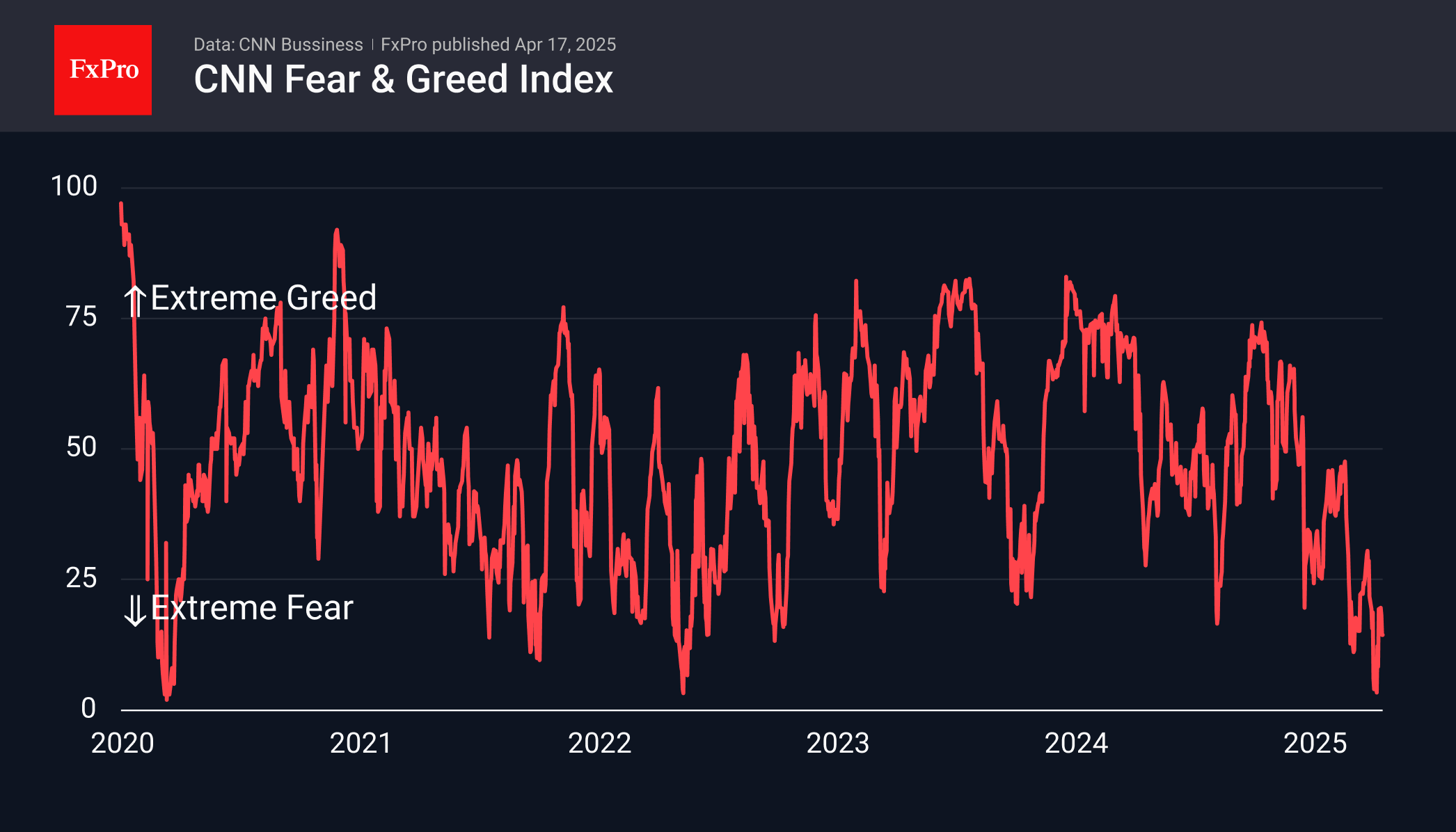

US stock indices have been under pressure, with the Nasdaq 100 losing about 6% over the week and the S&P 500 losing about 4.5%. While this is a wide range in normal times, the amplitude of the current swings is almost three times smaller than the previous week. Extreme fear continues to dominate the markets, but history shows that a return of the Fear and Greed Index to double-digit territory encourages investors to go into ‘buy on downturns’ mode, which maintains an upward bias even in the face of increased volatility and nervous trading patterns.

The S&P 500 continues to clash with the downtrend line formed over the past two months, but a strong bounce last week prevented a slide below the 200-week moving average, the most important support of the past 14 years. Previously, an approach or breach of this line has been accompanied by the launch of the Fed's emergency liquidity injection measures or a change in its policy. Additionally, on the daily charts, the RSI index has started to bounce off the lowest values seen since March 2020.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)