Bitcoin and Ether show bears’ strength

Bitcoin and Ether show bears’ strength

Market picture

The crypto market slightly corrected its previous growth, losing 0.3% of its capitalisation to $1.176 trillion. Bitcoin lost 0.5%, Ether - 0.2%, while top altcoins moved from -1.2% (XRP) to +0.9% (Dogecoin).

On Wednesday, Bitcoin attempted to climb above $30K and was again pushed back by sellers. The decline in financial markets didn’t help Bitcoin this time, as risk-off sentiment was driven by global economic growth and losses in tech stocks.

The technical picture at the start of the day on Thursday is on the side of the bears, who have managed to keep BTCUSD below its 50-day moving average, signalling a change in the medium-term trend from bullish to bearish. A break below $28.8K can switch the entire crypto market into a faster sell-off mode.

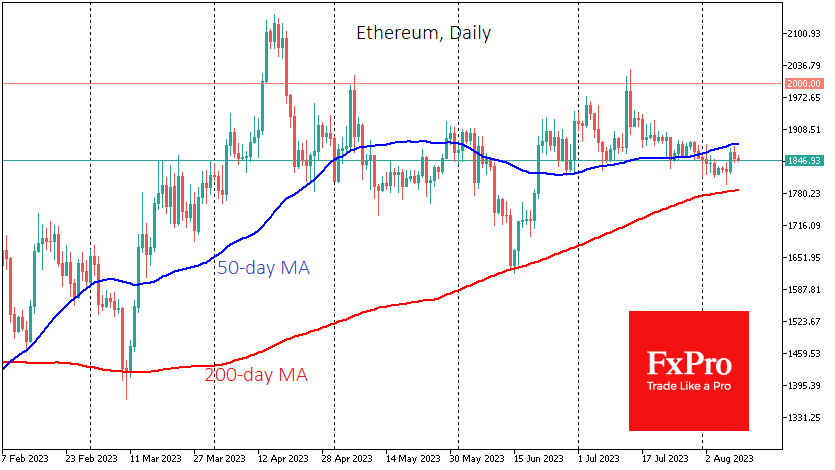

Ethereum has also been trading below its 50-day moving average since late last month, with the sell-off intensifying as it approaches $1900. A break below $1800 would likely accelerate the liquidation of long positions and highlight that the road to recovery for the crypto market will be long and bumpy.

News Background

Another recalculation saw bitcoin mining difficulty rise by 0.12%. The index reached 52.39T. The average hash rate since the previous change was 374.85 EH/s.

Mike Novogratz, Galaxy Digital CEO, citing sources at BlackRock and Invesco, said the first spot bitcoin ETF could be approved in the US sometime before February 2024.

The US Federal Reserve has increased its oversight of regulated banks involved in crypto and stablecoin transactions. Financial institutions must now obtain written authorisation from the agency before issuing, storing, or transacting crypto assets.

The stablecoin market could grow from $125 billion today to $2.8 trillion in the next five years, Bernstein predicts.

Meanwhile, the developers of the Telegram-bot wallet based on The Open Network announced the launch of the beta version of the TON Space non-custodial wallet.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)