Gold and Silver Surge to Record Highs as Shutdown and Oil Moves Stir Markets | 6th October 2025

Precious Metals Breakout

Precious metals extended their rally at the start of the week, with gold breaking above $3,900 and silver surging past $48.50, marking their highest levels in over a decade. The move came as investors sought stability amid prolonged US political gridlock and shifting expectations for Federal Reserve rate cuts. Meanwhile, OPEC+’s decision to raise output modestly provided mixed cues for commodities, while major FX pairs traded within tight ranges as traders assessed the evolving macro backdrop.

Gold Price Forecast (XAU/USD)

Current Price and Context

Gold extended its rally on Monday, breaking above the $3,900 mark to reach a new record high, as persistent US political uncertainty and rising expectations of a Fed rate cut boosted demand for safe-haven assets. Despite the sharp move higher, some traders are cautious about potential profit-taking near historic resistance levels.

Key Drivers

Geopolitical Risks: Continued US government shutdown and fiscal gridlock support safe-haven flows.

US Economic Data: Delayed US data limits clarity but reinforces dovish rate expectations.

FOMC Outcome: Markets price in higher odds of rate cuts, weakening the dollar and supporting gold.

Trade Policy: Global trade remains stable, keeping risk appetite balanced.

Monetary Policy: The Fed’s dovish bias strengthens gold’s long-term bullish outlook.

Technical Outlook

Trend: Strong bullish trend with momentum at record highs.

Resistance: Immediate resistance lies at $3,950, followed by the psychological $4,000 mark.

Support: Initial support at $3,850, then $3,800.

Forecast: A daily close above $3,900 could pave the way for a test of $4,000, though overbought conditions may trigger short-term pullbacks.

Sentiment and Catalysts

Market Sentiment: Bullish, with strong inflows into metals on safe-haven and rate-cut expectations.

Catalysts: Fed rate cut signals, US political developments, and inflation expectations will shape near-term direction.

Silver Price Forecast (XAG/USD)

Current Price and Context

Silver extended its rally to fresh 14-year highs above $48.50, mirroring gold’s strong momentum as investors piled into precious metals amid global uncertainty and dovish Fed expectations. The move highlights silver’s dual role as both a safe-haven and industrial asset, with buying interest reinforced by optimism in green energy and manufacturing demand.

Key Drivers

Geopolitical Risks: Ongoing US fiscal and political concerns lift demand for tangible assets like silver.

US Economic Data: Delays in US reports amplify rate-cut bets, fueling metals’ strength.

FOMC Outcome: A dovish Fed outlook keeps real yields under pressure, favoring silver.

Trade Policy: Stable trade conditions support industrial demand for the metal.

Monetary Policy: Global central banks leaning dovish sustain bullish metals momentum.

Technical Outlook

Trend: Strongly bullish, extending gains from mid-September lows.

Resistance: Next resistance seen at $49.00, followed by $50.00.

Support: Support rests at $47.80, then $46.80.

Forecast: Silver may test the $50 mark if momentum persists, though short-term consolidation is possible after rapid gains.

Sentiment and Catalysts

Market Sentiment: Strongly bullish amid record-breaking momentum and safe-haven flows.

Catalysts: Fed commentary, global inflation data, and moves in gold prices will be key drivers for silver’s next leg.

Crude Oil Price Forecast (WTI)

Current Price and Context

Oil prices found support near $62 per barrel after OPEC+ announced a modest production increase of 137,000 barrels per day for November, smaller than many traders anticipated. The limited hike helped stabilize crude markets after recent weakness, though lingering concerns over global demand and US political uncertainty continue to temper upside momentum.

Key Drivers

Geopolitical Risks: Ongoing US political turmoil and Middle East stability concerns influence oil sentiment.

US Economic Data: Softer economic signals weigh on demand expectations, capping rallies.

FOMC Outcome: Prospects of Fed rate cuts may indirectly support oil through weaker USD.

Trade Policy: Stable trade flows support moderate recovery in global energy demand.

Monetary Policy: Looser policy outlook across major economies could boost consumption in the medium term.

Technical Outlook

Trend: Mildly bullish recovery after sharp declines in prior weeks.

Resistance: Key resistance sits at $63.50, followed by $65.00.

Support: Support at $61.80, with stronger support at $60.50.

Forecast: Crude may consolidate as traders digest OPEC+’s decision, with potential upside toward $65 if demand outlook steadies.

Sentiment and Catalysts

Market Sentiment: Cautiously optimistic after OPEC+’s limited hike reassured markets of supply discipline.

Catalysts: OPEC+ follow-up guidance, US inventory data, and demand indicators from China will shape oil’s next direction.

New Zealand Dollar Forecast (NZD/USD)

Current Price and Context

The New Zealand Dollar held gains above 0.5800 as traders reacted to prolonged US government shutdown concerns and growing expectations of a Fed rate cut later this year. Although risk sentiment remains fragile, the Kiwi benefited from a softer US Dollar and steady demand for higher-yielding assets in the Asia-Pacific region.

Key Drivers

Geopolitical Risks: Ongoing US shutdown uncertainty keeps markets defensive but supports USD weakness.

US Economic Data: Delayed data releases make near-term dollar direction less predictable.

FOMC Outcome: Rising bets on a Fed rate cut underpin NZD/USD resilience.

Trade Policy: Stable trade with China continues to support New Zealand’s export outlook.

Monetary Policy: The RBNZ remains neutral, maintaining cautious optimism about domestic conditions.

Technical Outlook

Trend: Gradual bullish bias as pair stabilizes above 0.5800.

Resistance: Resistance at 0.5850, followed by 0.5900.

Support: Support lies at 0.5770, then 0.5730.

Forecast: NZD/USD could extend gains if the US Dollar remains under pressure and risk sentiment improves.

Sentiment and Catalysts

Market Sentiment: Moderately bullish as traders favor risk currencies amid easing Fed outlook.

Catalysts: Shutdown headlines, Fed commentary, Chinese economic data, and RBNZ updates will drive direction.

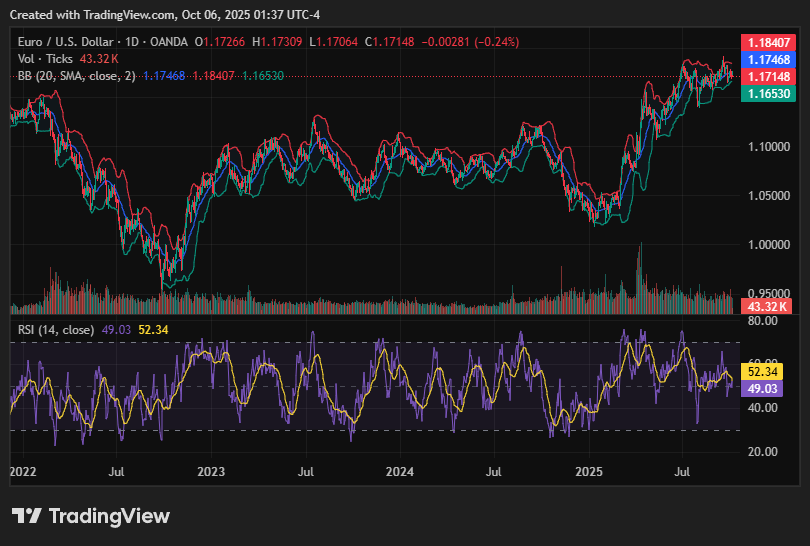

Euro Forecast (EUR/USD)

Current Price and Context

The Euro held near 1.1700, extending its mild downtrend as traders digested renewed US Dollar strength and Fed rate cut expectations. Despite recent losses, downside momentum appears limited, with investors hesitant to push the pair lower amid ongoing political and economic uncertainty in the US.

Key Drivers

Monetary Policy Outlook: Growing speculation of a Fed rate cut continues to provide a cushion for EUR/USD.

US Shutdown Concerns: Prolonged fiscal uncertainty weakens the USD, lending mild support to the Euro.

Eurozone Data: Mixed inflation and growth signals keep the ECB’s stance cautious but stable.

Risk Sentiment: The Euro benefits modestly when markets lean risk-on, particularly against the USD.

Yields: US Treasury yields have softened slightly, narrowing rate differentials.

Technical Outlook

Trend: Consolidation with a slight bullish bias above key support.

Resistance: 1.1730, followed by 1.1765.

Support: 1.1670, then 1.1630.

Forecast: EUR/USD may stabilize within a narrow range, with potential to recover if Fed easing bets strengthen.

Sentiment and Catalysts

Market Sentiment: Cautiously bullish as traders price in softer US policy.

Catalysts: Fed communications, Eurozone inflation prints, and shutdown-related updates will be key.

Wrap-up

The spotlight remains on the metals market as traders watch whether gold and silver can sustain momentum near record territory. Broader sentiment continues to hinge on Fed policy signals, global growth indicators, and energy market developments. With volatility persisting across commodities and currencies, traders are bracing for another dynamic week ahead.

Ready to trade global markets with confidence? Join Moneta Markets today and unlock 1000+ instruments, ultra-fast execution, ECN spreads from 0.0 pips, and more! Start now with Moneta Markets!