Short-term negatives from PMIs do not cause ECB to change course

Short-term negatives from PMIs do not cause ECB to change course

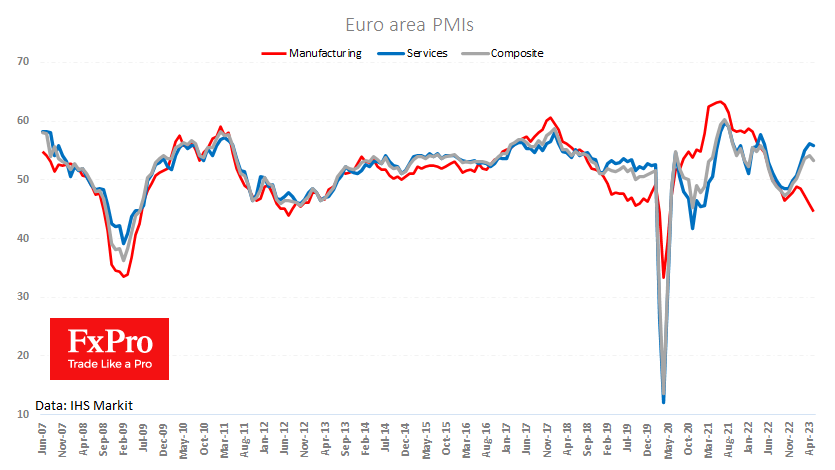

Preliminary readings of the PMIs for business activity in the euro area generally revealed a worse-than-expected deterioration. According to the composite index, the last time the euro area industry suffered this badly was in 2008-2009 when the economy was in a sharp downturn.

The persistent decline in manufacturing activity since the beginning of the year has already impacted the services sector, where a reversal from growth to contraction may have occurred after the annual highs in April.

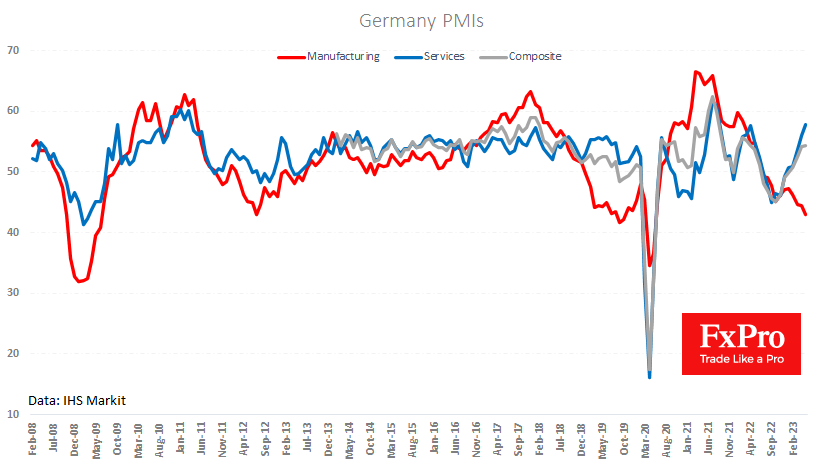

The principal destabilising factor was the collapse in German manufacturing activity, where the corresponding index fell from 44.5 to 42.9, against expectations for a rise to 44.9. The surprise in this collapse was the sharp fall in gas prices in recent months, which should have boosted activity.

The services sector has been solid, especially in Germany. The gaps between the indices have not existed since 2009, and at least they were moving in the same direction, with manufacturing falling faster. However, services are gaining ground as they can pass on higher costs to buyers.

This is a very uncomfortable picture for the central bank. A contraction in output is a strong argument for a softer monetary policy. This is also reflected in employment trends, which are already showing a reversal. However, price developments in the services sector point to secondary inflationary effects - the central bank's worst enemy.

The ECB faces a difficult choice between inflation and recession. The signals we have received at the last two rate-setting meetings indicate a willingness to sacrifice growth temporarily in favour of a quicker victory over inflation. And this choice is in line with the historical behaviour of continental Europe.

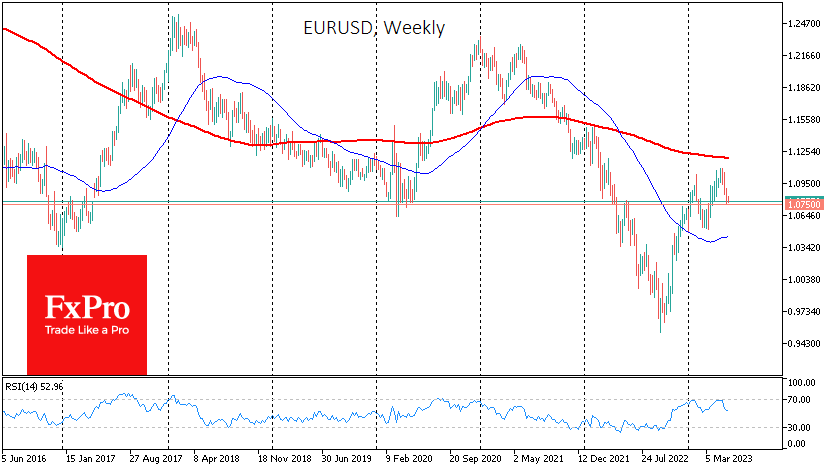

Overall, the weak PMI data for May could put some pressure on the Euro in the short term. However, investors and traders should remember that there has been no sign of a pause in interest rate hikes from the ECB, and the new data strengthens the case for a continued fight against inflation.

Technically, the EURUSD is in bearish territory, below the 50 SMA and testing a two-month low at 1.0780. There is also a key support area for the pair in 2020 and from 2015 to 2017. The pullback in the EURUSD over the past four weeks looks like a correction from the accumulated overbought area from the 16% rise in the pair from last October's lows.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)