Gold in a wait-and-see mode

It was a harsh weekend, as Iran’s retaliatory missile and drone attack against Israel sparked concerns of global conflict. But traders seem to have concluded this attack will not lead to further escalation for the time being, averting another record rally in the safe-haven gold.

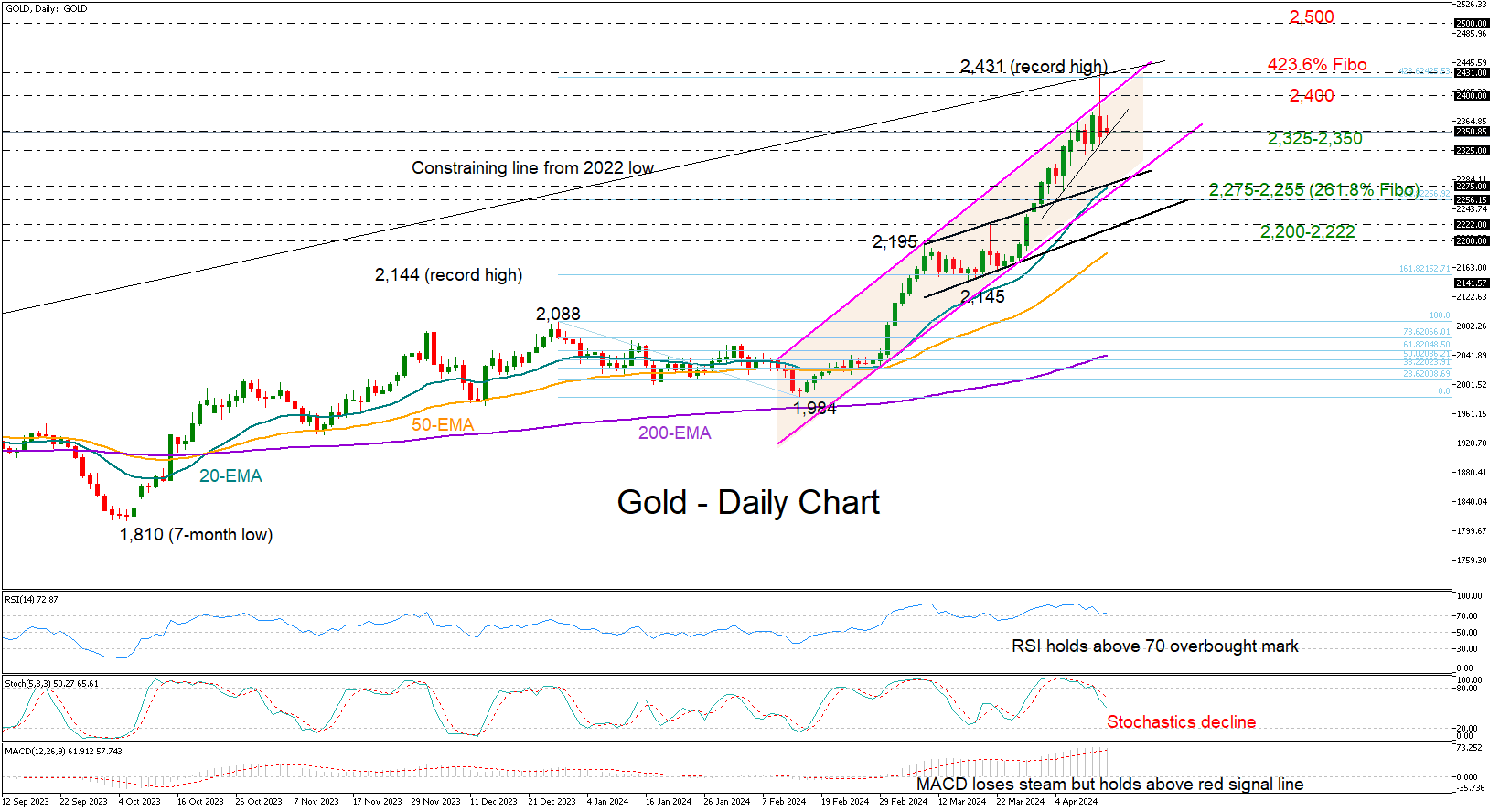

Bullion started the day steady, remaining close to the 2,350 level, which aligns with the 20-period EMA on the four-hour chart, after reaching a record high of 2,431 on Friday.

Technically, overbought conditions are still present. Thus, it is possible that a downside correction will occur in the near future. However, in order for selling pressures to intensify, the bears need to crack the 2,325 floor. In this case, the price could tumble towards the 2,255-2,275 territory, where the 20-day EMA and the broken short-term resistance line from March are located. Even lower, the price could pause within the 2,200-2,222 region.

On the upside, the 2,400-2,430 zone, which includes the 423.6% Fibonacci extension of the December-February downfal and the upper boundary of a bullish channel, will be closely watched. A decisive break higher could see an advance towards the 2,500 psychological level. Nevertheless, for that to happen, there must be a significant deterioration in global geopolitical conditions.

Overall, gold maintains a strong bullish trend in the big picture. A sustainable move above 2,430 or below 2,325 could navigate the market accordingly.

.jpg)