USDCAD shrugs off upbeat US jobs data

USD/CAD could not successfully capitalize on stronger-than-expected US nonfarm payrolls, ultimately closing marginally lower on Thursday. The passage of Trump’s megabill in the Republican-controlled House of Representatives – expected to increase fiscal debt by more than $3 trillion – came as no surprise to investors and kept volatility subdued as US investors logged off for the July 4 celebrations.

However, concerns over global trade partners beginning tariffs payments on August 1 continued to weigh on market sentiment early on Friday, reinforcing the bearish short-term outlook.

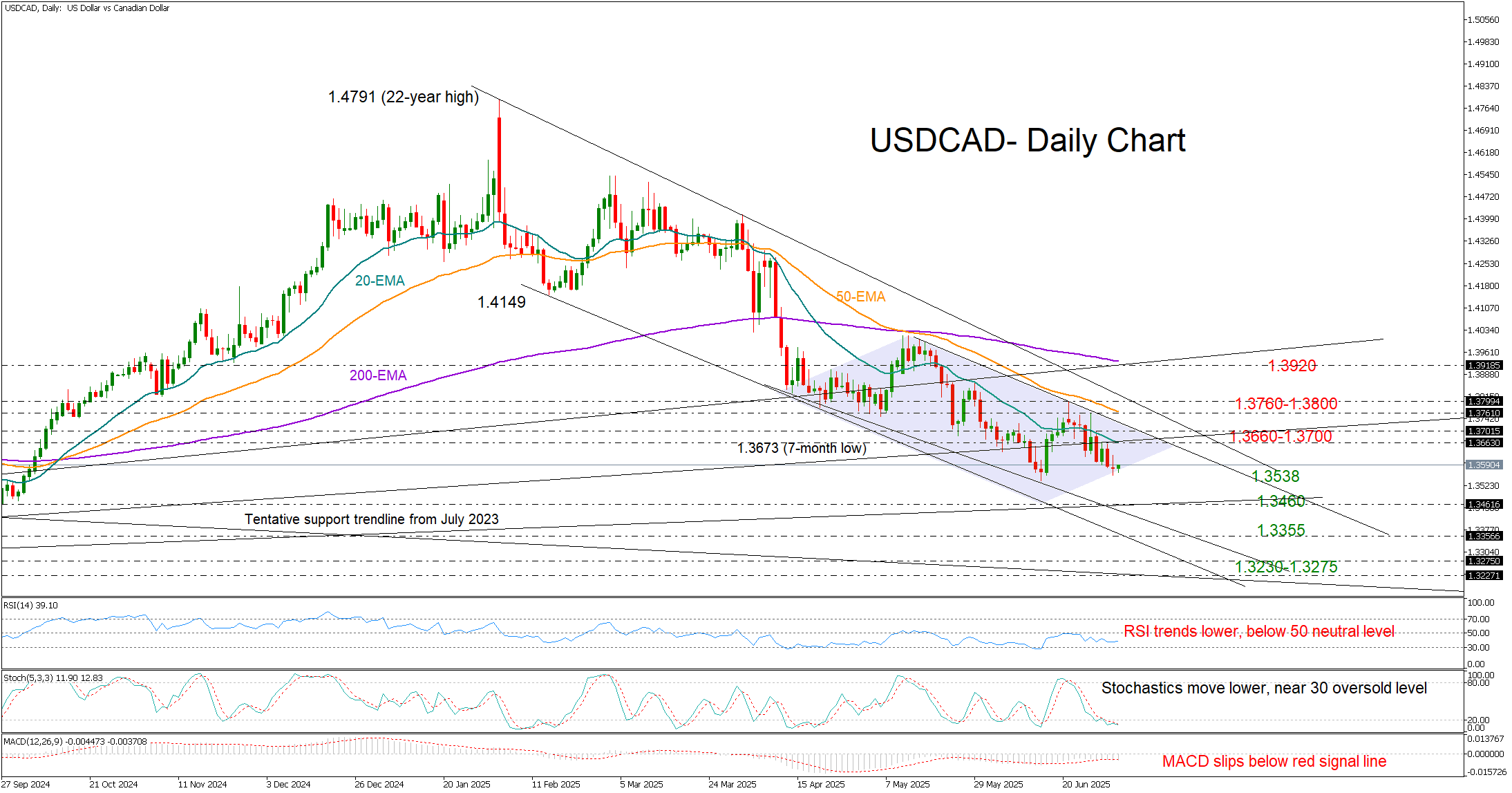

Technical indicators are clearly pointing downwards, flagging a potential downtrend extension below May’s low of 1.3538. In this scenario, the tentative support line from July 2023 could come to the rescue near 1.3460. If this level fails to hold, the decline may accelerate toward the 1.3355 support zone, which was last tested in January–February 2024. A further drop could target the 1.3230–1.3275 area.

On the upside, the bulls may encounter immediate resistance between the 20-day simple exponential average (EMA) at 1.3660 and the psychological 1.3700 level. Further up, the 50-day EMA and the 1.3800 mark, which may limit upward momentum and prevent a swift recovery toward 1.3920.

In summary, the current bearish phase in USD/CAD appears to have more room to run, with a new lower low potentially forming around 1.3460.

.jpg)