A Fed nightmare?

A Fed nightmare?

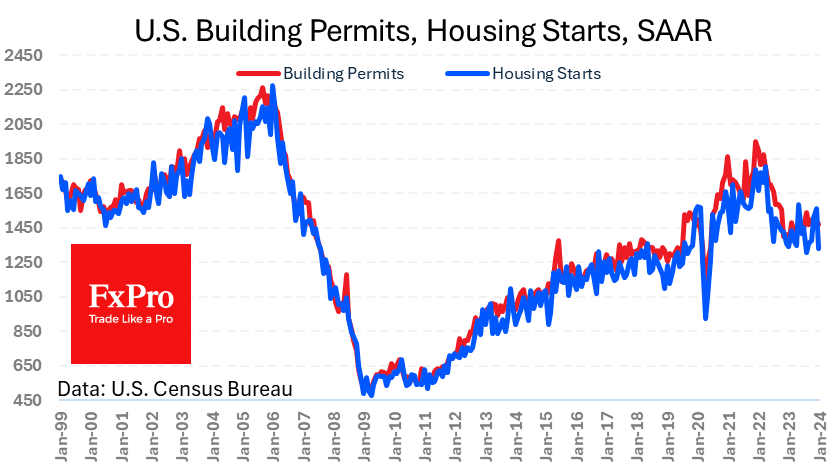

US housing starts plunged 14.8% to 1.331m in January, reversing four months of growth and taking the figure back to last year’s lows. This is in sharp contrast to analysts’ average expectations of 1.450m.

The number of building permits issued fell less dramatically, by 1.5% to 1.47 million, against expectations of 1.51 million.

The worse-than-expected data added to fears of a slowdown in final demand after the previous day’s disappointing retail sales data. This is bearish news for the dollar as it brings the date of monetary easing closer.

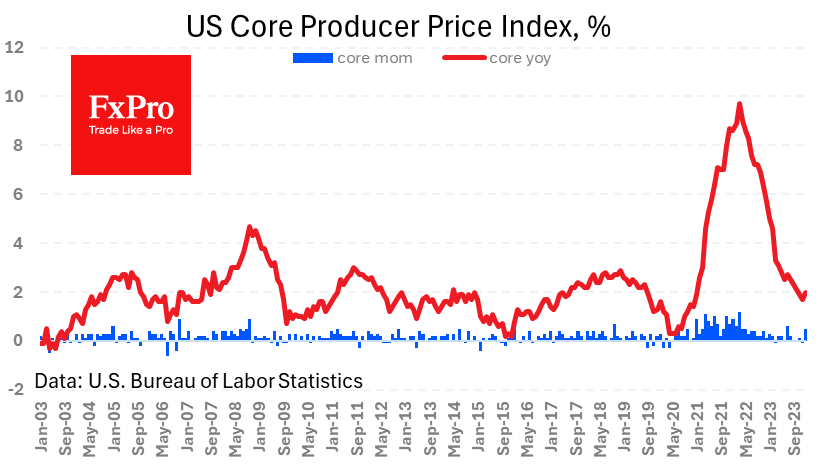

Working against this argument, however, is inflation. The core PPI rose 0.5% m/m and accelerated to 2.0% y/y last month. Economists, on average, expected a slowdown to 1.6% y/y. This is another inflation surprise after the upbeat CPI data earlier in the week.

Isn’t this the realisation of the Fed’s nightmare of accelerating inflation and economic slowdown at the same time? In our view, it is more likely that the FOMC will opt for an extended pause in this environment, which should be bearish for equities and bullish for the dollar.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)