AUDUSD challenges the recent 3-month peak

· AUDUSD faces strong battle near 200-day SMA

· MACD and RSI suggest bullish bias

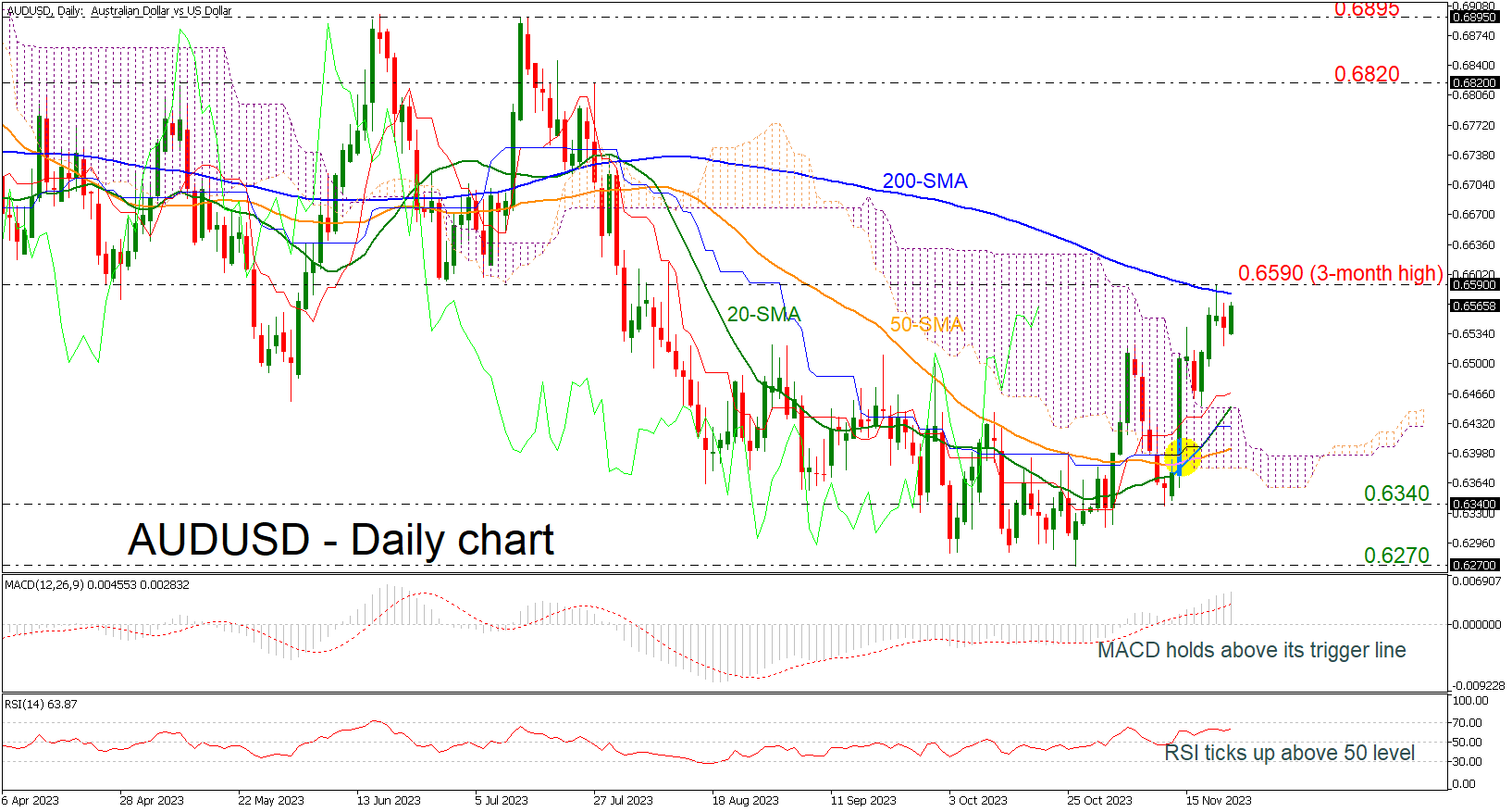

AUDUSD could not find enough buyers to expand Tuesday’s bull run above the three-month high of 0.6590, closing with some losses on Wednesday.

Technically, the short-term risk is leaning to the upside. The price is developing well above the Ichimoku cloud, while the MACD oscillator is strengthening its positive momentum above its trigger and zero lines. Also, the RSI is pointing north and is moving towards the 70 level.

Given the current positive momentum, the question now is whether the pair will move above the 200-day simple moving average (SMA). A clear step above it and beyond the three-month high of 0.6590 would drive the market towards the next psychological marks, such as 0.6600, 0.6700 and 0.6800 before challenging the 0.6820 resistance level, registered on July 27.

However, if the market fails to climb above the recent peak, traders will turn to the downside again meeting the Ichimoku cloud and the 20- and the 50-day SMAs at 0.6450 and 0.6400 respectively. More losses would put the bearish outlook back into play, resting near 0.6340 and 0.6270.

To sum up, the latest spike in AUDUSD has not excited traders yet. An extension above the 200-day SMA and the 0.6590 barricade is still required to make the upturn look more credible. Note that the bullish cross between the 20- and 50-day SMAs is still intact.

.jpg)