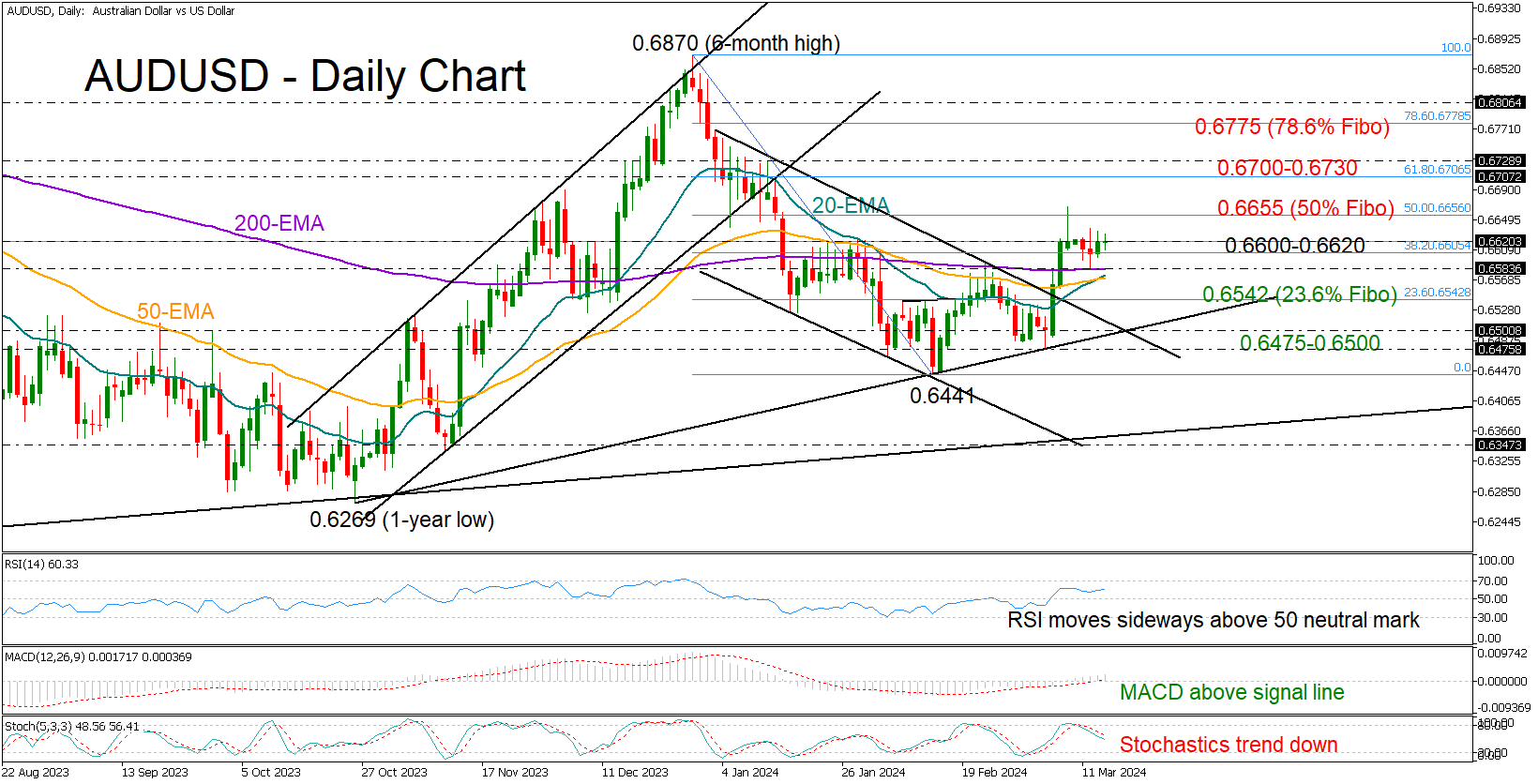

AUDUSD waits for direction after bullish break

AUDUSD regained positive momentum and climbed above its exponential moving averages (EMAs) after breaking out of its 2024 bearich channel. But the 0.6620 region, which was a tough barrier in January, dented the upside forces following the flash spike to 0.6666.

The technical indicators are sending mixed signals, though the nearby support area of 0.6600, which has been limiting downside movements, is preserving a ray of hope that the ongoing tight consolidation phase might develop to the upside.

A close above 0.6620 could help the price to reach the 50% Fibonacci mark of 0.6655 and then stretch towards the 61.8% Fibonacci of 0.6706 and the 0.6730 resistance. Additional gains from there are expected to pick up steam towards the 0.6770 barrier.

Should the price dip below the 38.2% Fibonacci level of 0.6600 and the EMAs, it may find immediate support at the 23.6% Fibonacci mark of 0.6542, thus preventing a decline towards the ascending trendline from October at 0.6500. If the bears claim the March low of 0.6476 too, the door will open for the February trough of 0.6441.

All in all, AUDUSD is within a tight neutral territory, waiting for a clear close above 0.6620 or below 0.6583 to get a new direction.