AUD/USD remains undecided near crucial technical region

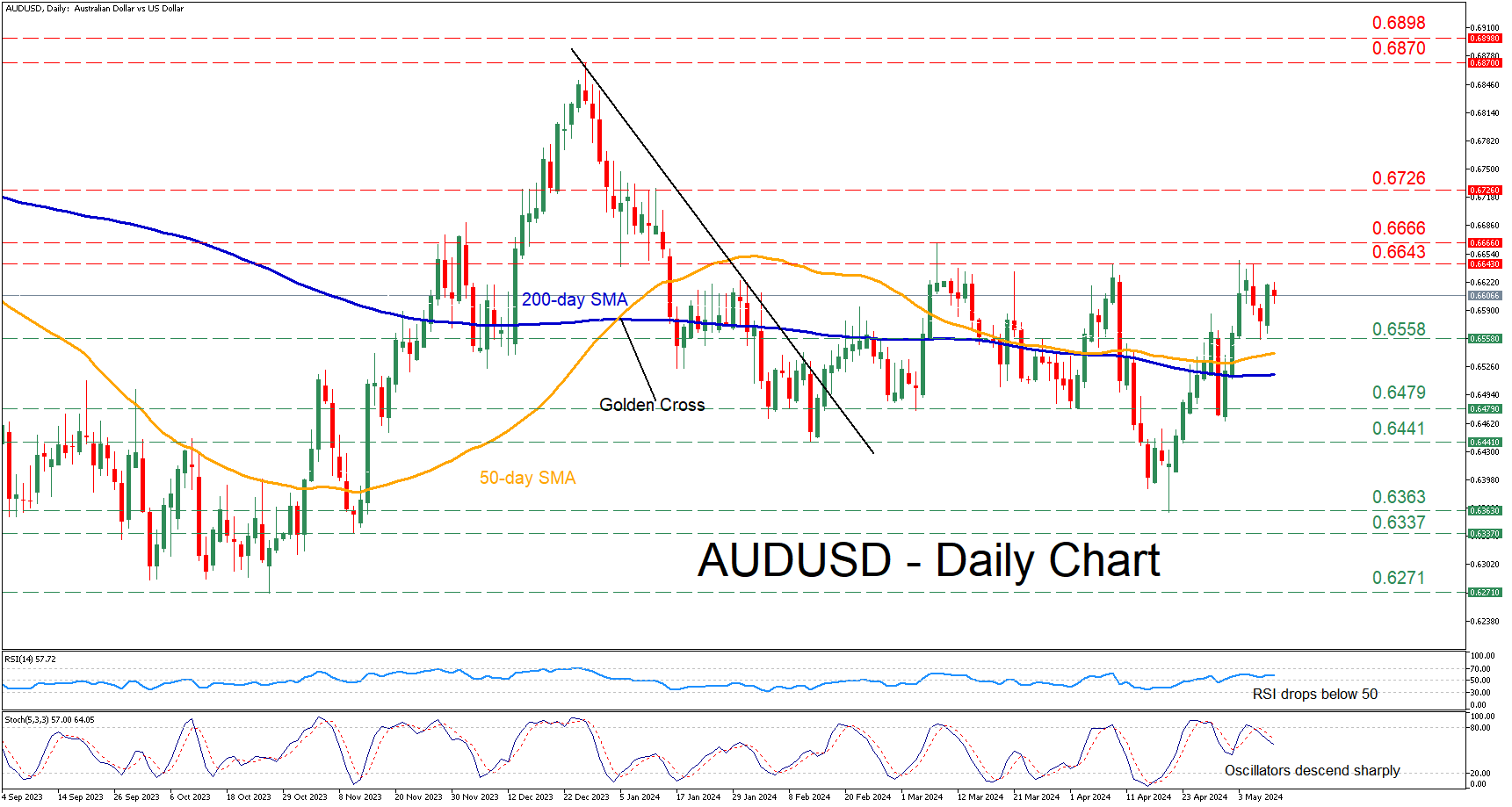

AUDUSD has been in a steady advance since its bounce off the five-month low of 0.6363 in mid-April. Although the pair has been rejected at the 0.6643-0.6666 range three times so far in 2024, the bulls do not seem ready to give up.

If buying pressures persist, the price may initially test the recent rejection region of 0.6643, which also held its ground in early April. A break above that zone could set the stage for the 2024 peak of 0.6666. Even higher, the December-January resistance territory of 0.6726 could prevent further upside attempts.

On the flipside, should the pair reverse lower, the recent support of 0.6558 could act as the first line of defence. In case of a downside violation, the bears may attack the February-March support of 0.6479. Failing to halt there, the price might challenge the February bottom of 0.6441.

In brief, AUDUSD has repeatedly failed to conquer the congested 0.6643-0.6666 region, but the technical picture remains bullish as the price holds above both its 50 and 200-day simple moving averages (SMAs).

.jpg)