Bitcoin is looking at stocks, and that's worrisome

Market picture

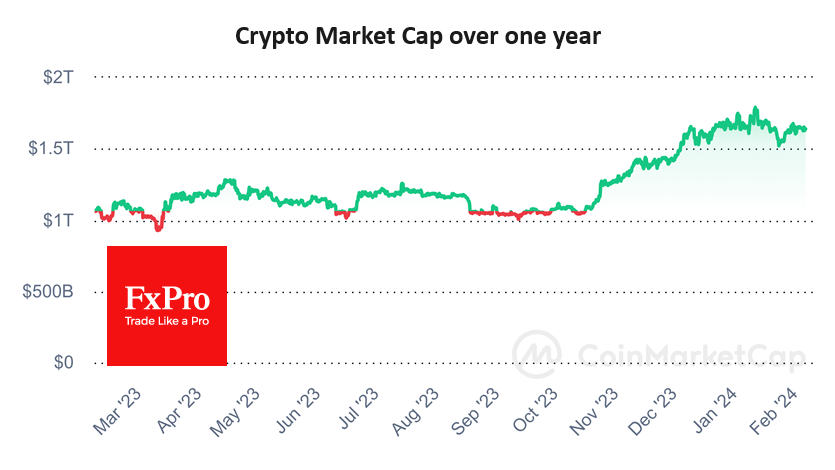

The crypto market remains stable while waiting for further signals. The crypto cap is up 0.4% in 24 hours to $1.64 trillion.

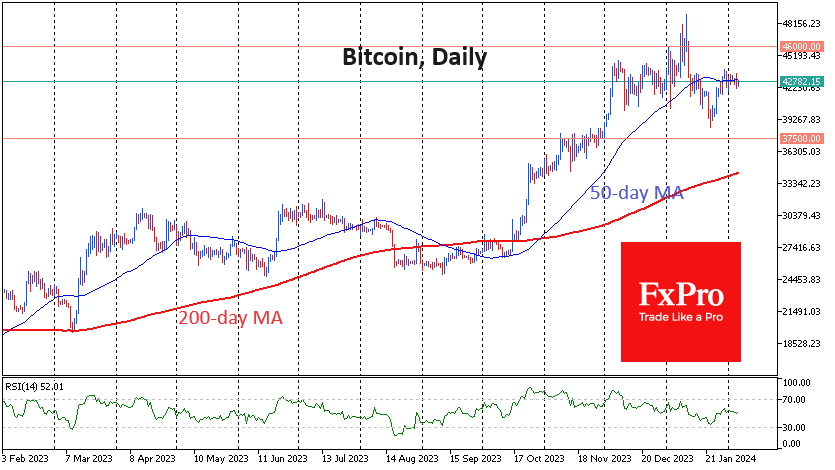

Bitcoin is trading at $42.7K - virtually unchanged in 24 hours, just 1.4% lower than a week ago and a 1.8% decrease over 30 days. Don't think that the first cryptocurrency has turned into a stablecoin, as December's stabilisation after growth has been replaced by a January pendulum swing.

Bitcoin's correlation with stock market sentiment has risen markedly in recent weeks. This looks like a worrying sign because stocks are in the late stages of a rally, where abnormally sharp moves in some instruments (Meta, Nvidia, Amazon) are juxtaposed with corrections in most securities.

According to CoinShares, crypto funds saw inflows of $708 million last week after outflows of $500 million a week earlier. Investments in Bitcoin rose by $703 million, in Solana - by $13 million, while in Ethereum they decreased by $6 million.

Inflows into recently launched spot ETFs (since 11 January) totalled $7.7bn, offset by outflows from a $6bn futures fund. The total global assets under management are $53 billion, CoinShares said.

News background

According to The Block, the volume of transactions in the BTC network is growing for the fourth consecutive month and reached $1.21 trillion in January, the highest since September 2022. Meanwhile, Bitcoin volatility remains at its lowest since December 2023.

Spot bitcoin ETFs from BlackRock and Fidelity were among the top 10 largest U.S. ETFs in terms of asset inflows in January, according to Morningstar data. The two funds had total net inflows of $4.8 billion, with outflows from the GBTC fund reaching $5.7 billion.

Bankrupt cryptocurrency lender Genesis filed for bankruptcy in New York District Court on Saturday. The company is asking it to approve the sale of its $1.6 billion worth of digital assets placed in Grayscale trusts, which could have a negative impact on the cryptocurrency market.

According to CryptoQuant, mining pool reserves have fallen to their lowest level since July 2021. Miners are selling off BTC in preparation for halving when the reward for mining a block drops by half.

Bitcoin will "test investors' resolve" with a sell-off after the halving and will only renew its all-time high in the fourth quarter. This is the forecast presented by analysts DecenTrader.

Bitcoin supporter Nayib Bukele was re-elected president of El Salvador. Experts expect an inflow of specialists and capital to the country.

Spain will expand control over the monitoring of crypto assets to confiscate them to pay off tax debts.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)