Gold attempts recovery after pullback from record high

Gold is attempting to find its footing above 4,250, building an intraday uptick following a pullback from its record peak of 4,380 set on Friday, triggered by easing US-China trade tensions. That said, persistent geopolitical risks, Fed rate cut expectations, and the ongoing US government shutdown continue to act as tailwinds for the precious metal.

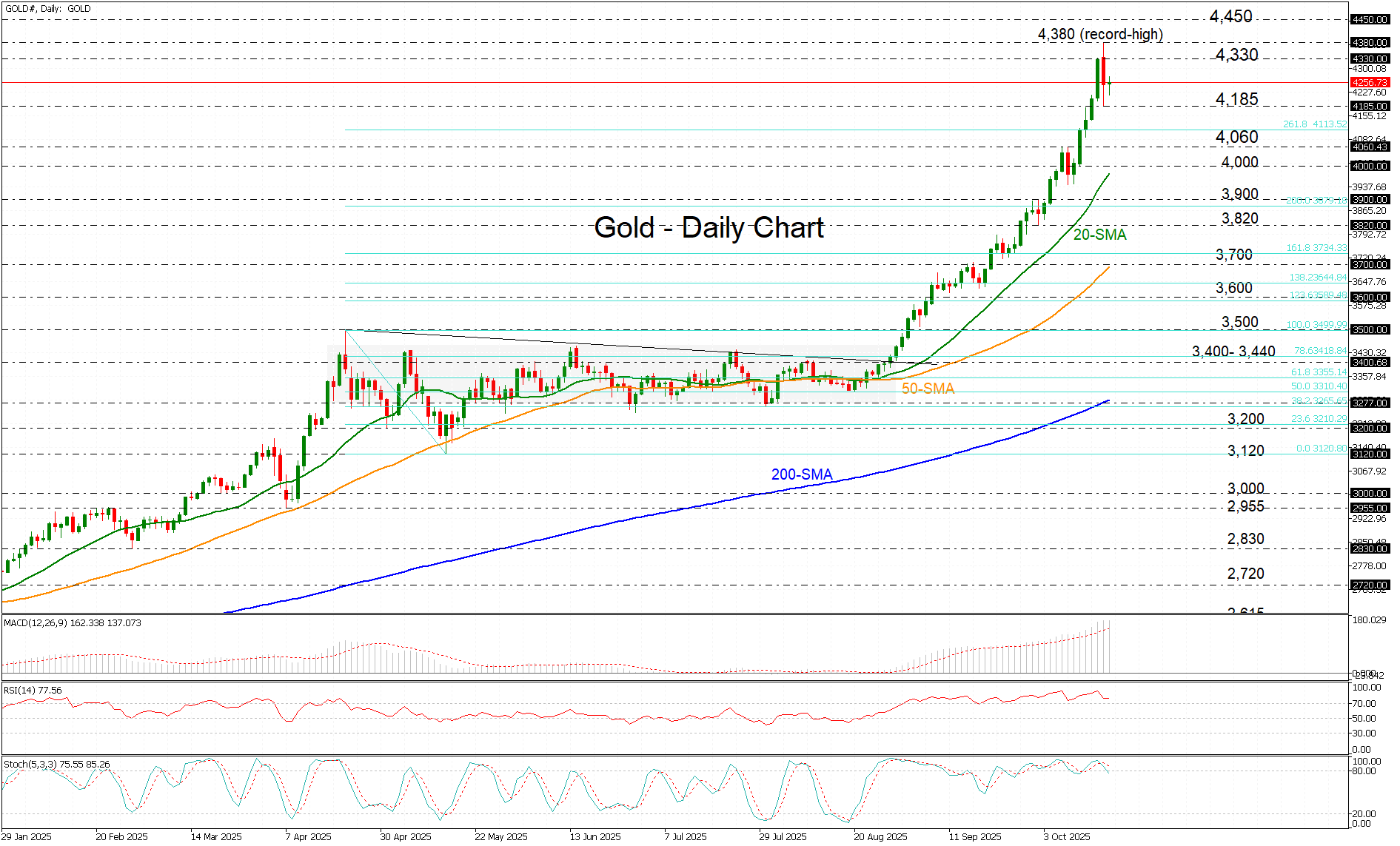

A subsequent move higher is likely to face strong resistance at the October 16 peak of 4,330, followed by the all-time high of 4,380. Beyond that, momentum could extend into uncharted territory, targeting the 4,450 psychological level.

The technical indicators reflect strong bullish sentiment, with the MACD, stochastics, and RSI all in overbought territory. However, they also point to a potentially overstretched market, signalling the possibility of a short-term correction. The %K line of the stochastic oscillator has crossed below the %D line, the RSI is flatlining above the 70 level, and the MACD histogram appears overextended to the upside.

A pullback would first find initial support at Friday’s swing low near 4,185, followed by the 261.8% Fibonacci extension of the previous decline from 3,500 to 3,120, targeting the 4,113 level. Further selling below the 4,100 area, could push prices toward the 4,060-4,000 region, before testing the 20-day simple moving average (SMA) located just below at 3,978, which has held as support since the end of August. A break below that level could suggest a potential top and pave the way for a deeper corrective decline.

All in all, Gold is edging higher at the start of the week and, for now, appears to have stalled its sharp retracement from Friday’s all-time peak. A firm close above the key 4,200 level would support its potential to appreciate further.

--

--