Bitcoin set for a deeper correction

Market picture

The cryptocurrency market capitalisation remained near $1.127 trillion as attempts to develop growth came up against selling pressure near $1.14 trillion. The top cryptocurrencies over the past 24 hours have ranged from a 0.7% decline (Solana) to a 5.6% rise (XRP), while Bitcoin is losing 0.3% and Ether is rising by the same amount.

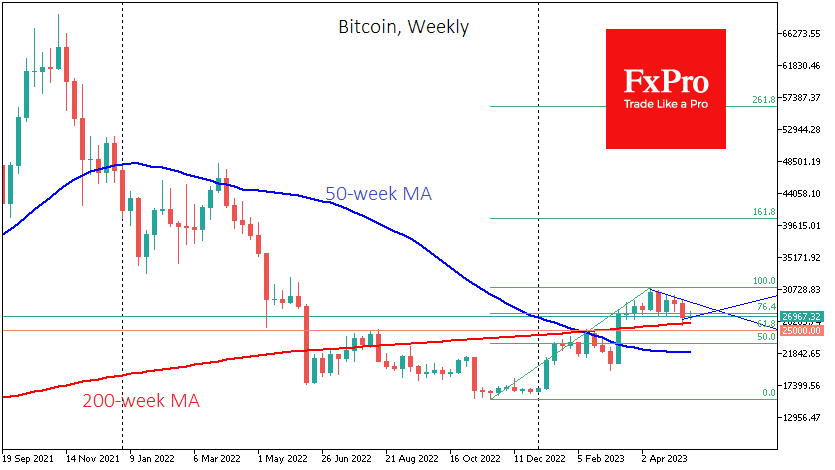

One can discern a moderately upward trend on Bitcoin's intraday charts, but it's worth noting that the price is failing to push up from that local support, which now passes near $27K. Investors and traders should be prepared for a price decline into the $25K area, as the market seems set for a full rally correction from the November lows.

Despite the Bitcoin network's continued rise in transaction volume, the number of active addresses has fallen to 764K - its lowest since July 2021. Due to the hype around BRC-20 and Ordinals tokens, the average transaction fee on the blockchain rose from $2.5 last year to $16.08 at the peak. The situation is to the benefit of Bitcoin miners, who are getting more commission on transactions than from mining for the fifth time in history (6.25 BTC), Glassnode noted.

News background

Bernstein Research expects lower US interest and bank deposit rates will spur public interest in Ethereum-stacking, which generates more interest income. In turn, it could start a new bullish trend in the crypto market.

According to Bloomberg, the appeal of Bitcoin and other cryptocurrencies will decline as US crypto policy tightens and default risks increase.

During the trial of a lawsuit filed by exchange Coinbase, US Securities and Exchange Commission (SEC) officials said drafting laws to regulate cryptocurrencies will take years. In the meantime, fines will "come down". The SEC called Coinbase's lawsuit "unfounded".

The number of transactions on the Dogecoin network has surpassed that of Bitcoin and Litecoin. The community speculates that this momentum is due to activity around DRC-20 tokens, which enable the creation of new digital assets on top of the blockchain.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)