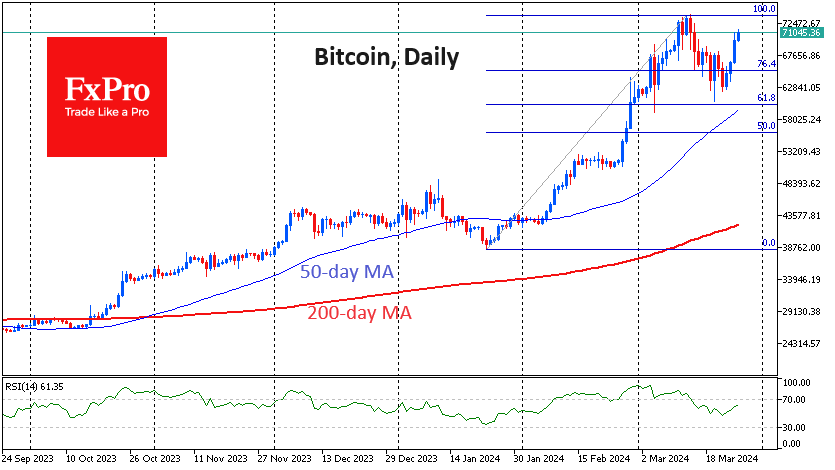

Bitcoin tops $71K

Market picture

Crypto market capitalisation regained another 5% in 24 hours, peaking earlier in the day at $2.7 trillion against a recent peak of 2.7 in mid-March and around $3 trillion at the end of 2021. The recovery is faster than before the decline, promising prospects for further growth.

Bitcoin has once again surpassed the psychologically important 71K. The main intrigue of the next few days is the ability to overcome the previous highs at $73.7K. Strengthening above $75K will make the growth scenario up to 95.5 workable. But until then, one should be prepared for a re-intensification of selling in the first cryptocurrency.

News background

According to CoinShares, investments in crypto funds fell by a record $942 million last week after two weeks of updating all-time highs in inflows. Investments in Bitcoin were down $904 million; Ethereum was down $34 million, and Solana was down $5.6 million. Investments in funds that allow for bitcoin shorts were down $4 million.

Goldman Sachs said there is growing client interest in cryptocurrencies, fuelled by the approval of spot bitcoin ETFs in the US. Demand is mainly coming from traditional hedge funds. However, the institution intends to reach a "broader paradigm of clients", including asset managers and banks and select cryptocurrency-focused companies.

Skybridge Capital founder Anthony Scaramucci advised bitcoin investors not to sell the cryptocurrency even if they are spooked by market volatility.

CommEX unexpectedly announced a complete shutdown on 10 May. Binance said the exchange "failed to fulfil its obligations" as part of a deal to sell the exchange's Russian business to it.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)