BoJ Dovish Rate Hike Weaken Japanese Yen

- The Japanese Yen plunged after the BoJ announced its first rate hike since 2007.

- All eyes will be on the FOMC interest rate decision due today.

- The Reserve Bank of Australia’s dovish tone after announcing its interest rate decision hammers the Australian dollar lower.

Market Summary

The Bank of Japan (BoJ) has concluded its era of negative interest rates with its first rate hike since 2007, simultaneously ending its yield curve control (YCC) policy. Despite this adjustment, the Japanese central bank will persist in purchasing the country's government bonds. This move has been characterised by the markets as a "dovish hike," which significantly impacted the Japanese Yen, rendering it the weakest currency among its peers. Consequently, the Yen plummeted to its lowest level against the dollar since the previous November.

Attention now shifts to the Federal Open Market Committee (FOMC) and its impending interest rate decision, scheduled for later today. The market's expectations have leaned towards a hawkish stance by the Fed, especially after last week's Producer Price Index (PPI) readings came in higher than anticipated, signalling potential inflationary pressures.

In the commodities sector, gold prices have remained relatively stable, awaiting the outcome of the FOMC's interest rate decision. Similarly, oil prices are currently at a recent high, with market participants also awaiting the Fed's decision as well as the weekly American Petroleum Institute (API) crude data, which is due for release today.

Current rate hike bets on 20th March Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (95%) VS -25 bps (5%)

Market Movements

DOLLAR_INDX, H4

DOLLAR_INDX, H4

Following the yen's selloff, investors sought refuge in the safe-haven dollar, resulting in positive gains. With a flurry of central bank decisions dominating currency markets, particularly the Federal Reserve's upcoming announcement, market focus remains keenly on potential interest rate adjustments and monetary policy statements. Expectations lean towards the Fed maintaining its current interest rate range of 5.25% to 5.50%, while closely monitoring the bank's guidance for future actions.

The Dollar Index is trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 72, suggesting the index might experience technical correction since the RSI entered overbought territory.

Resistance level: 104.45, 104.95

Support level:103.70, 103.05

XAU/USD, H4

Better-than-expected inflation data from the US prompted expectations of a hawkish tone from the Federal Reserve during its interest rate decision. Consequently, US Treasury yields climbed alongside the dollar, triggering a selloff in non-yielding assets like gold. Despite this, gold may consolidate within a range ahead of key events, with investors advised to monitor closely for further trading signals, particularly from the Fed's monetary policy decisions.

Gold prices are trading lower while currently testing the support level. MACD has illustrated diminishing bullish momentum, while RSI is at 66, suggesting the commodity might extend its losses after breakout since the RSI retreated sharply from overbought territory.

Resistance level: 2150.00, 2235.00

Support level: 2080.00, 2035.00

GBP/USD,H4

The GBP/USD pair experienced a slight recovery from yesterday's lows but continued to exhibit weakness against the dollar. The market's hawkish expectations reinforced the dollar's strength, particularly in response to last week's robust U.S. Producer Price Index (PPI) reading. Investor focus now turns to the U.K.'s Consumer Price Index (CPI) reading, scheduled for release today, followed by the Federal Open Market Committee (FOMC) interest rate decision. Both sets of data are anticipated to significantly influence the price dynamics of the GBP/USD pair.

GBP/USD recorded a rebound but remains trading in a bearish trajectory. The RSI remains hovering in the lower region while the MACD flows below the zero line, suggesting that the pair remains trading with bearish momentum.

Resistance level: 1.2780, 1.2880

Support level: 1.2630, 1.2530

EUR/USD,H4

The EUR/USD pair has recovered from its lowest point in March, ahead of the critical Federal Open Market Committee (FOMC) interest rate decision. A hawkish stance from the Fed could place additional downward pressure on the pair. Nonetheless, the pair has been supported by encouraging data from the ZEW Economic Sentiment Index, which recorded a value of 33.5, surpassing the previous figure of 25. This indicates an optimistic economic outlook within the eurozone economies.

EUR/USD remains trading in a descending trajectory despite a technical rebound. The MACD remains flowing below the zero line, while the RSI hovering close to the oversold zone suggests the pair remain trading with bearish momentum.

Resistance level: 1.0960, 1.1040

Support level: 1.0775, 1.0700

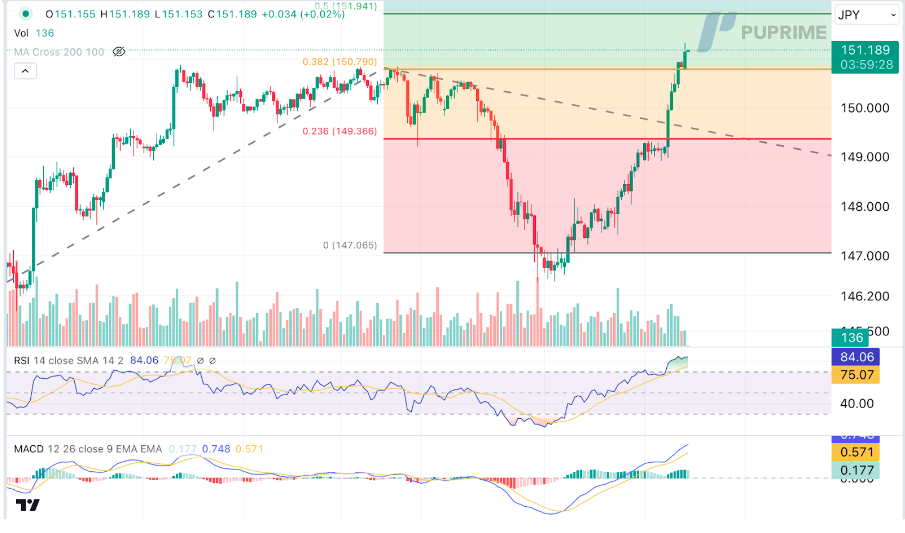

USD/JPY,H4

The Japanese yen faced significant downward pressure, tumbling to a four-month low, even as the Bank of Japan announced the end of its negative interest rate policy and quantitative easing measures. Market participants, having already factored in the policy change, engaged in profit-taking, leading to a sharp decline of over 1% in the yen's value. However, the possibility of further monetary policy tightening by the BOJ in response to persistent high inflation could offer support to the yen in the future, warranting continued vigilance among investors for trading cues.

USD/JPY is trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 84, suggesting the pair might enter overbought territory.

Resistance level: 151.95, 153.10

Support level: 150.80, 149.35

AUD/USD, H4

The AUD/USD pair remains under pressure, approaching its lowest level in March. Following the Reserve Bank of Australia's (RBA) interest rate decision, which met market expectations by maintaining rates at 4.35%, the Australian dollar experienced further weakness. This was exacerbated by comments from the RBA governor indicating that the central bank has concluded its monetary tightening program. Such a dovish tone from the Antipodean central bank contributed to the decline in the Australian dollar.

The AUD/USD pair recorded a minor rebound after a significant plunge yesterday. The RSI is hovering closely above the oversold zone, while the MACD continues to edge lower, suggesting that the bearish momentum remains strong.

Resistance level:0.6576, 0.6617

Support level: 0.6484, 0.6450

CL OIL, H4

Crude oil prices extended gains, reaching multi-month highs for the second consecutive session, driven by rising geopolitical tensions, notably recent attacks by Ukraine on Russian refineries. Concerns over supply disruptions intensified as the attacks targeted a significant portion of Russian refining capacity, leading to the shutdown of approximately 7% of daily refining output. The escalating conflict underscores the volatile nature of global oil markets and highlights the potential for further price fluctuations.

Oil prices are trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 67, suggesting the commodity might experience technical correction since the RSI entered the overbought territory.

Resistance level: 82.85, 84.10

Support level: 80.20, 78.00