Crypto: Extreme greed is not a sell signal

Crypto: Extreme greed is not a sell signal

Market picture

The cryptocurrency market is developing gains, rising 2.2% on the day to $2.17 trillion. These levels replicate the April 2022 peak.

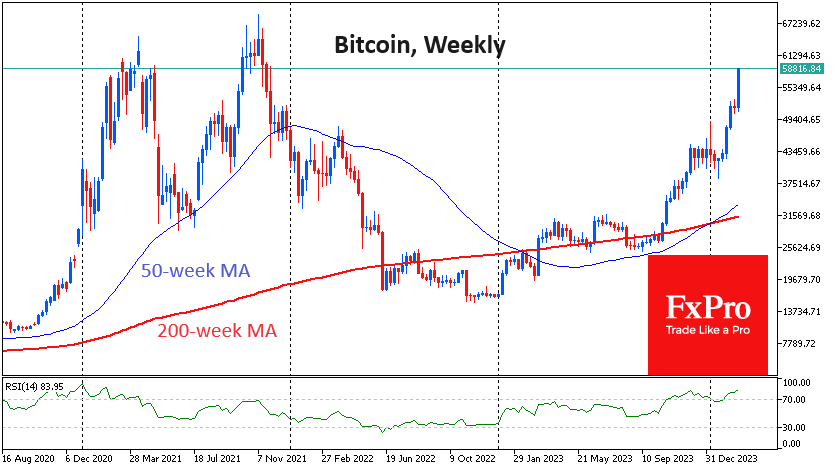

Bitcoin is now only 15% below its all-time high, while total capitalisation is 38% below its peak.

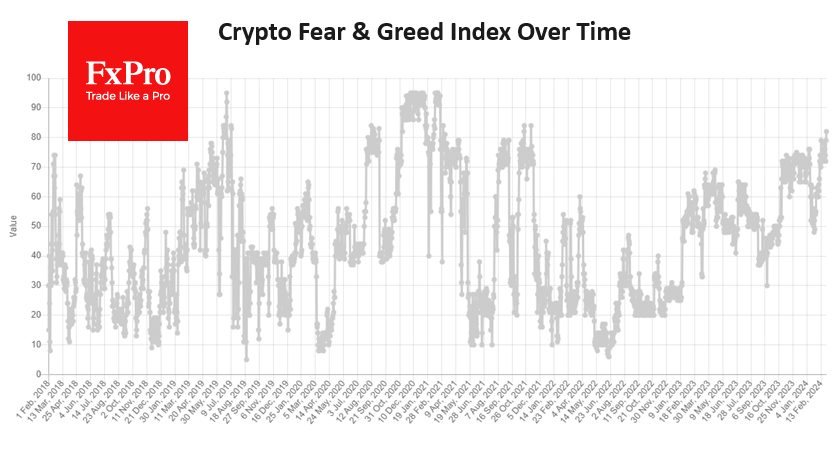

A further move higher would be a repeat of the early 2022 highs. The Cryptocurrency Fear and Greed Index rose to 82 by Wednesday - the highest since November 2021 - extreme greed. This time, the active rally came at the start of the European session, as Bitcoin moved to update the November 2021 highs, so it would not be surprising to see the index rise further.

According to the indicator's design, this state makes it look for a turning point for a correction. However, we believe that short-term corrections only fuel the greed of buyers. Looking at Bitcoin's chart alone, the dynamics are like what we saw in the second half of 2020. The index was above 90 then, and getting out now, just since greed levels are at 82, could be a painful mistake.

Fundamentally, it is more logical to expect weak performance before a halving, but that is not the case, and investors must accept this reality with a false start to the market due to the influx of institutionalisation via comfortable spot ETFs. Demand is also being helped by strong risk appetite thanks to all-time highs in the major indices.

News background

The main reason for BTC's growth is the trading volume of spot bitcoin ETFs (excluding GBTC), according to Metalpha. The index reached a record $2.4 billion at the beginning of the week, almost doubling the previous daily average.

Bloomberg does not rule out that bitcoin ETFs will overtake gold ETFs in terms of accumulated capital within the next two years.

BitMEX Research notes that outflows from GBTC slowed to $44 million, the lowest since 11 January. The structure has lost $7.5 billion in AUM since becoming an ETF.

Ethereum has taken the most significant share among cryptocurrencies in financial institutions' investment portfolios due to the upcoming Dencun upgrade, Bybit noted. According to The Block, open interest in Ethereum options on the top 5 exchanges (excluding CME) reached an all-time high.

Despite the growing competition between blockchains, Grayscale Research believes the launch of the Dencun update will help Ethereum "mature" by reducing transaction fees and increasing the network's scalability.

The value of assets locked in the Lido liquid-stacking protocol has reached $30.56 billion, according to The Block. Lido dominates the segment, controlling 32% of Ethereum's total stakes.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)