Crypto let off steam rather than starting a reversal

Market picture

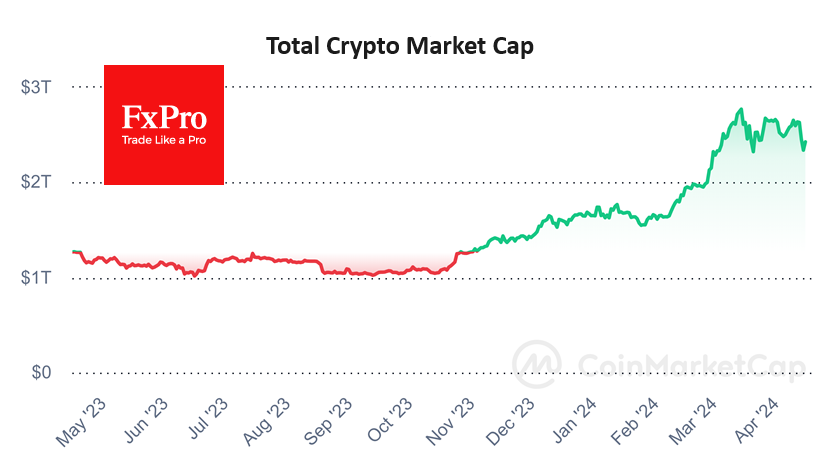

It was a non-boring weekend for the cryptocurrency market. Market sentiment swung sharply towards buying the dollar and selling stocks, gold, and cryptos on Friday afternoon. Also operating over the weekend, the crypto market accelerated its decline on Saturday, with capitalisation falling to $2.2 trillion (-18% from Monday's peak) but began to recover on Sunday and has risen to $2.42 trillion (-7% in seven days) at the time of writing.

Bitcoin's weekly decline was the largest in eight months and, in dollar terms, the largest on record since the November 2022 FTX crash. Following Bitcoin, other digital assets collapsed as well. Many of the largest altcoins lost about a third of their value over Friday and Saturday.

Bitcoin dipped below $60K over the weekend, but a recovery on Sunday and at the start of the day on Monday brought the price back up to $66.2K. The weekend's failure made the technical picture more contradictory. On the bullish side, BTCUSD met strong buying on the decline to the 61.8% retracement level from the rise from the lows at the beginning of the year to the peaks in March. It's a classic correction that often clears the way to the upside.

Bears, on the other hand, may cite a sharp dip below the 50-day moving average, which could break the multi-month uptrend. But we see this dip as a repeat of the January correction - necessary to keep buyers interested and to shake weak hands out of the market.

News background

CryptoQuant said the current cryptocurrency market crash is necessary to reset traders' unrealised profits to zero - usually a bottom signal in bull markets. MicroStrategy founder Michael Saylor emphasised that "chaos is good for bitcoin".

If spot bitcoin ETFs are launched in Hong Kong, demand from Chinese mainland investors could reach $25bn, Matrixport expects. According to Bloomberg, Hong Kong may approve ETFs based on the first cryptocurrency and Ethereum as early as 15 April.

Crypto Nova believes that altcoin season is just around the corner. The bitcoin dominance index "is in a sideways movement, and that almost always happens before a reversal".

Solana developers said they have started testing solutions to deal with congestion and increasing network errors. The update is not yet available on the main Solana network, which will give developers a chance to test the innovations.

Robert Kiyosaki confirmed Kathy Wood's prediction and also stated that he expects Bitcoin to grow to $2.3 million, the price ARK Invest predicts by 2030. Kiyosaki also noted that he doesn't trust Wall Street financial products, preferring to buy BTC through exchange-traded funds (ETFs) rather than the spot market.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)