Daily Global Market Update

Oil's Recent Drop

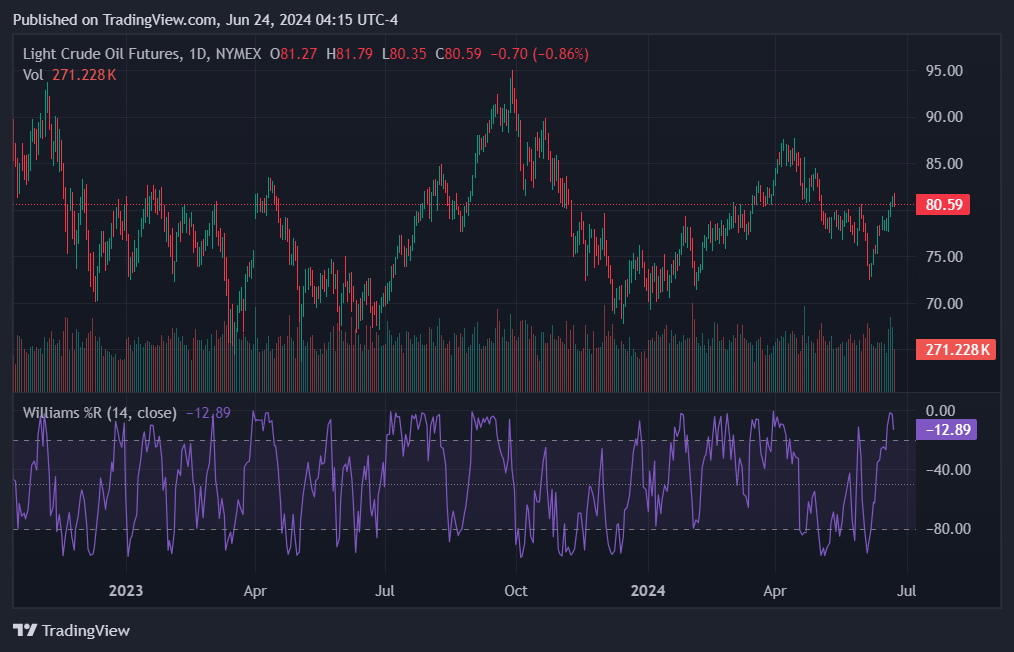

Oil experienced a decrease of 0.7% against the dollar in the last session. According to the Williams Percent Range, we are currently in an overbought market.

AUD/USD's Stability

The AUD/USD pair remained largely unchanged in the last session. The Ultimate Oscillator is giving a positive signal.

EUR/USD's Steady Position

The EUR/USD pair remained largely unchanged in the last session. The Rate of Change (ROC) is giving a positive signal.

USD/JPY's Market Condition

The USD/JPY pair remained largely unchanged in the last session. According to the Stochastic RSI, we are in an overbought market.

Upcoming Economic Highlights

Gold prices dropped more than 1% on Friday, weighed down by a stronger dollar and higher bond yields after data showed strong US business activity, while palladium jumped to a one-month high. US business activity crept up to a 26-month high in June amid a rebound in employment, but price pressures subsided, offering hope that a recent slowdown in inflation was likely to be sustained. The S&P 500 and NASDAQ closed marginally lower last week, weighed down by a decline in Nvidia shares, which dragged down the technology sector. Technology was the biggest loser among the 11 major S&P 500 sectors, down 0.84%, while communications services led the gains.

Here's a brief rundown of today's anticipated economic releases:

• US Chicago Fed National Activity Index - 1230 GMT

• US Dallas Fed Manufacturing Business Index - 1430 GMT

• Eurozone's Eurogroup Meeting - 0700 GMT

• Germany's IFO Business Climate Index - 0800 GMT

• Japan's CFTC JPY NC Net Positions - 1930 GMT

• UK's CFTC GBP NC Net Positions - 1930 GMT