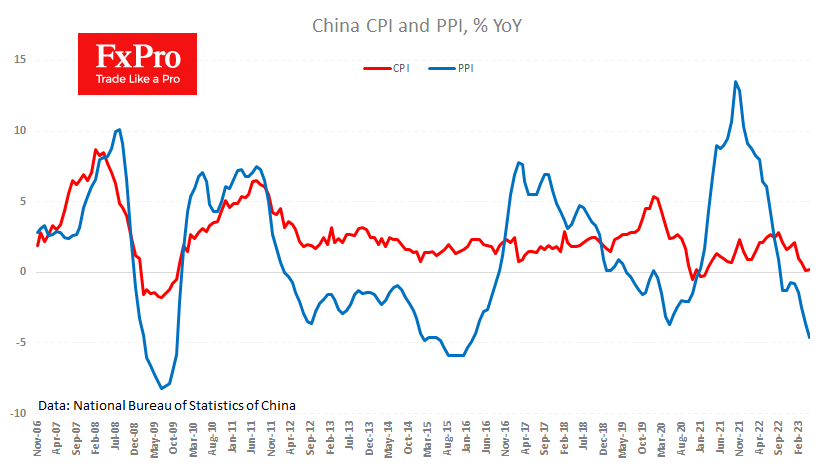

Deepening deflationary trends in China

Inflation in China remains worryingly weak, official producer and consumer price data for May confirmed today.

The CPI was up 0.2% y/y last month, only slightly increasing from the 0.1% y/y pace in April.

The producer price index shows that the disinflationary trend is continuing. It has been falling year-on-year for the past eight months, accelerating from 3.6% y/y to 4.6% y/y in May. This is the steepest decline in seven years.

Producer prices are a leading indicator of consumer inflation and the overall economy. The latest data confirms the weakness of the world's second-largest economy.

The shallow inflation frees the People’s Bank of China to stimulate the economy further by cutting interest rates or putting pressure on the renminbi.

As a result, USDCNH quickly rebounded from the previous day's pullback to trade back above 7.14, not far from the highs seen since last November.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)