Dollar Index and Indices Analysis

Dollar Index and Indices Analysis

Dollar Index

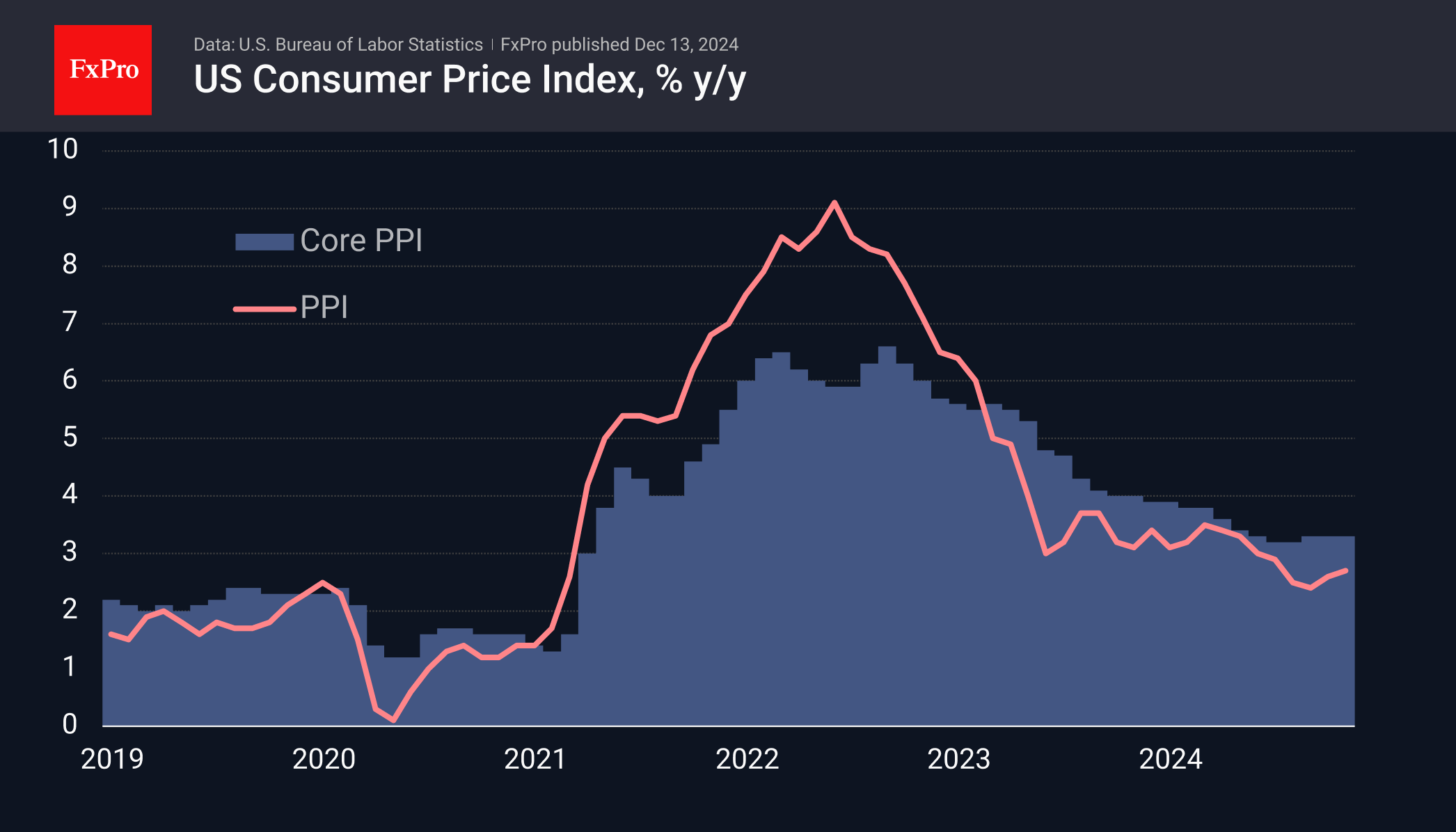

The US dollar methodically gained ground over the week. The DXY rose for six consecutive sessions, gaining 1.3% on the back of macroeconomic data. Neutral inflation readings provided the latest leg of gains. Consumer prices rose in line with average forecasts, up 2.7% headline and 3.3% excluding food and energy. Markets reasoned that this would not prevent a Fed rate cut next week.

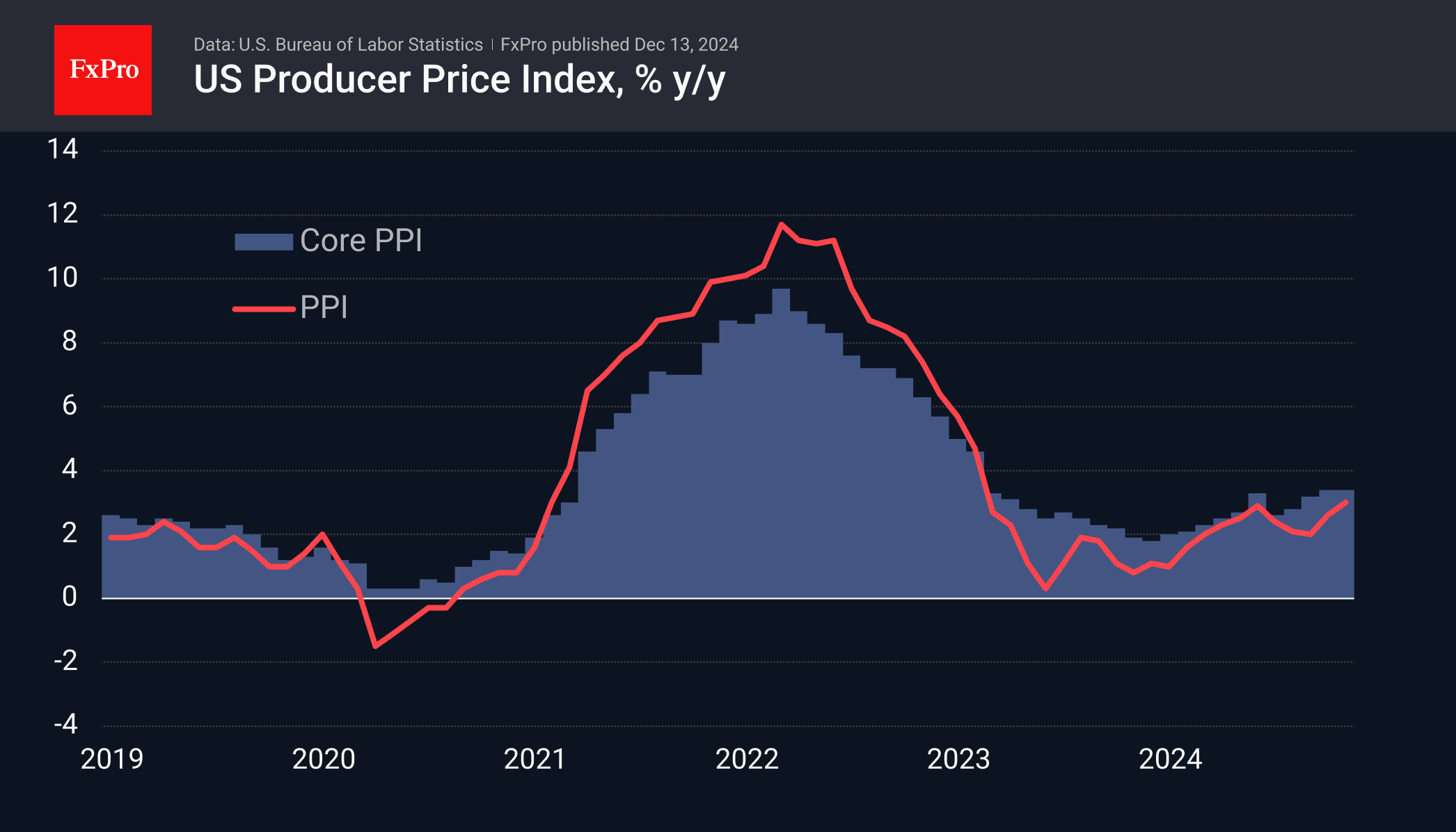

At the same time, expectations of aggressive rate cuts are fading in the outlook for next year, which is what drives markets most. In addition to a strong labour market, producer prices also have an impact. The PPI growth rate has risen to 3%, the highest since February 2023. Core inflation, at 3.4% y/y, is accelerating through 2024.

Policymakers and investors are also spooked by the uncertainty over the risks of renewed trade wars, which is shaping inflation risks. However, these risks are still too uncertain to influence central bank officials and move markets, although the topic has not left the front pages of the financial media.

The technical picture suggests that the dollar has turned to growth after a two-week correction. As the advance continues, the focus will be on the momentum of the DXY around the 108 level, where the highs were made at the end of last month. If the dollar can overcome this resistance, we can expect a breakout to the late 2022 highs around 113. These could be tough times not only for emerging markets but also for equity markets.

Indices

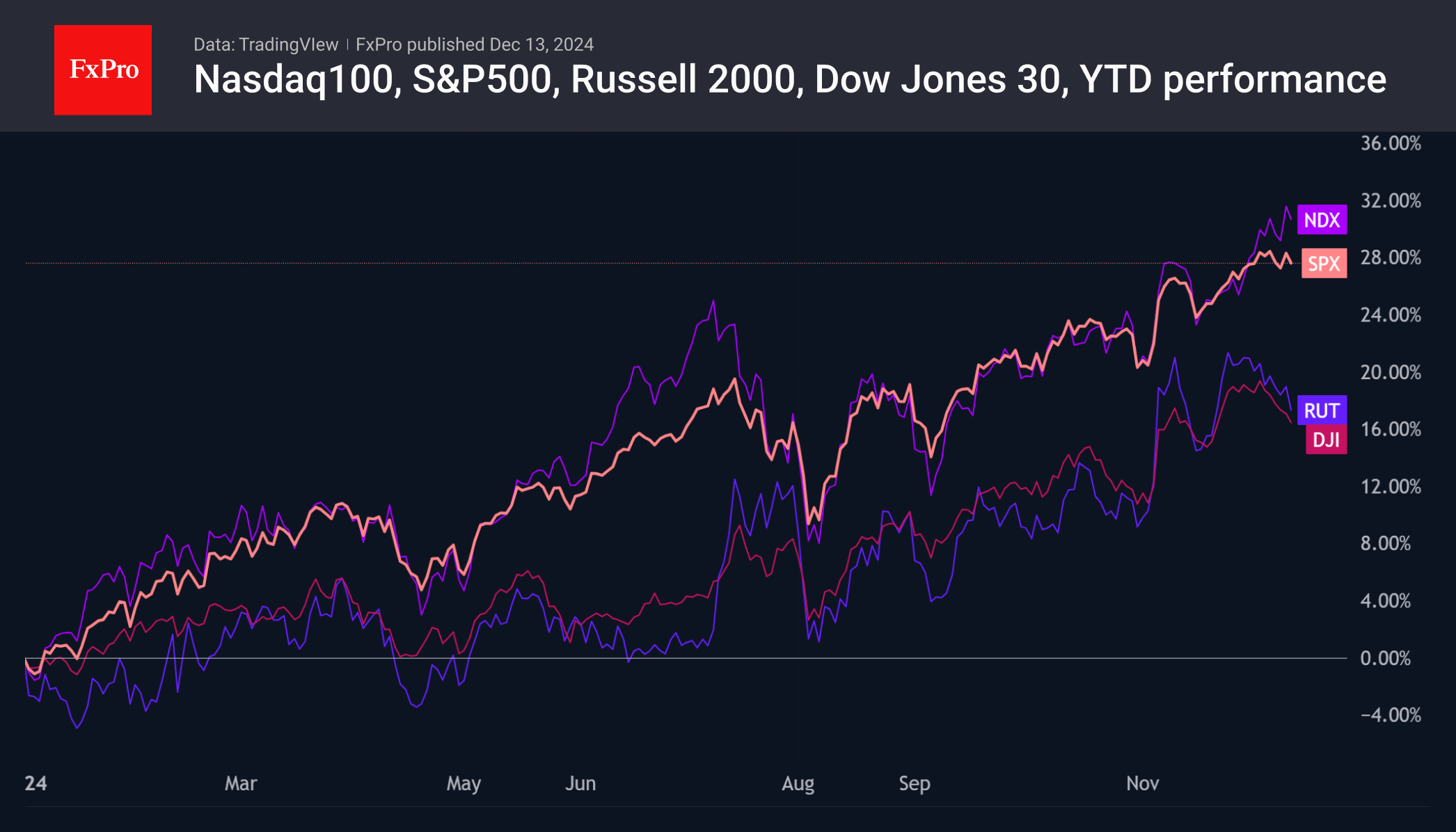

The dollar's rise in the final week of the year weighed on the Dow Jones and Russell 2000 indices, which fell 2.8% and 4.8%, respectively, from their recent highs. However, the Nasdaq100 was boosted by the success of the high-tech giants. This index approached 21800, moving further into all-time high territory.

This kind of divergence is not sustainable. This means that in the next week or two, we will either see an acceleration in the Russell and Dow or a correction in the S&P500 and Nasdaq100. A rising dollar argues for the second scenario, but the Fed's comments could dramatically change sentiment.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)