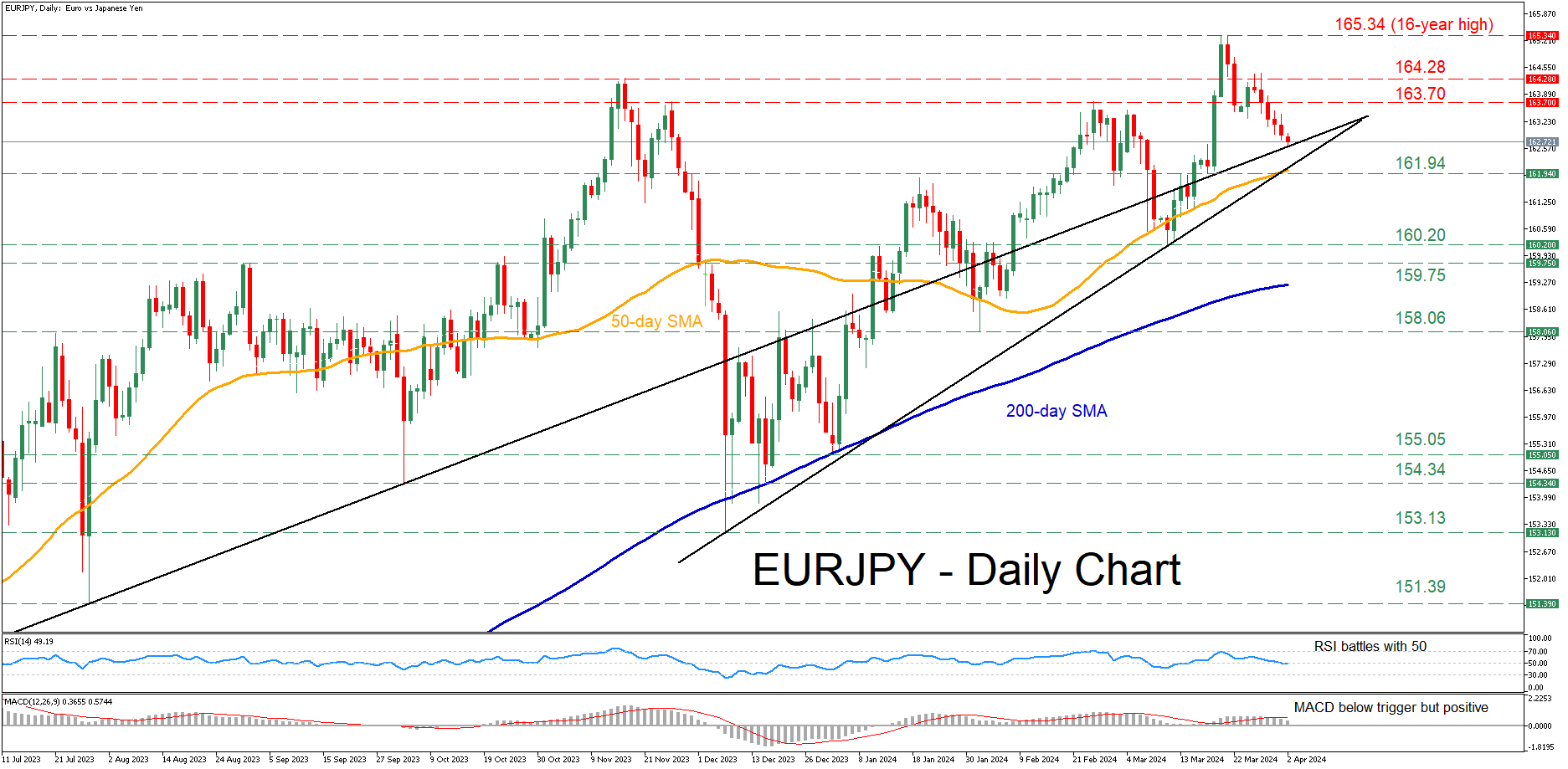

EUR/JPY pulls back towards crucial trendline

EURJPY had been in a steady advance since December 2023, peaking at a fresh 16-year high of 165.34 on March 20. Since then, the pair has been undergoing a downside correction, with the upward sloping trendline that connects higher lows since July 2023 currently acting as a strong support.

Should the trendline fail to hold its ground, the pair could slide towards the recent support of 161.94, which lies very close to the 50-day simple moving average (SMA). A violation of that zone could pave the way for the Mach bottom of 160.20. Further declines might then cease at the August-October resistance region of 159.75, which might serve as support in the future.

On the flipside, bullish actions could propel the price towards the February peak of 163.70. Conquering that barricade, the bulls may attack the 2023 high of 164.28. If that barrier fails, the price could ascend to revisit its 16-year high of 165.34.

In brief, EURJPY has been on the retreat in the past few sessions, experiencing a solid setback from its recent 16-year peak. For the bears to gain confidence for a sustained decline, the pair needs to break below the 50-day SMA.

.jpg)