Euro turns to ECB decision, Tesla earnings disappoint

ECB to steer markets to summer rate cuts

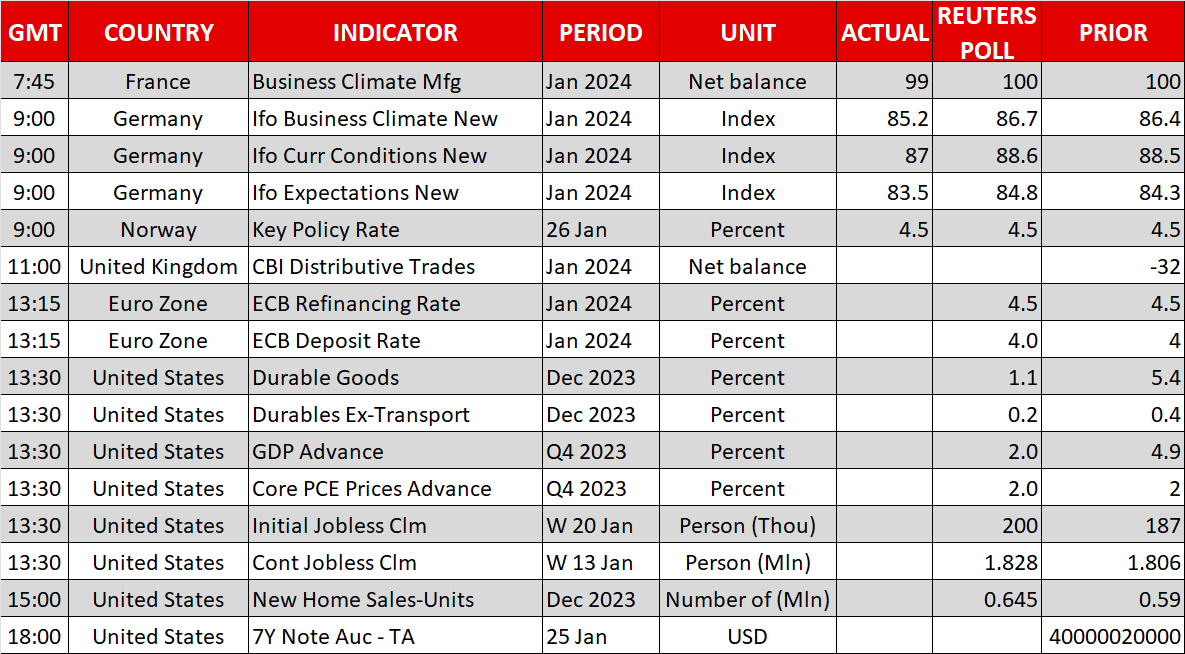

The spotlight will fall squarely on the European Central Bank rate decision today. Market pricing suggests the ECB will do nothing, so the action in financial markets will come mostly from the commentary by President Lagarde.

Several ECB officials have tried to downplay speculation about imminent rate cuts lately, warning that the central bank is unlikely to slash interest rates in April as traders currently expect, pointing to a summer easing cycle instead. Waiting until June would allow policymakers access to updated wage growth data, helping them decide whether inflation is truly defeated.

If the ECB emphasizes this message today and preaches patience, the euro could briefly spike higher as traders push out bets on the first rate cut towards the summer. That said, it’s difficult to envision a sustained rally in the euro as long as economic growth is stagnant and recession risks remain in play, so any ECB-fueled gains in the euro might be short-lived.

Dollar and gold brace for US GDP data

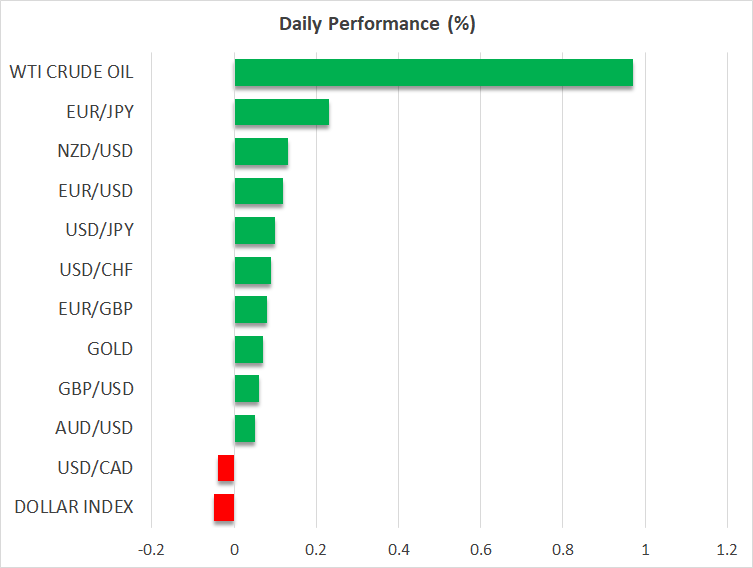

In the US, the latest round of business surveys from S&P Global was optimistic on all fronts, reinforcing the notion that the world’s largest economy can achieve a soft landing. American businesses reported a significant acceleration in growth driven by rising new orders, while inflationary pressures continued to cool with selling prices rising at the weakest pace since the 2020 lockdowns.

With optimism in the US economy running high, the dollar recovered some lost ground in the aftermath, drawing fuel from the interest rate channel as yields marched higher. The next event for the dollar will be the US GDP print for Q4 later today, where there is some scope for an upside surprise considering that the estimate of the Atlanta Fed GDPNow model is higher than official forecasts.

Gold suffered yesterday at the hands of rising real yields, losing around 1% of its value in the wake of the encouraging business surveys, which dampened demand for safe haven assets. An above-consensus GDP reading today could deal another blow to the precious metal, especially if it is accompanied by rosy jobless claims figures.

That said, the broader outlook for bullion seems positive against the backdrop of unstable geopolitics, interest rates heading lower, and central banks purchasing record amounts of gold in recent years. Therefore, any selloff that remains limited above the $1,975 region could be seen as providing better entry points for long-term investors.

Tesla misses, Chinese stocks recover

In the stock market, Tesla shares are down 8% in pre-market trading today after the company missed analyst estimates on both revenue and earnings. The price war with Chinese competitors has eaten into Tesla’s profit margins, and with the stock’s valuation being extremely stretched, the underwhelming results served as a reality check for many investors.

Chinese stock markets climbed for a third session as a series of stimulus announcements finally did the trick in restoring investor confidence. The latest reports suggest Beijing will deploy about 2 trillion yuan to stabilize its markets by purchasing stocks directly. Beyond that, the central bank announced a sharp cut to bank reserves, a move that will inject liquidity into the banking system and hopefully kickstart growth.

Finally, the Canadian dollar fell yesterday after the central bank opened the door to cut rates later this year.

.jpg)