EURUSD gets assistance after rejection from 200-EMA

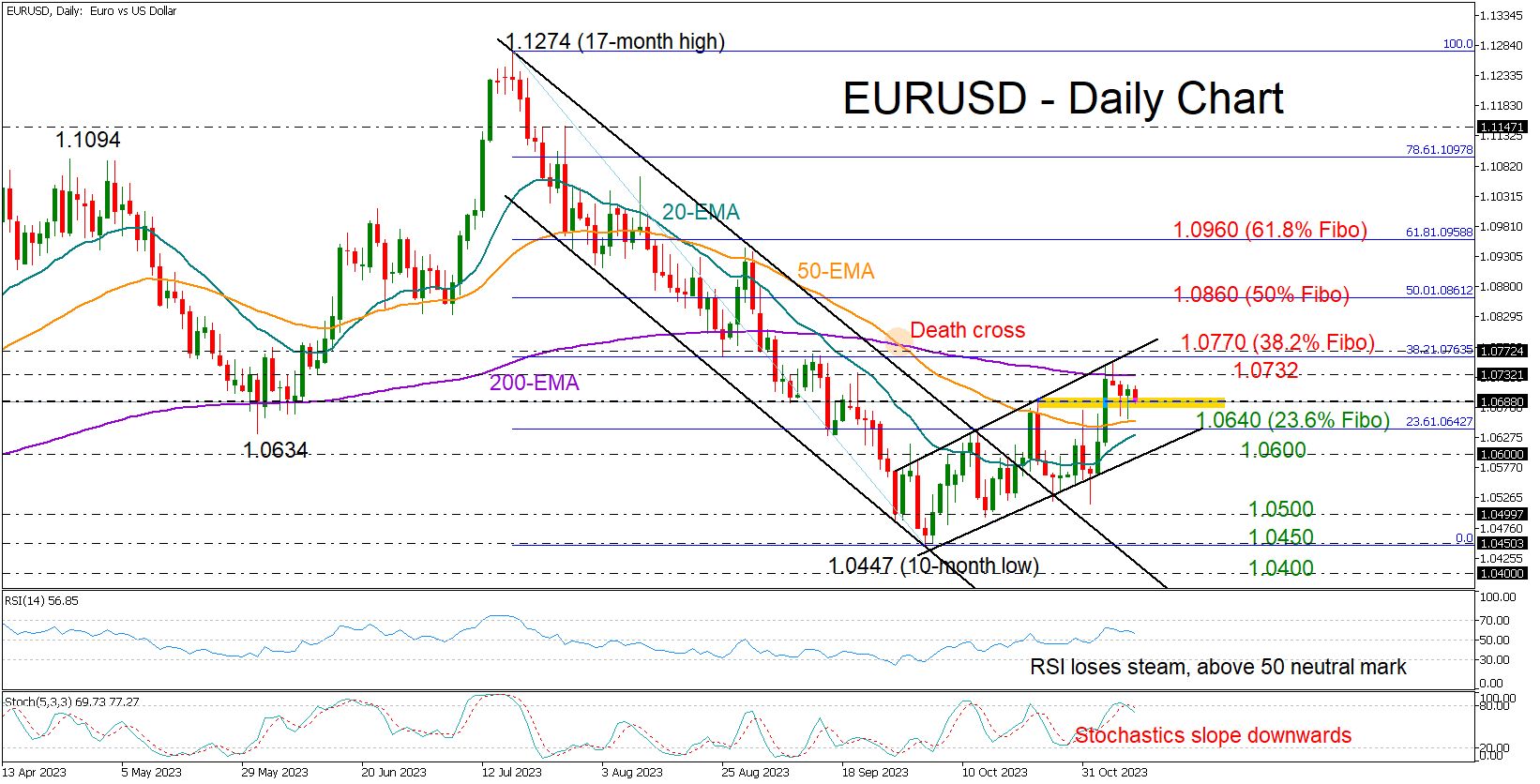

EURUSD could not carry last week’s impressive rally above its 200-day exponential moving average (EMA), but the 50-day EMA helped the pair to hold within the 1.0700 zone and above its previous high.

The market structure is positive in the short-term picture as the pair keeps fluctuating within a bullish channel. Hence, even if downside pressures resume, the pair will remain attractive unless it exits the bullish formation below 1.0600. If that bearish scenario unveils, selling forces could intensify towards the 1.0500 mark. Then, additional losses from there could retest October’s low near 1.0450 and the 1.0400 psychological mark, where the upper band of the previous bearish channel is positioned.

In the event the price stays resilient above its October high and the 1.0700 number, the bulls might push for a close above the 200-day EMA and out of the bullish channel at 1.0763. This is where the 38.2% Fibonacci retracement of the previous downleg is placed. Therefore, a successful move higher could immediately shift the attention to the 50% Fibonacci of 1.0860 and then towards the 61.8% Fibonacci of 1.0960.

Technically, the bulls might still be in the town as the RSI is still clearly above its 50 neutral mark despite losing some ground, but any gains could be short-lived as the stochastic oscillator seems to have peaked in the overbought zone above 80.

In a nutshell, EURUSD may remain supported in the coming sessions, though room for improvement could be limited before the next bearish round takes place.