EURUSD hits another milestone

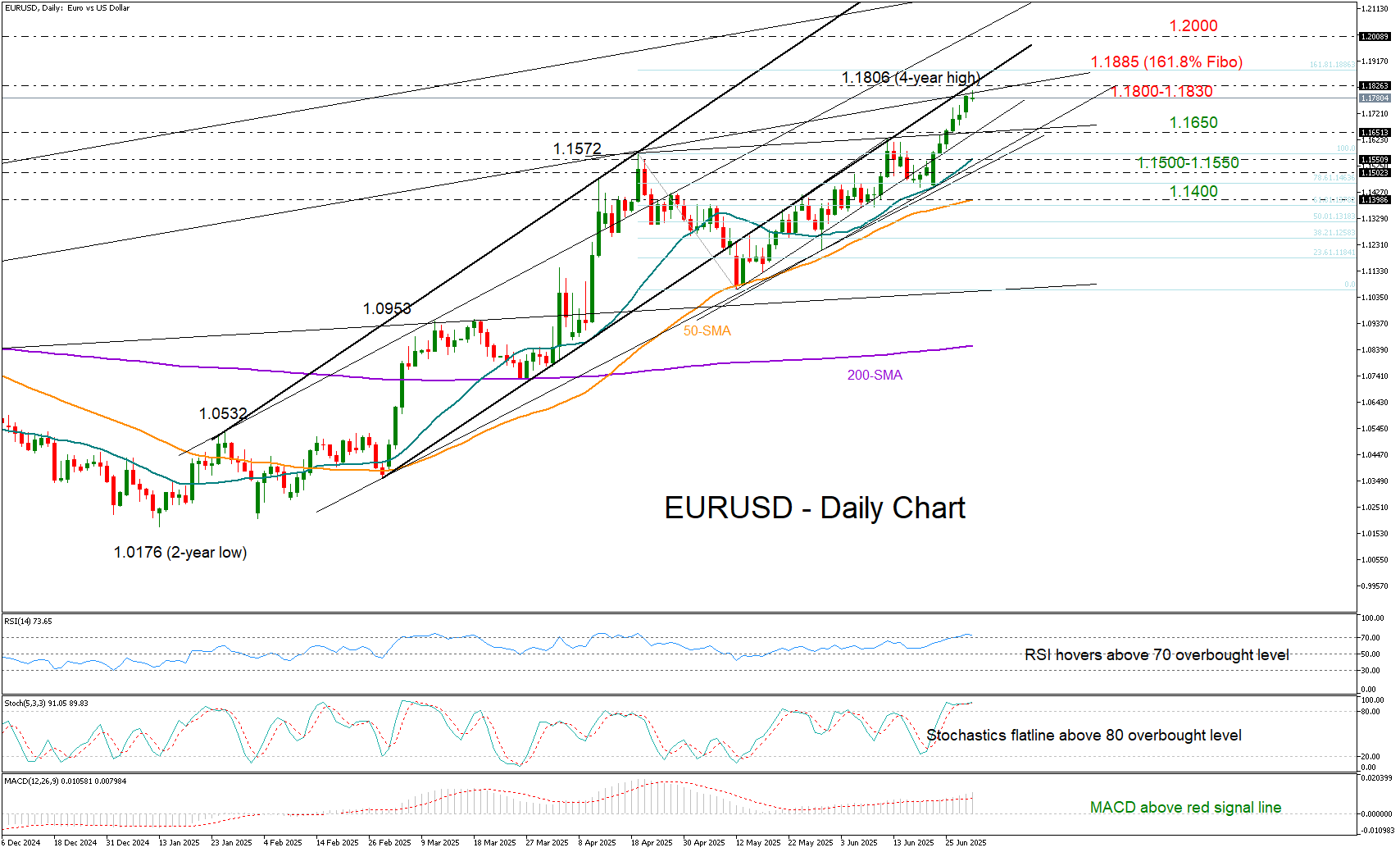

EURUSD reached the 1.1800 level for the first time in nearly four years, supported by ongoing weakness in the US dollar and growing optimism that the EU may soon finalize a trade agreement with the US.

Following the impressive 7.0% rally from May's low of 1.1064, however, there is speculation that some stability could emerge in the short-term as the RSI and the stochastic oscillator are flattening in the overbought territory and the price is hovering near the critical support-turned-resistance trendline from June 2024.

Should bearish momentum build – particularly if eurozone CPI inflation continues to fall below the European Central Bank’s 2.0% target—the pair may flip backwards to test the 1.1650 support zone ahead of the 20-day simple moving average (SMA) at 1.1550. Additional declines below 1.1500 could stall near the 50-day SMA, while a break below this level may intensify selling pressure towards 1.1270.

On the other hand, a resurgence in inflation above 2.0% could lead ECB policymakers to maintain current interest rates for a longer period. This scenario could empower the bulls to push past the 1.1800–1.1830 resistance area, opening the door to 1.2000 – provided the 161.8% Fibonacci extension of the previous downtrend at 1.1885 and the 1.1950 resistance from August–September 2021 are cleared.

In summary, EURUSD has strengthened its bullish outlook, but with technical indicators signaling overbought conditions, a short-term slowdown or correction may be imminent.

.jpg)