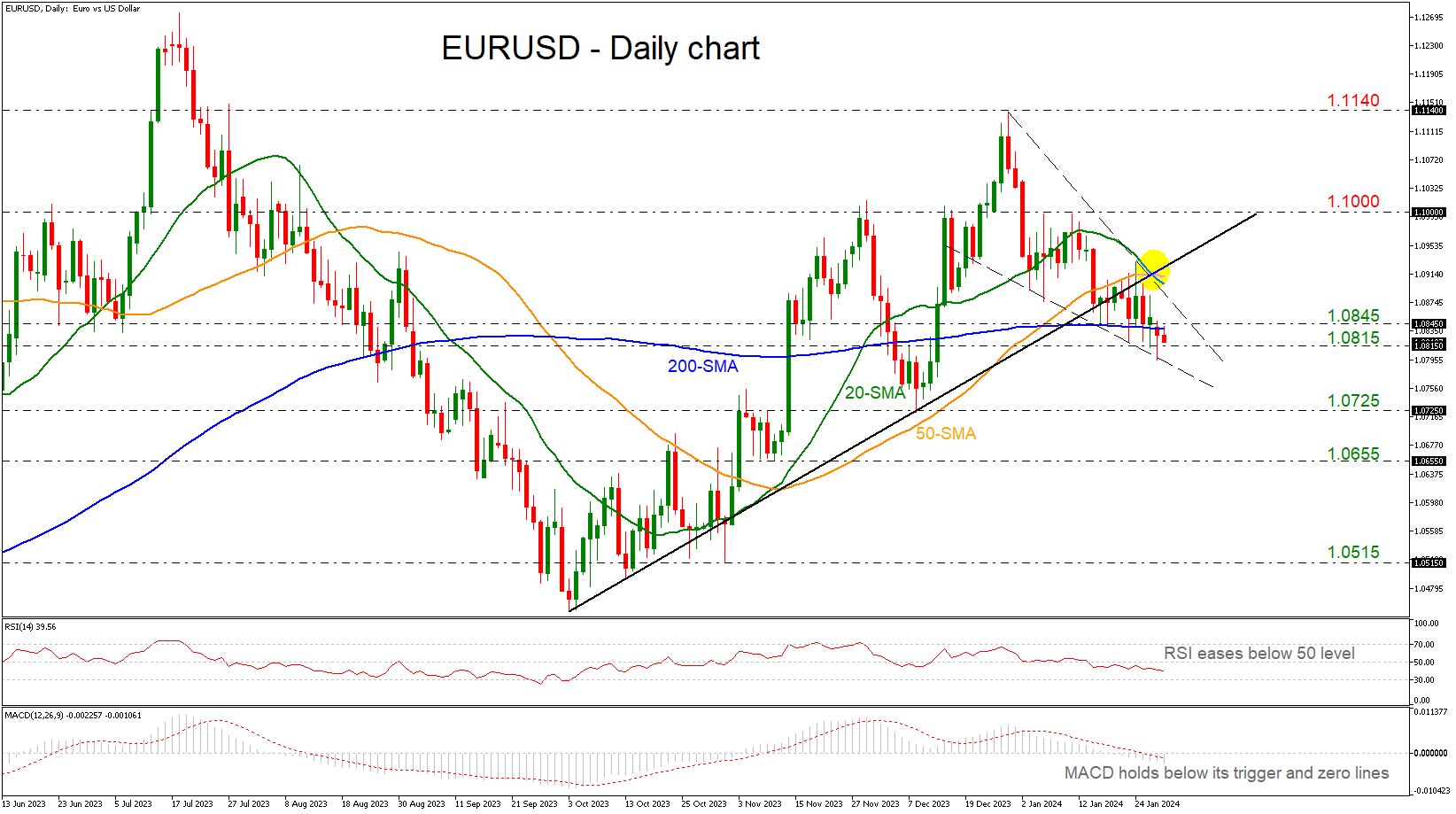

EURUSD slips further after the fall below 200-day SMA

· EURUSD touched 1.0800 but returned higher

· Price moves within bearish triangle

· MACD and RSI suggest negative bias

EURUSD tumbled below the crucial 1.0845 restricted zone, generating concerns that the decline from the 200-day simple moving average (SMA) may continue. Also, the market declined slightly below the 1.0800 round number during Monday’s session, meeting the lower boundary of the bearish triangle but it returned quickly above the 1.0815 barrier.

Prior to resuming their efforts, the bulls might attempt to close above the 200-day SMA at 1.0845. They could then contend for a channel breakout above 1.0870 ahead of the bearish crossover between the 20- and the 50-day SMAs at 1.0915. Beyond that region, the psychological threshold of 1.1000 may present a substantial obstacle.

In the most favourable scenario, more losses could open the door for the 1.0725 support level before touching the 1.0655 support, shifting the outlook to a strongly bearish one.

From a technical standpoint, the RSI is positioned below 50 and exhibits a southward bias, whereas the MACD is continuing its bearish trajectory beneath its zero and trigger lines. Both indicators point to a bearish momentum.

In summary, EURUSD may be poised to extend its latest slide, especially after the dive beneath the 200-day SMA and the medium-term ascending trend line.

.jpg)