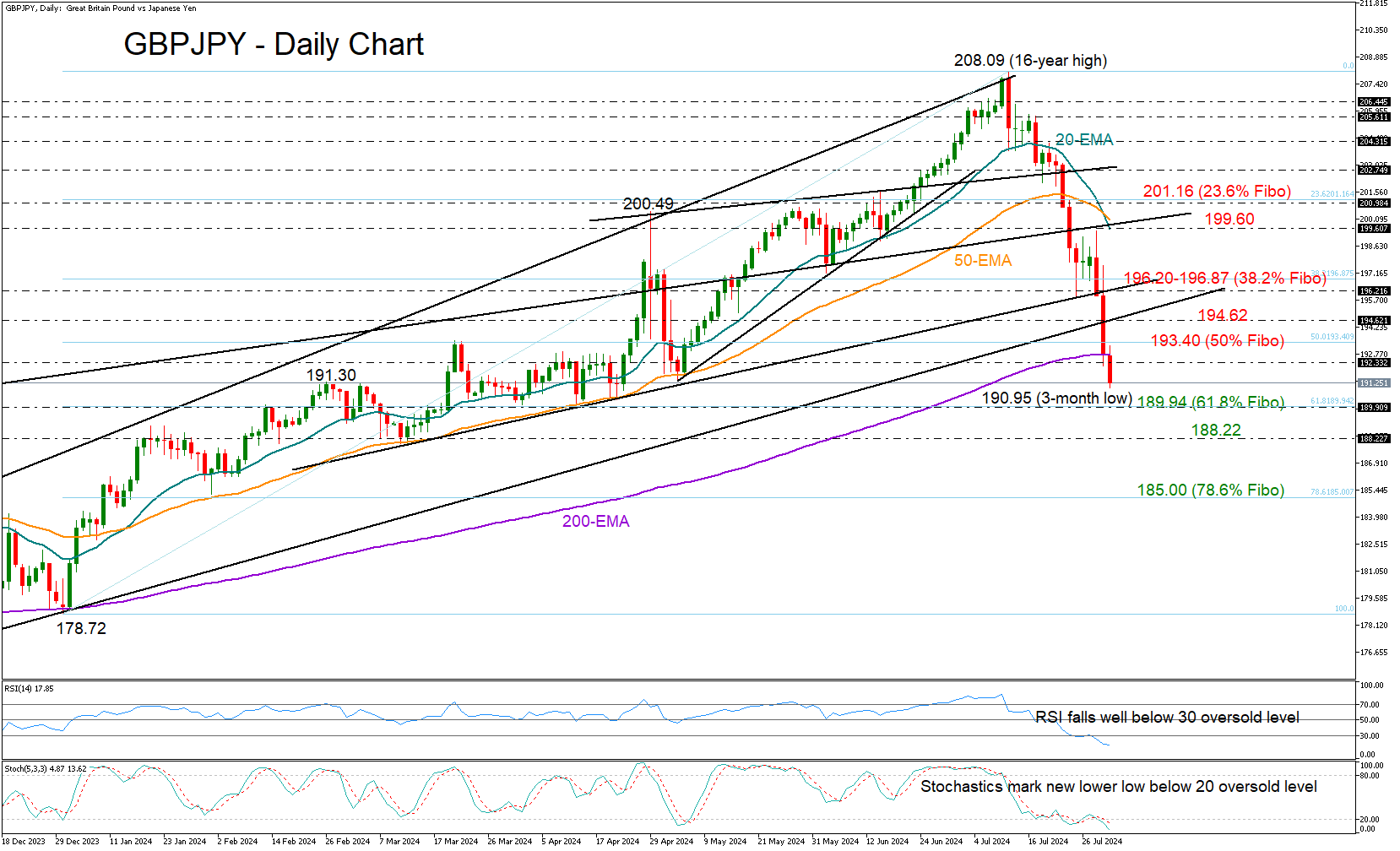

GBPJPY selling drama stretches below 200-EMA

GBPJPY suffered another bold attack this week, giving back 8% of its value since its peak at a 16-year high of 208.09 on July 11. With downside pressures intensifying below the 200-day exponential moving average (EMA) today, more sellers could join the market.

However, past drops below the 200-day EMA have been brief and quickly reversible. Encouragingly, the RSI and stochastic oscillator are currently both deeply oversold, which suggests that the aggressive sell-off may pause soon.

The 61.8% Fibonacci retracement of the 2024 upleg is within breathing distance at 189.94 and could immediately tackle downside forces ahead of the 188.22 support area taken from March. Failure to pivot there could see an extension towards the 185.00 mark, which overlaps with the 78.6% Fibonacci level.

On the upside, a move above the 200-day EMA and the 50% Fibonacci mark of 193.40 could initially stall somewhere between the broken support trendline from December 2023 at 194.20 and the 38.2% Fibonacci of 196.87. A step higher, the pair could gain fresh bullish traction towards the 20- and 50-day EMAs at 199.60 and then up to the 23.6% Fibonacci number of 201.16.

Overall, GBPJPY may continue to face selling pressure in the short term, but given the oversold signals and the nearby protective zone of 189.94, the bearish momentum could soon slow down.

.jpg)