GBP/USD at a crossroads as BoE rate decision looms

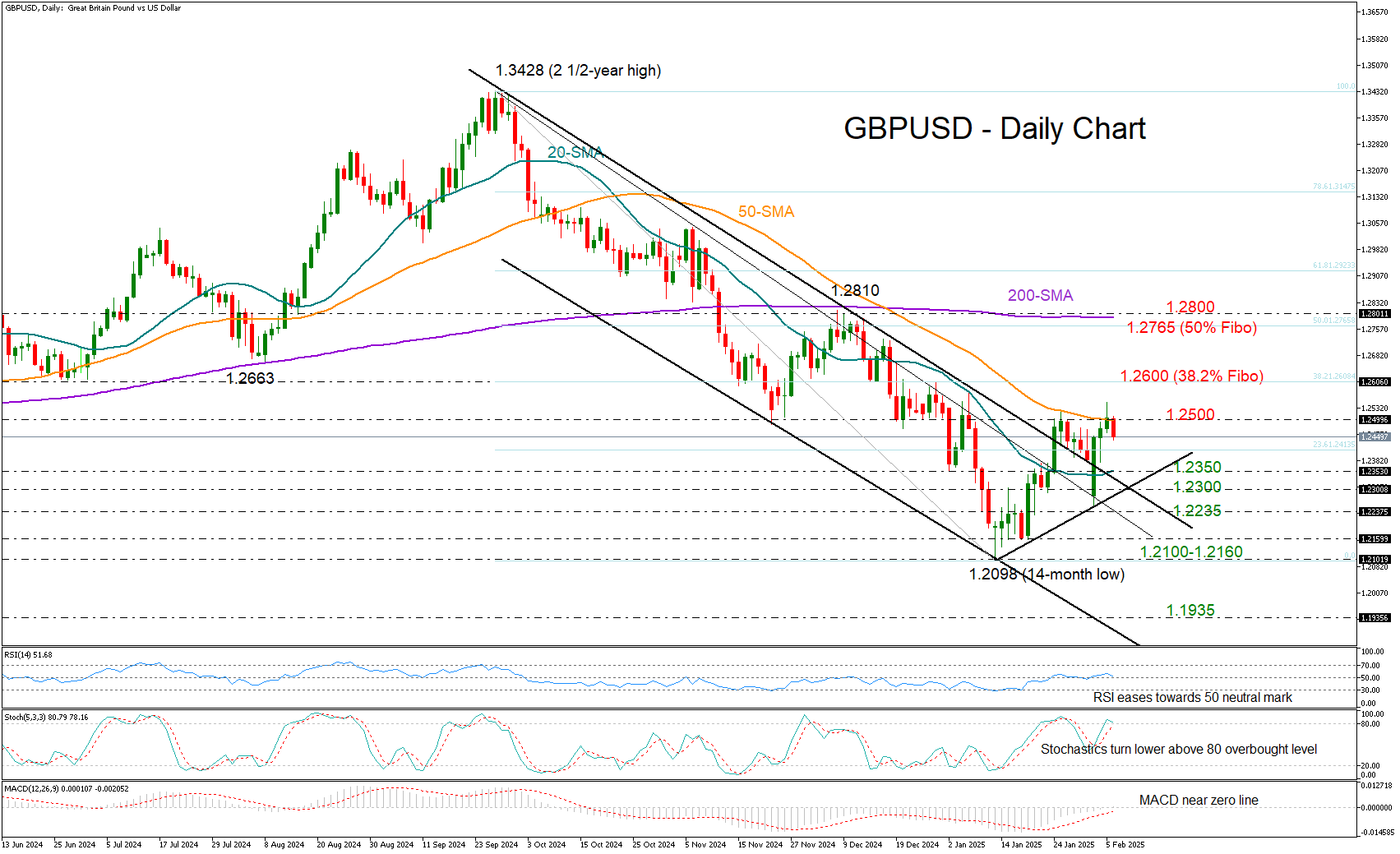

GBPUSD is facing a pivotal moment near the 1.2500 round level and its 50-day simple moving average (SMA) just a few hours before the Bank of England’s policy announcement at 12:00 GMT. A decisive break above this psychological barrier could fuel optimism that the recent rebound from the 14-month low of 1.2098 is something more than a fleeting recovery.

From a technical standpoint, caution is warranted as the rise in the RSI seems fragile and the Stochastic oscillator is already near its 80 overbought level, hinting at easing buying interest. If the bears take over, the price could slide towards the 20-day SMA at 1.2350 and then retest the support trendline from January at 1.2300. A continuation lower and beneath 1.2235 could target the crucial area of 1.2100-1.2160.

If the bulls successfully claim the 1.2500 border, the next barrier could lie around the 1.2600 mark, which overlaps with the 38.2% Fibonacci retracement of the latest downtrend. A step higher could trigger a fast rally towards the 50% Fibonacci of 1.2765 and the 200-day simple moving average (SMA).

In brief, GBP/USD is searching for a fresh bullish catalyst to extend its recovery and shift the trend decisively upward. A clear close above 1.2500 could bring new buyers into the market, while a drop beneath 1.2300 may increase selling activity.

.jpg)