GBP/USD’s rebound: A dead cat bounce?

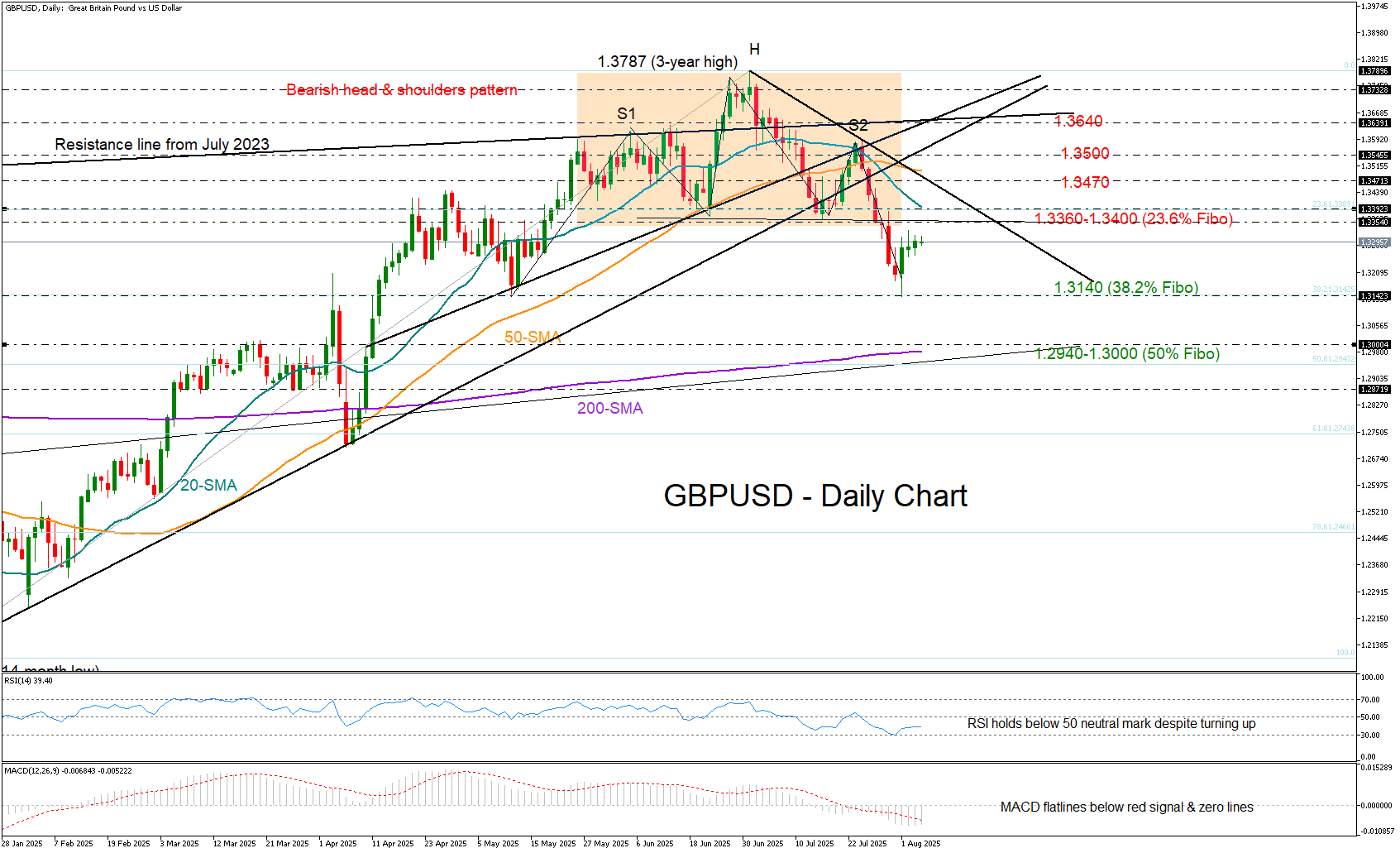

GBP/USD held its ground around May’s 1.3140 support area and rebounded, attempting to correct the recent sharp decline that confirmed a bearish head and shoulders pattern below the 1.3360–1.3400 region.

The recovery phase is unfolding just ahead of the Bank of England’s policy meeting, where a fifth consecutive quarter-point rate cut to 4% is expected on Thursday. The policy move comes amid signs of a weakening labor market and in response to Chancellor of the Exchequer Rachel Reeves’ April tax hikes and ongoing global trade tensions. Yet, whether the resurgence in inflation could prompt some hawkish language and a division in the voting structure, might attract greater attention.

Price momentum has been lackluster following Friday’s rebound, increasing speculation that the latest rebound may be part of the negative cycle that started in July. The bearish crossover between the 20- and 50-day simple moving averages (SMAs) is endorsing the ongoing downtrend, while both the RSI and MACD remain in bearish territory.

Therefore, if the bulls fail to break through the 1.3360–1.3400 resistance zone, the pair could retest the 1.3140 support level. A drop below this level could intensify selling pressure toward the 200-day SMA and the psychological 1.3000 mark, with the 50% Fibonacci retracement of the January–June uptrend at 1.2940 coming next in sight.

On the other hand, if the price rises above 1.3400, the next resistance could emerge around the descending trendline and the 50-day SMA at 1.3470. A further move higher could lead the bulls to challenge the 1.3500 level, before targeting the 1.3640 resistance area.

Overall, the latest upturn in GBP/USD does not appear convincing and may prove to be a temporary bounce within the prevailing downtrend – particularly if the 1.3360–1.3400 barrier holds firm.

.jpg)