Global risk-off tone prevails

OVERNIGHT

Risk-off sentiment prevailed across Asia following declines in US markets. The Hang Seng index fell almost 3%, while the Nikkei pared nearly 2%. Equity futures suggest markets will open in the red in Europe. The minutes of last month’s Fed ‘pause’ decision was released last night and revealed that “almost all” rate-setters agreed interest rate rises should resume. Markets also assessed whether China might deploy as much stimulus measures as hoped.

THE DAY AHEAD

In the UK, this morning’s Decision Maker Panel (DMP) survey of businesses is released and is closely looked at by policymakers. In particular, the report’s findings on firms’ pricing behaviour and their expectations for inflation and wage growth will be closely monitored, especially as still-accelerating UK services inflation seems to one of the key factors that persuaded the BoE to hike by 50bp rather than 25bp at the last meeting. There are indications from the survey that firms’ price and wage growth expectations are moderating, but they remain high relative to historical averages.

Separately, the June update of the UK construction PMI will be released. The May data signalled solid growth in the commercial and civil engineering sectors but contraction in housebuilding activity.

Global markets will continue to await tomorrow’s monthly US labour market report. Ahead of that, this afternoon’s unofficial ADP jobs report and the ISM services survey will garner attention. US trade, job openings and weekly jobless claims data will also be released. We are looking for evidence from the ADP that US jobs growth eased in June but remained at a decent pace. Meanwhile, we expect the ISM services index to rise to 51.0, therefore staying above the 50 threshold to signal modest growth in contrast to the weak outturn for the manufacturing survey. The prices index will also be watched for further signs of moderation. Initial weekly jobless claims are expected to tick back up to 245k.

In the Eurozone, retail sales figures for May are expected to show modest month-on-month growth at best. German factory orders data released earlier this morning showed a stellar increase of 6.4% in May but they are still down by 4.3% compared with a year ago. Tomorrow morning’s German industrial production report will be watched in light of recent weaker than expected outturns and survey evidence pointing to further deceleration in activity.

MARKETS

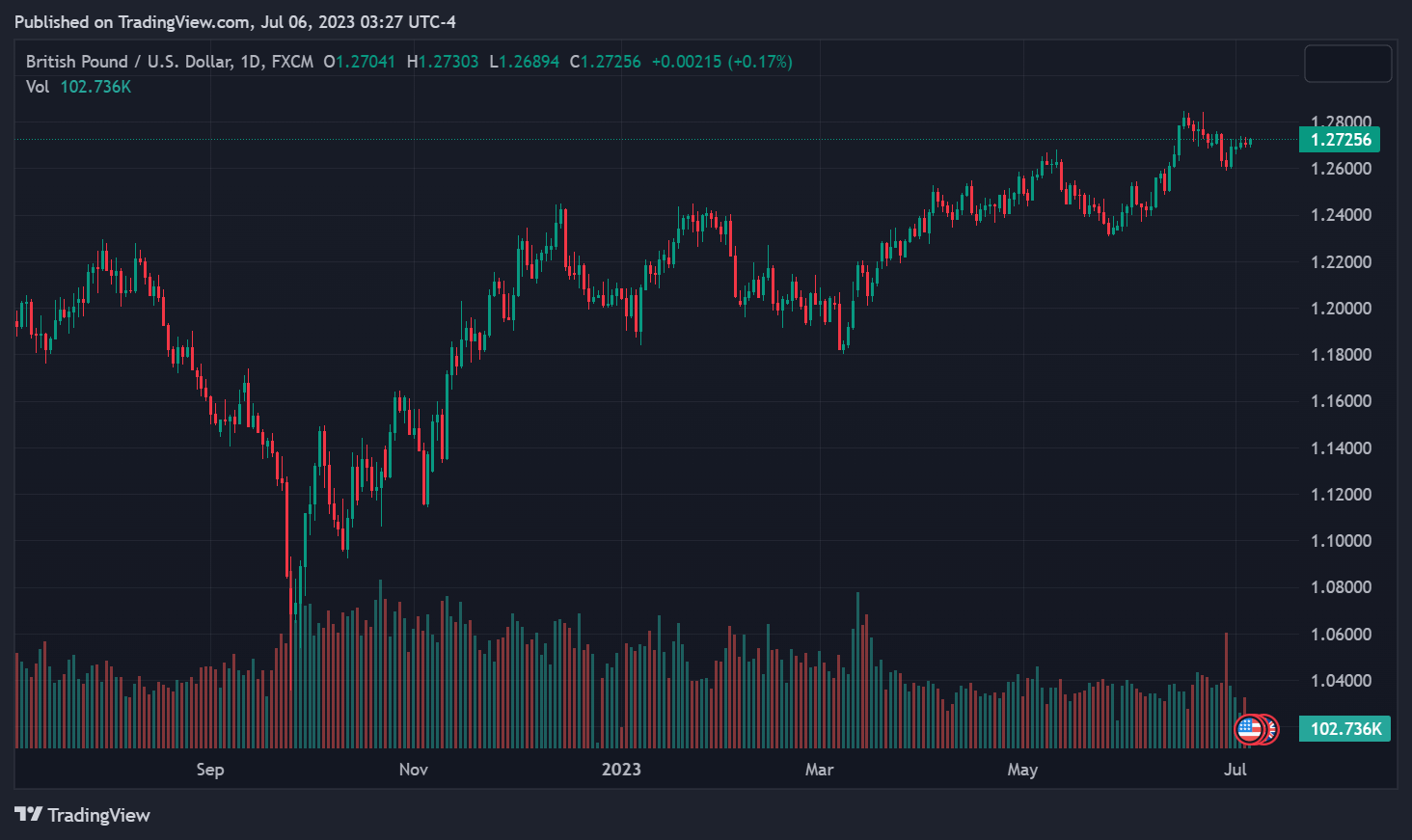

US Treasury yields moved higher overnight, with 2- and 10-year yields near 5% and 4%, respectively. UK 2-year gilt yields rose further above last year’s highs after the mini-budget, ending yesterday up 6bp at 5.38%. In the currency markets, there was relatively little change in GBP/USD at 1.27, while the euro received a little boost after this morning’s surprisingly strong German factory orders data.