Gold Reaches 11-Month High as Global Demand for Safe Assets Surges

By RoboForex Analytical Department

Gold prices surged to an 11-month high, reaching 2,750 USD per troy ounce, a level last seen in November of the previous year. The metal’s rally reflects heightened demand for safe-haven assets amid escalating global trade tensions and a weakening US dollar.

Drivers of Gold’s rise

The growing appetite for Gold comes as fears of global 'trade wars' intensify. Investors seek refuge in safe assets following US President Donald Trump’s announcement of plans to overhaul the country’s tariff policies. The uncertainty surrounding potential escalations with Canada, Mexico, and China has rattled markets. The market eagerly awaits updates on these developments, but for now, the environment is ripe for Gold’s continued appeal.

In addition, Trump recently vowed to impose tariffs on the EU, though specifics remain unclear. The move is perceived as a potential tool for political leverage, raising further risks for global capital markets.

Another factor to watch is US inflation. Trump’s policies were initially expected to drive inflation, which supported the Federal Reserve’s elevated interest rates. While this would typically weigh on Gold, much will depend on the details of forthcoming economic measures.

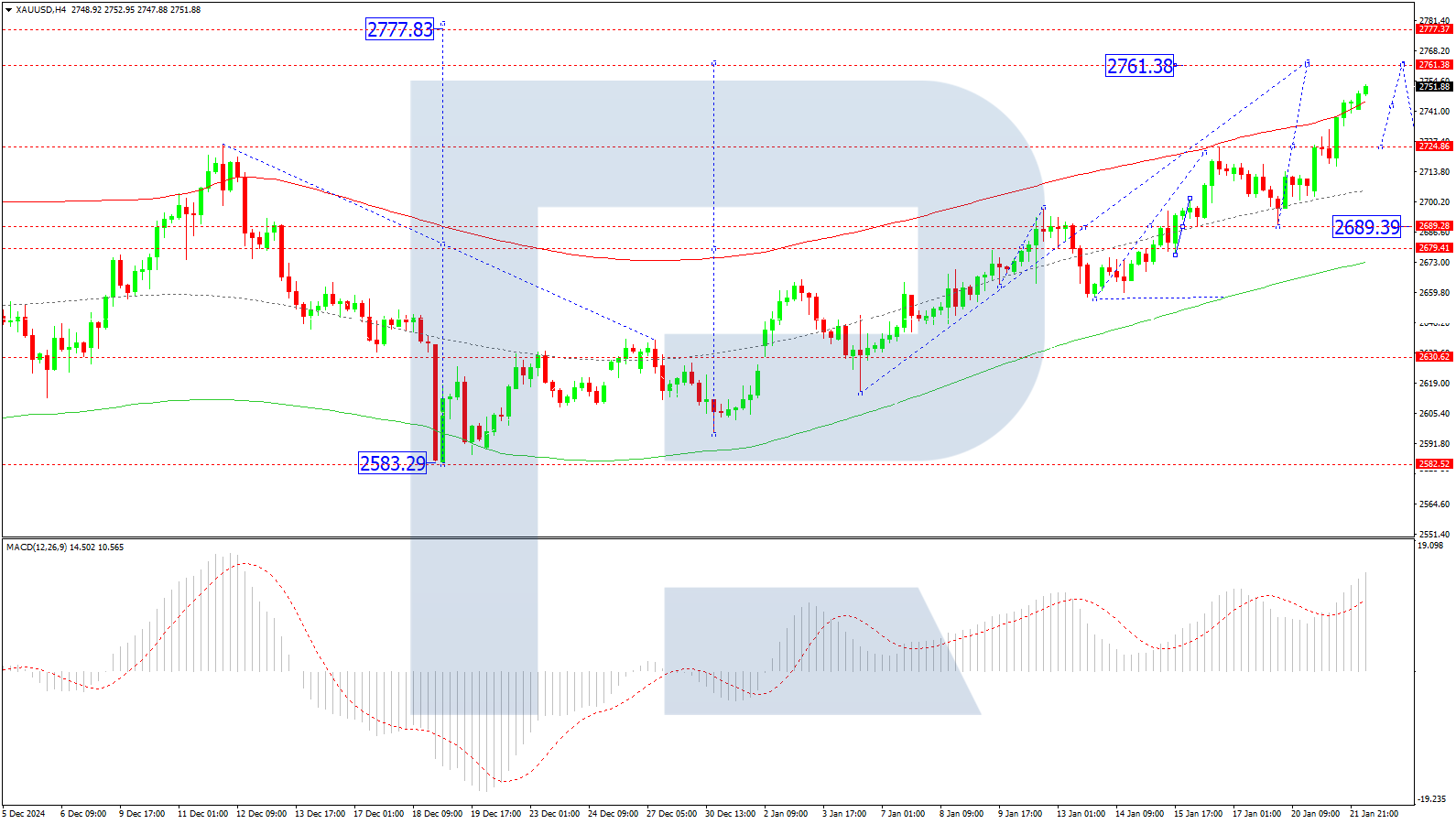

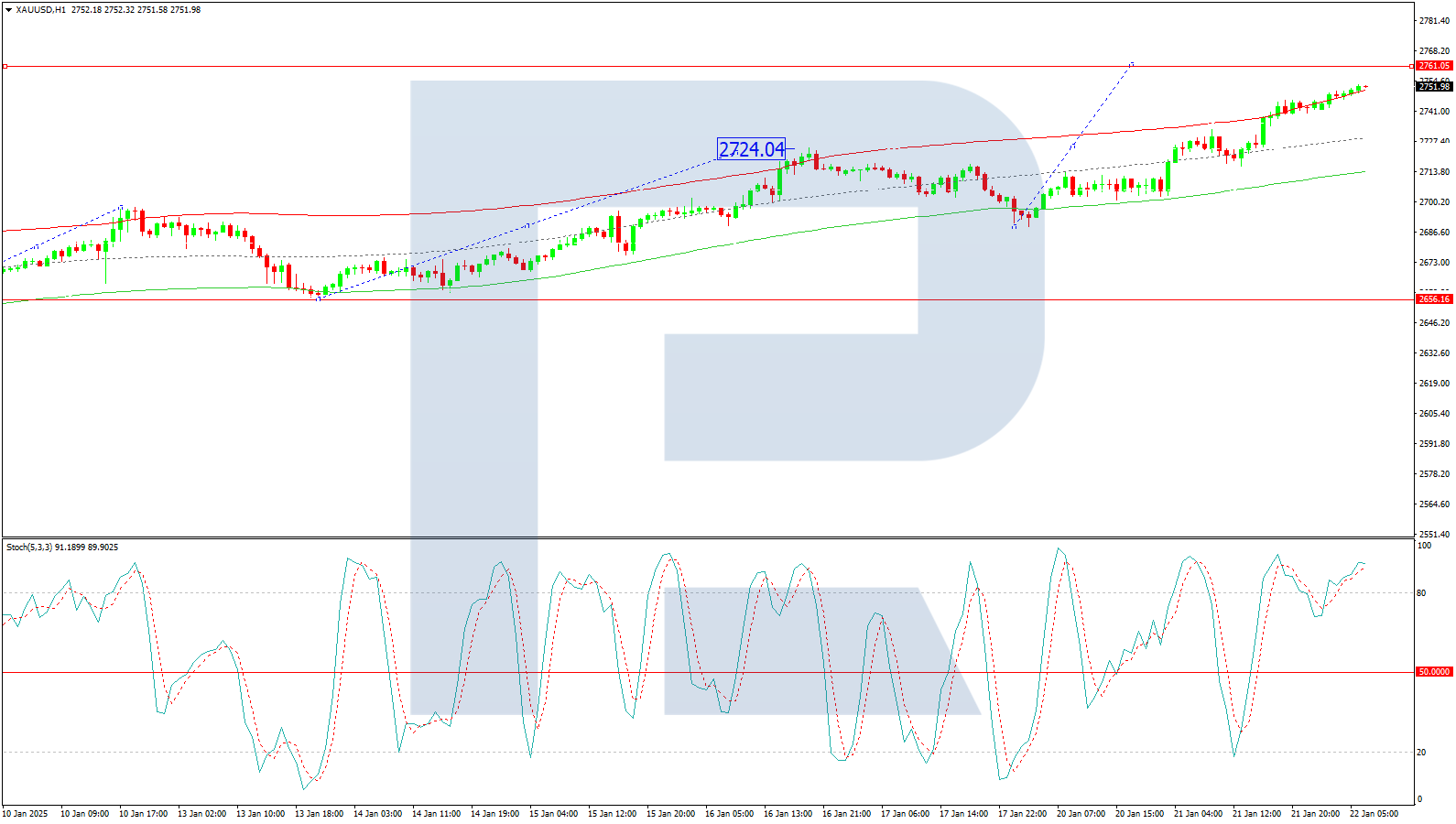

Technical analysis of XAU/USD

On the H4 chart, XAU/USD formed a consolidation range around 2,689 USD before breaking out upwards to 2,724 USD. After testing 2,689 USD from above, the market resumed its upward movement, breaking through 2,724 USD and advancing towards the next target of 2,761 USD. A correction back to 2,689 USD remains possible in the future. The MACD indicator supports this scenario, with its signal line above the zero level and trending strongly upwards, reflecting bullish momentum.

On the H1 chart, the pair consolidated around 2,724 USD before breaking upwards to continue its growth wave. The immediate target is 2,761 USD and is expected to be reached soon. After hitting this level, a downward wave back to 2,724 USD could emerge, potentially extending to 2,689 USD as part of a correction. The Stochastic oscillator confirms this view, with its signal line above the 80 level but showing signs of preparing for a decline towards 20, indicating potential short-term bearish movement.

Conclusion

Gold’s rise to an 11-month high reflects its renewed safe-haven status amid escalating trade uncertainties and a softer US dollar. Technical indicators point to further gains towards 2,761 USD in the short term, though a correction to levels around 2,724 USD or 2,689 USD remains possible. Broader movements will depend on developments in US trade policy and inflation, with the market keenly focused on updates from Washington.

Disclaimer

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.