Gold Surge on Rising Geopolitical Issues

- The Chinese equity market soared as the Chinese government reportedly implemented a bolder stimulus package.

- The U.S. dollar gained in strength ahead of Wednesday's CPI reading.

- With the interest rate decision due tomorrow, the Canadian dollar is weighing on a 50 bps rate cut speculation.

Market Summary

Chinese equities soared as top leaders signaled more aggressive stimulus measures to revitalize the economy. The Hang Seng Index and China A50 Index both rallied over 3% in the previous session, with momentum carrying into today’s trading. Oil prices rebounded from recent lows, buoyed by China’s economic revival plans and geopolitical tensions in the Middle East, as reports emerged of Syrian rebel groups toppling the Assad regime. Gold surged to a two-week high, reflecting heightened demand for safe-haven assets amid rising geopolitical uncertainties.

The Japanese yen extended its slide despite better-than-expected economic data released yesterday. Market skepticism over the Bank of Japan’s ability to hike interest rates, coupled with increased geopolitical uncertainty, weighed on the currency.

The U.S. dollar gained ground following robust labor market data last Friday, which showed lower unemployment and higher wage growth. Traders are now awaiting Wednesday’s U.S. inflation data, which could offer further clarity on the Federal Reserve's monetary policy trajectory.

Meanwhile, the Canadian dollar faces downward pressure ahead of the Bank of Canada’s rate decision tomorrow. Markets anticipate a 50 basis point rate cut, which, if confirmed, could dampen the currency’s appeal.

Current rate hike bets on 18th December Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (40.4%) VS -25 bps (59.6%)

Market Movements

DOLLAR_INDX, H4

The Dollar Index extended its gains as investors continued to digest robust US jobs data. Nonfarm Payrolls and the US Average Earnings Index + Bonus exceeded expectations. However, US CPI data, due later this week, remains the focal point for global investors. Though, gains experienced by the dollar are limited by downbeat analysts' opinions. Morgan Stanley recently suggested the dollar’s momentum has slowed, raising the possibility of a technical correction.

The Dollar Index is trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 54, suggesting the index might extend its gains since the RSI rebounded sharply from oversold territory.

Resistance level: 106.85, 108.05

Support level: 105.80, 104.45

XAU/USD, H4

Gold prices remained resilient, supported by heightened geopolitical risks following the fall of the Bashar al-Assad regime in Syria. Over the weekend, Assad and his family fled to Moscow, ending five decades of dictatorship. Additionally, the People’s Bank of China (PBoC) resumed gold purchases after a six-month hiatus, providing further support to gold prices.

Gold prices are trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 59, suggesting the commodity might extend its gains since the RSI stays above the midline.

Resistance level: 2655.00, 2705.00

Support level: 2610.00, 2555.00

GBP/USD,H4

The GBP/USD pair continues to trade within its established uptrend channel but shows signs of waning upward momentum. The dollar's renewed strength, bolstered by last Friday's robust U.S. jobs report, has pressured the pair. The strong labor market data has heightened expectations of a more hawkish stance from the Federal Reserve, lending support to the greenback and challenging the pound's recent gains.

GBP/USD despite trading with its uptrend channel but has formed a lower-high price pattern, suggesting a potential trend reversal for the pair. The RSI remains above the 50 level while the MACD is flowing flat above the zero line, giving a neutral signal for the pair.

Resistance level: 1.2790, 1.2850

Support level: 1.2700, 1.2620

EUR/USD,H4

The EUR/USD pair briefly broke above the short-term resistance level at 1.0560 but failed to hold above this threshold, signaling a lack of bullish momentum. With the European Central Bank's interest rate decision approaching, market speculation around a more significant rate cut is weighing on the euro's strength. This dovish outlook has dampened sentiment and raised concerns about a potential trend reversal for the pair.

EUR/USD has formed a lower-high price pattern, a break below from the 1.0530 mark shall be a bearish signal for the pair. The RSI remains at above the 50 level while the MACD remains at above the zero line, suggesting that the bullish momentum remains intact with the pair.

Resistance level: 1.0607, 1.0700

Support level: 1.0440, 1.0325

USD/JPY, H4

The Japanese yen continued to slide against its peers, with the USD/JPY pair breaking above the short-term resistance level at 150.75, signaling a bullish bias. The market has lowered expectations for another rate hike from the Bank of Japan at its December 19th interest rate decision, adding to the yen's weakness. In contrast, the dollar remains buoyed by robust U.S. job data released last week, which has reinforced the prospect of a hawkish Federal Reserve and provided additional upward momentum for the pair.

USD/JPY broke above the short-term resistance level and formed a higher-high price pattern, suggesting a bullish signal for the pair. The RSI has broken above the 50 level while the MACD surged above the zero line, suggesting that the bullish momentum is forming.

Resistance level: 151.80, 154.15

Support level: 149.40, 146.45

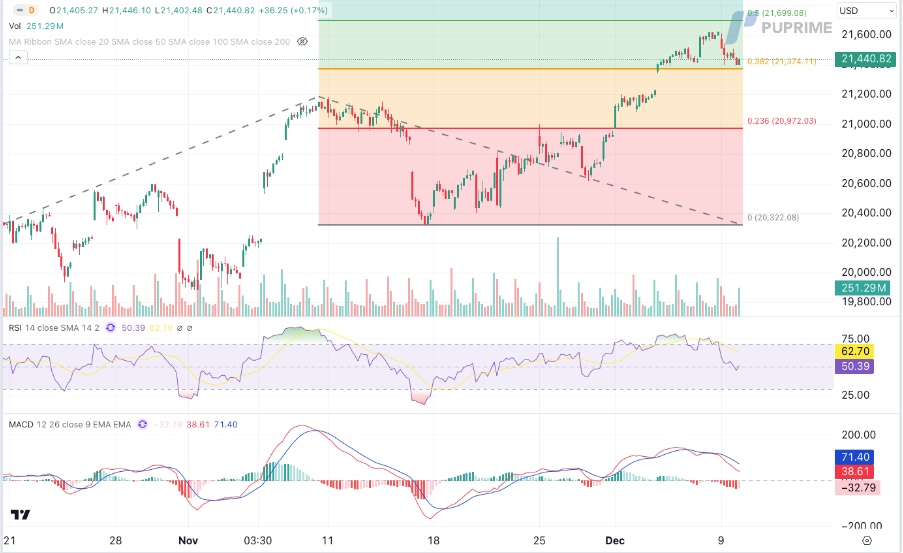

NASDAQ, H4:

Wall Street dipped slightly as profit-taking in tech stocks weighed on performance ahead of the inflation report. NVIDIA (NVDA) fell 2.6% and another 0.6% after hours on reports of a Chinese antitrust probe, while Oracle (ORCL) plunged 8% post-earnings miss, citing competition from Microsoft (MSFT) and Amazon (AMZN), raising AI prospect concerns.

Nasdaq is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 50, suggesting the index might extend its losses since the RSI retreated sharply from overbought territory.

Resistance level: 21955.00, 23100.00

Support level: 21170.00, 20395.00

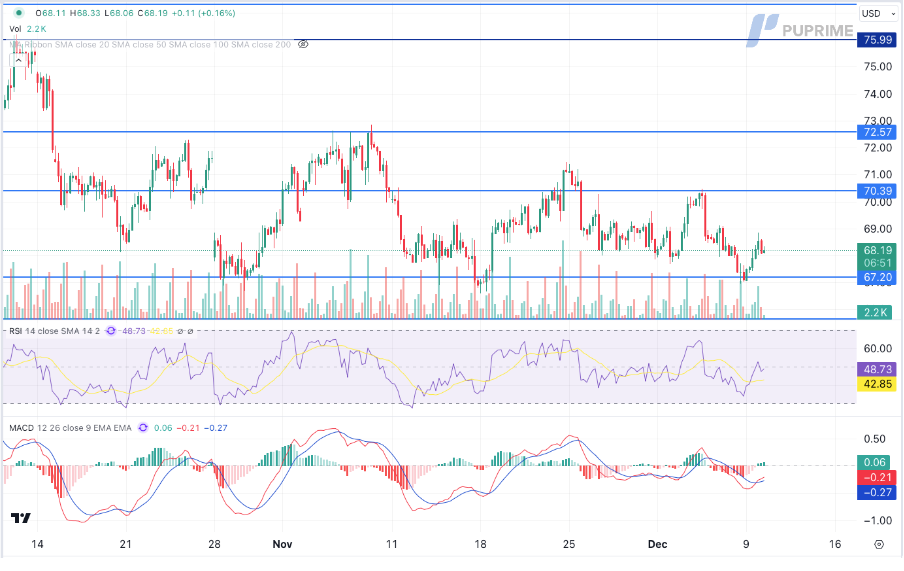

CL OIL, H4

Crude oil prices rebounded on escalating geopolitical tensions following the overthrow of Syrian President Bashar al-Assad. The regime’s collapse has raised concerns about potential regional conflicts that could disrupt oil supplies, driving up WTI prices. However, Saudi Arabia's recent price cuts and extended OPEC+ output constraints continue to highlight weak demand fundamentals, particularly from China.

Oil prices are trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 49, suggesting the commodity might extend its gains since the RSI rebounded sharply from oversold territory.

Resistance level: 70.40, 72.55

Support level: 67.20, 65.65