Is AUDUSD set for a break higher?

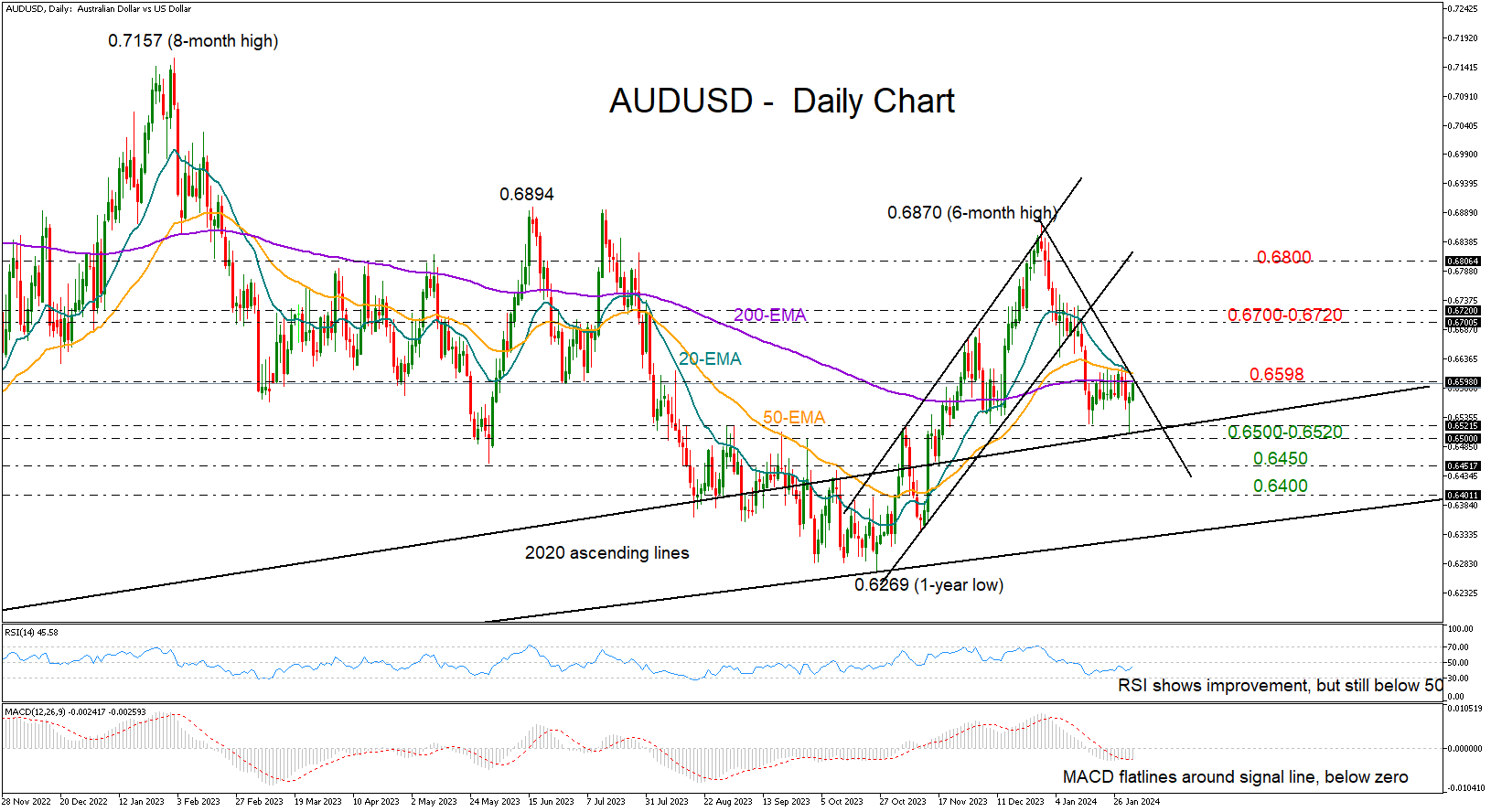

AUDUSD bulls came into action instantly after the price dropped to a more-than-two-month low of 0.6507 to test the ascending trendline from the 2020 low. The pair finished the day with a bullish long-tailed hammer candlestick, which is theoretically a positive signal of an upside reversal. Yet, traders will need another big green candlestick to confirm a continuation higher.

The exponential moving averages (EMAs) have been capping upside movements around the 0.6598 level over the past week. Therefore, a clear break above this wall is probably required for a rally towards the next resistance of 0.6700-0.6720. Even higher, the pair could retest the lower band of the broken bullish channel near the 0.6800 psychological mark.

Note that the RSI has yet to rise above its 50 neutral mark, while the MACD remains stable near its red signal line, reflecting some uncertainty in the market.

If the pair gets a rejection near the 0.6600 number, the focus will turn back to the 0.6500-0.6520 constraining zone. A close below this region could trigger a decline towards the 0.6450 area, where the pair paused several times in the second half of 2023. The 0.6400 round level could be the next destination if sellers stay in play.

All in all, AUDUSD is displaying a bullish tendency, with traders likely awaiting a durable move above the 0.6600 mark to boost the price higher.

.jpg)