Oil bulls fail again

Oil bulls fail again

Oil once again failed to confirm the bullish trend on Wednesday, moving lower under pressure from news of a jump in US inventories.

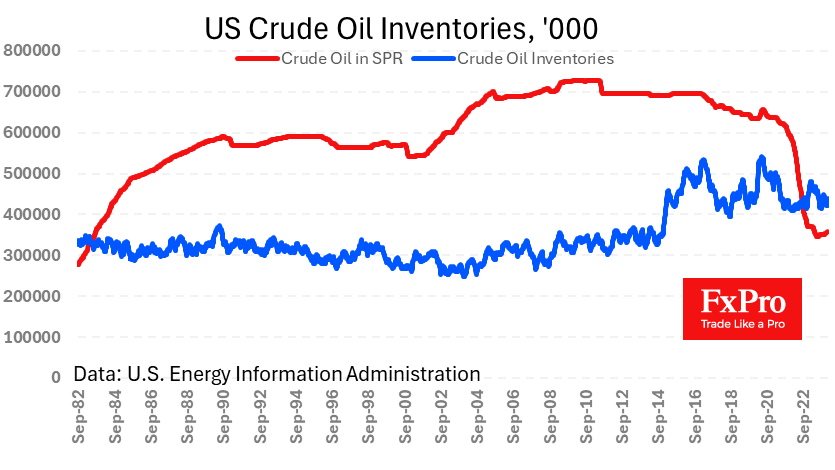

The Department of Energy reported that commercial inventories rose by 12 million barrels last week, bringing the three-week total to 18.8 million barrels. Analysts had forecast an average increase of 5.5 million barrels. At the same time, Strategic Petroleum Reserve stocks rose by 0.75 million for the week and 2.25 million over three weeks. This short-term view highlighted that America is hoarding oil, which is bearish.

But it's also worth looking at the bigger picture. Commercial inventories are now 6.8% lower than the same week last year and remain close to the lows of the last nine years. There is 3.5% less fuel in the strategic stockpile than a year ago, and the build-up has been prolonged from a 41-year low, and it will take years, if not a decade, to fully recover to the peak.

Admittedly, that is unlikely ever to happen. For now, the US continues to produce oil at a record 13.3 million bpd, is becoming a net exporter of the fuel and is promoting alternative energy investment at the government level. In such an environment, there is simply no need to maintain the high stockpiles of the 1990s, let alone the higher levels of the 2010s.

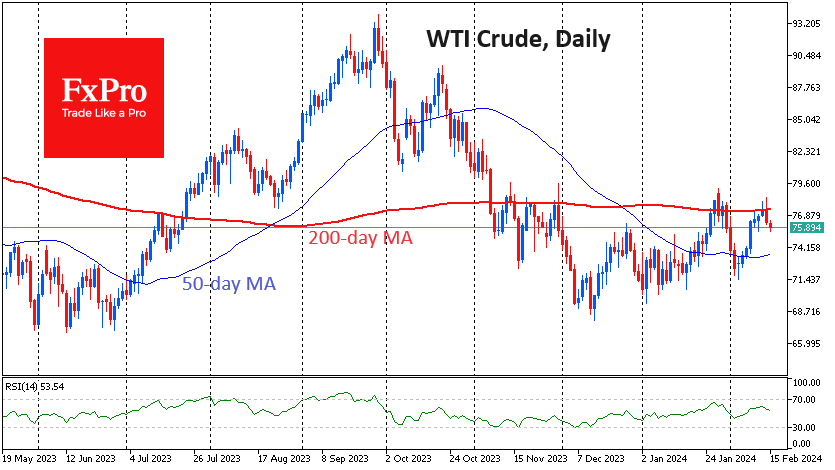

Either way, the inventory news emboldened the bears and added to the pressure on oil, which retreated 3.5% from Wednesday's highs. This sell-off has once again stopped oil's attempt to settle above its 200-day moving average. It hasn't been broken since November last year.

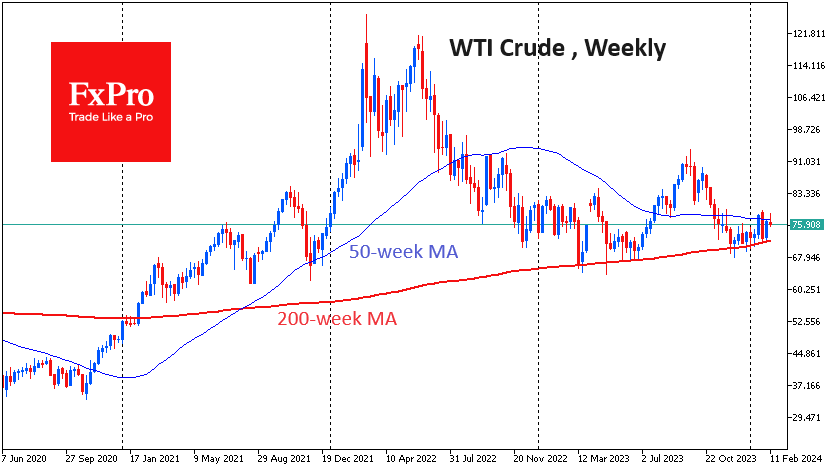

This is a relatively strong bearish signal, which creates downside potential in the coming days. However, the downside is limited by the equally important 200-week average line, which runs through the $72.0/bbl WTI/$75.0/bbl Brent level.

Oil has been tied between the ranges of 72-79 for WTI and 75-82 for Brent for many months now. Only when we break out of this range can we talk about a new trend in oil. Perhaps caused by the shrinking economies of Japan and the UK, as well as recession forecasts in Germany, combined with a slowing China.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)