Oil surges as Israel attacks Iran, gold and dollar climb too

Israel targets Iran’s nuclear and missile sites

Israel carried out overnight air strikes on Iran, targeting its nuclear facilities and ballistic missile factories, as well as senior military commanders, raising tensions in the region once again. The head of Iran’s Revolutionary Guard has reportedly been killed, but military leaders weren’t the only targets as six Iranian nuclear scientists have also been killed by the strikes.

Iran has already responded by launching more than 100 drones, most of which will likely be intercepted by Israel’s Iron Dome air defence system.

The offensive comes as the United States and Iran were negotiating a new deal that would have allowed Tehran to maintain a limited nuclear programme in return for reduced sanctions on oil exports. The next round of talks, which were due to take place on Sunday, have now been called off by Iran despite the US confirming that it had no involvement in the overnight strikes.

Oil futures pare earlier gains

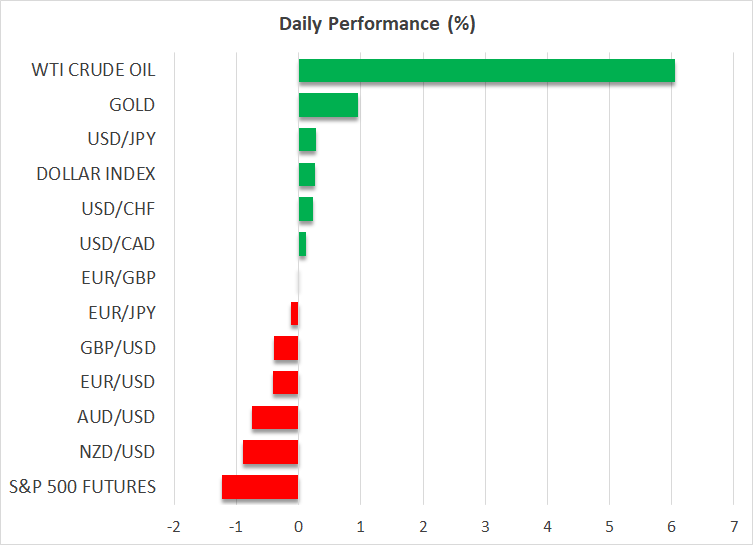

Oil prices surged as the headlines about the attacks emerged. WTI and Brent crude futures both jumped by more than 10% initially before easing somewhat to stand almost 6% higher during European trading.

Although there’s no indication that Israel has struck any of Iran’s oil facilities, this major escalation has the potential to turn even uglier, such as a wider and more prolonged regional conflict. At the very least, a nuclear deal in the near future has been taken off the table, and this puts a floor under oil even if things were to de-escalate in the coming days.

Dollar bounces back from 3-year low

Safe havens, including the battered US dollar, also rallied, while equity markets sagged. The dollar is making a bit of a comeback today as the heightened geopolitical risks appear to have restored some of its lost allure. It is outperforming its safe-haven peers, the yen and Swiss franc, even as Fed rate cut bets have been ratcheted up this week following the soft CPI and PPI reports out of the US.

However, in the bigger picture, the dollar looks set to struggle for a while longer as the trade war isn’t about to end anytime soon, while President Trump is once again raising the prospect of interfering with Fed policy.

Speaking on Thursday, Trump expressed his frustration about the government having to spend $600 billion a year on debt repayments because of high interest rates, saying that “I may have to force something”.

His cryptic remarks added to the market angst as they came hot on the heels of Wednesday’s comments about setting unilateral tariff rates if countries have not agreed to any trade deals by the July 9 deadline.

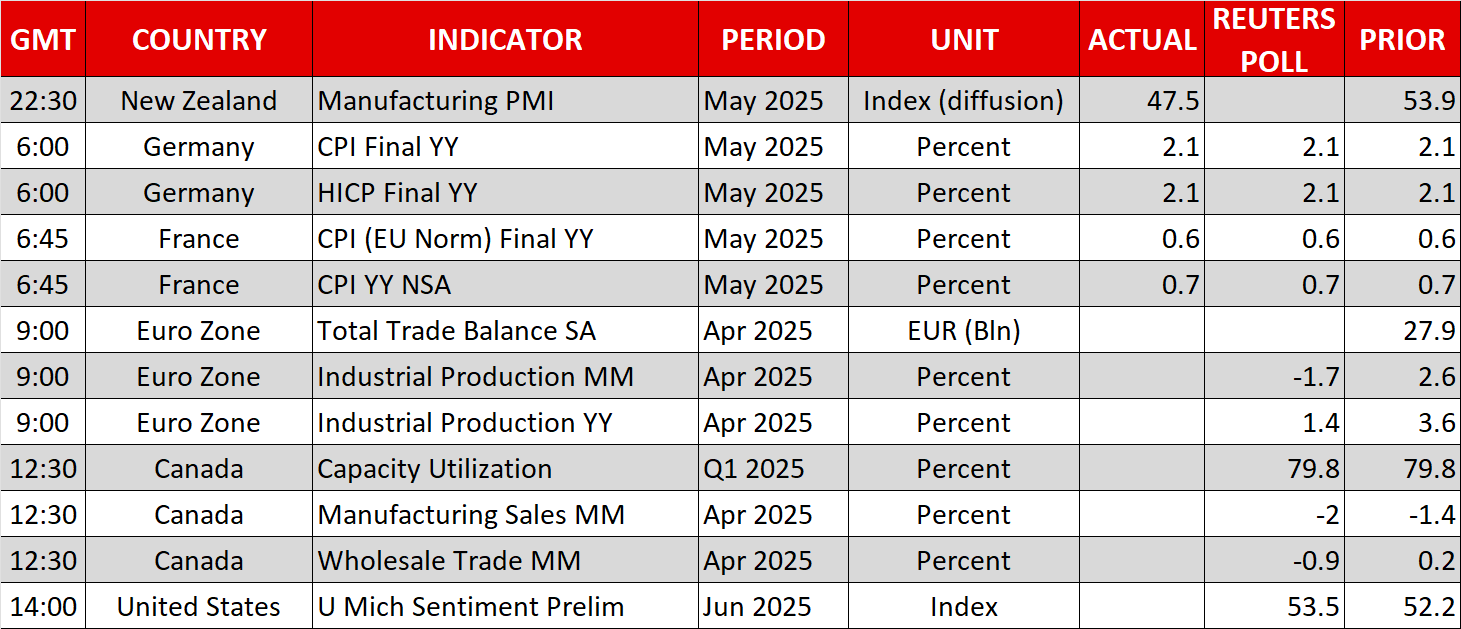

The focus later today will be on the University of Michigan’s preliminary consumer sentiment survey, with the dollar advancing about 0.3% against a basket of currencies ahead of the data, recovering from yesterday's more than three-year low.

Yen edges higher as BoJ decision looms

The yen is also having a positive day, except against the greenback, receiving an additional boost from a Bloomberg report that Bank of Japan officials expect inflation to be a little stronger than expected this year, even though no rate hike is anticipated at next week’s meeting.

The June decision will likely focus on the Bank’s bond buying plans amid worries about long-term yields rising too fast. But any slowdown in tapering could be accompanied by a more hawkish outlook on short-term rates.

Gold shines, stocks avoid a sharp selloff

Gold, meanwhile, is flying past the $3,400 level as it eyes its April all-time high of $3,500. The precious metal is well placed to reach a new record if there’s a further flare-up of military tensions between Israel and Iran. But growing doubts about whether the US will be able to sign new trade deals with its key trading partners in time before the next deadline is also a significant tailwind in the near term.

The only real surprise is how well equities have been performing despite all the uncertainties. Asian losses on Friday did not exceed 1%, while European shares and US futures are currently between 1-1.5% lower.

.jpg)