Pound shines as strong data limits room for BoE’s rate cut

Pound shines as strong data limits room for BoE’s rate cut

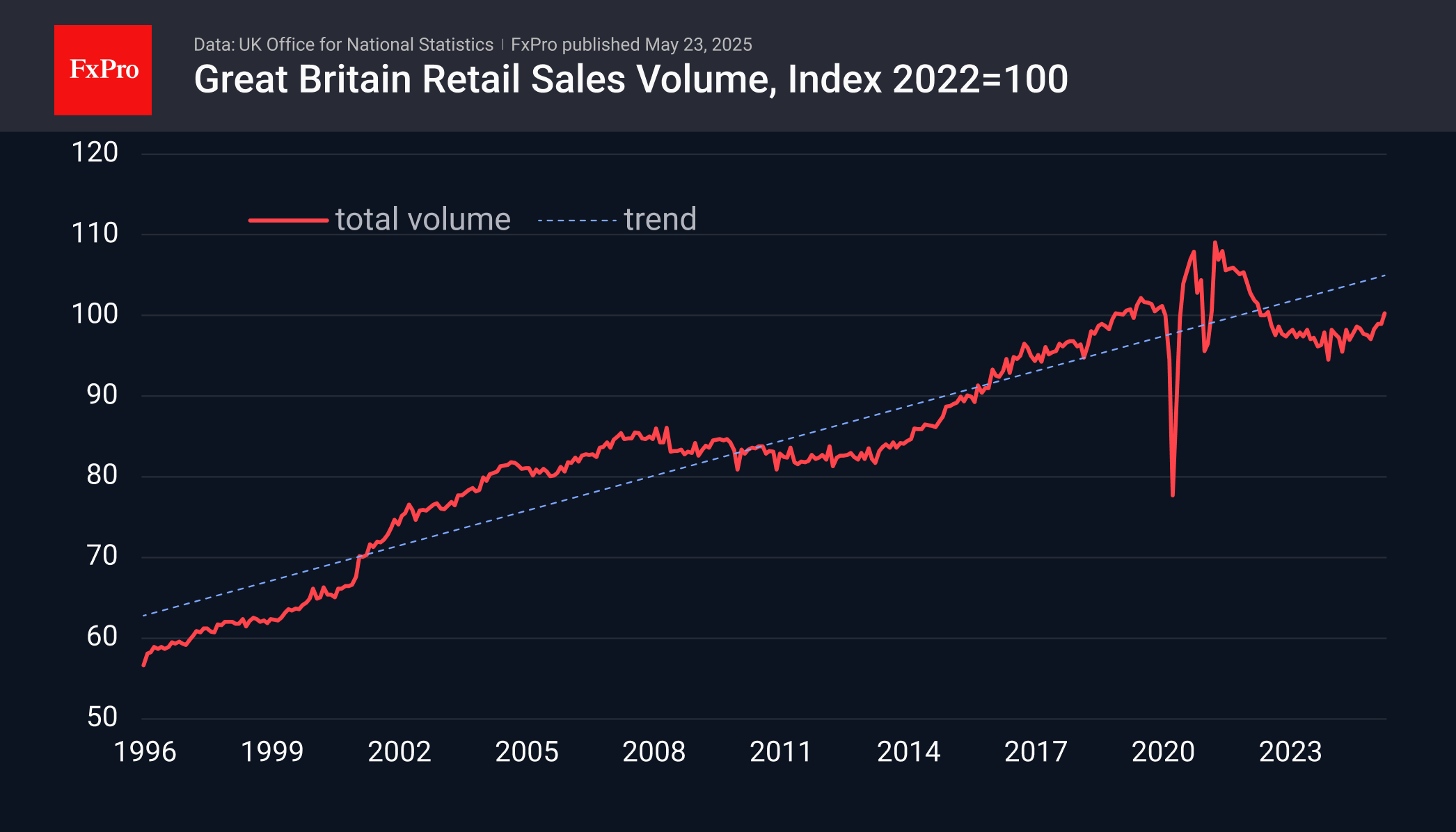

Britain continues to be surprised by strong retail sector data. Data on consumer inflation accelerating to an annualised pace of 3.5% was complemented by strong retail sales figures, renewing buying momentum in GBPUSD.

For April, sales excluding fuel rose by 1.3%, and by the same month last year, the increase was 5.3%. This is much stronger than the average forecasts of economists, who expected to see +0.3% and +4.4%, respectively. Total sales rose 1.2% m/m and 5.0% y/y, equally impressively beating expectations.

UK consumer activity has strengthened since the end of last year, beginning an active return to its long-term linear trend. This news, combined with the latest jump in inflation, limits the room for the Bank of England to cut rates.

This is good news for the currency, so it is no surprise that the pound is hitting 39-month highs. Along with a strong economy comes rising long-term bond yields in Britain, which are historically higher than their US, European and Japanese counterparts. There is a lot of talk now about how difficult it is for America to service its debt at current yields; we can't forget the 95.5% debt-to-GDP ratio in the UK and the 5.5% yield on local 30-year notes versus the 5% yield in the US. Attention to this issue at the Ministry of Finance or the Bank of England could dramatically change the trend of the pound.

By the FxPro Analyst

-11122024742.png)

-11122024742.png)