Stocks rally ahead of NFP report, pound climbs after BoE caution

Wall Street shrugs off blurry outlook

Wall Street staged a comeback on Thursday after suffering its worst day since September in the aftermath of the FOMC decision on Wednesday. There was no clear catalyst for yesterday’s rebound as neither the data nor the latest earnings offered a decisive view on where the economy is headed.

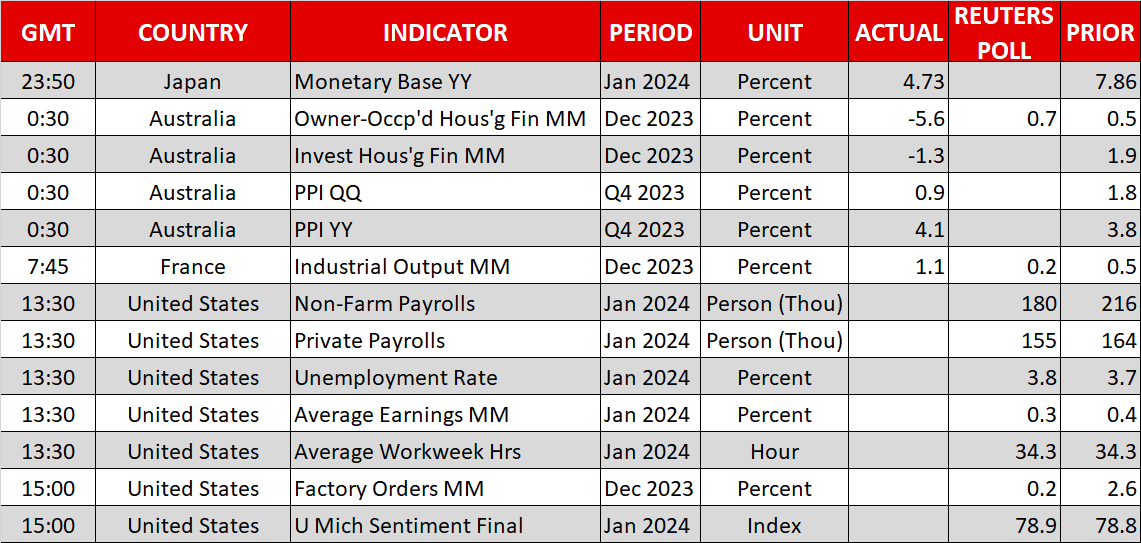

The ISM manufacturing PMI unexpectedly rose in January, with the new orders component growing for the first time since August 2022. But the price paid index also jumped higher, which should have spooked markets a bit, but investors seem to have focused more on the uptick in jobless claims, which increased for the second month in a row to the highest since November.

A softening labour market bodes well for dovish expectations for the Fed even if markets have to contend with the first rate cut arriving somewhat later than hoped. When combined with lower yields, there is little reason for investors to remain downbeat for too long.

Big Tech’s hit or miss earnings turns to rally

Treasury yields have taken a substantial hit this week from the Treasury Department’s announcement that it will borrow less this quarter than previously estimated, putting equities on the front foot at the start of the week. Disappointing earnings from Alphabet upset the positive mood mid-week but the selloff was contained and Thursday’s rebound stands a good chance of extending today following stellar results from Amazon and Meta.

Apple is likely to be a drag, however, as its better-than-expected revenue growth was overshadowed by falling sales in China and weak guidance for the current quarter.

Will NFP report upset the bull market?

The S&P 500 rallied 1.3% to close back above the 4,900 level, while the Dow Jones set a new record high. Exxon Mobil and Chevron are in the earnings spotlight on Friday. Overall, investors seem to be taking the view that the earnings misses aren’t so disastrous when considering the AI-driven growth potential that’s yet to be fully tapped into by the Big Tech. Even a fresh scare for US banking stocks hasn’t been able to faze the broader stock market.

But if there is anything that can spoil this optimism, at least in the short term, it’s today’s nonfarm payrolls report. The US economy likely added 180k jobs in January versus 216k in December. The unemployment rate is expected to rise slightly to 3.8%. Any upside surprises risk further pushing back the timing for a rate cut by the Fed.

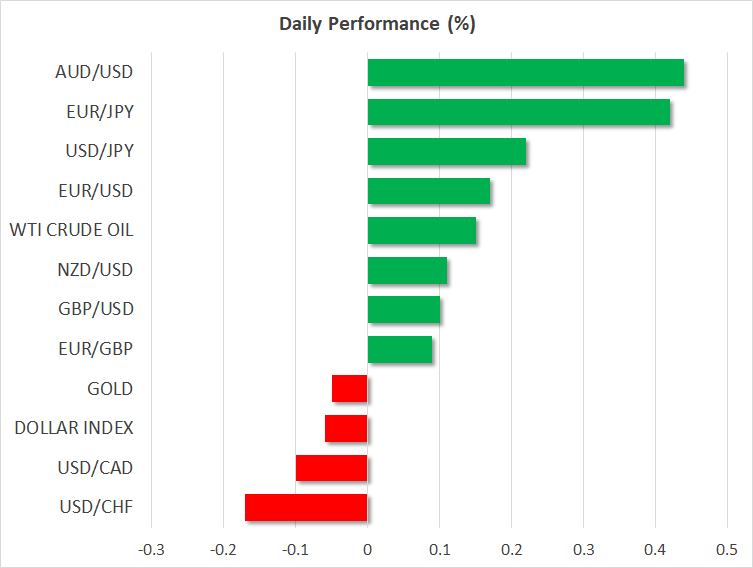

Dollar succumbs to falling yields as euro gets a CPI lift

The US dollar is headed for weekly losses despite Fed Chair Powell clearly signalling that there is no urgency to cut rates, with the slide in Treasury yields finally catching up with the currency.

The softer dollar has been good news for the euro, which received an additional boost on Thursday from somewhat hotter-than-expected readings in underlying inflation in January’s flash estimate. The single currency is trading back above $1.0890 today.

Pound firmer after seesawing on BoE decision

Sterling has also perked up after a very choppy session on Thursday following the Bank of England’s policy meeting. The Bank of England took a more neutral stance as it kept rates on hold but appeared in no rush to lower borrowing costs. Governor Andrew Bailey warned that inflation may pick up again even if, as expected, it briefly hits the 2% target in the spring.

However, investors were mainly surprised by the three-way split within the Monetary Policy Committee as two policymakers continued to vote for a hike, while one member wanted a cut at the February meeting. The pound bounced from a low of $1.2622 to a high of $1.2755 and is slightly advancing those gains today.

Gold slips after solid week, US ME response eyed

The weaker dollar failed to lift gold prices on Friday, although the precious metal is on track for solid gains for the week. Today’s losses may simply be a bit of profit taking but there could be some caution as well amid a fresh attempt by Israel and Hamas to strike a temporary ceasefire deal to allow the exchange of hostages.

A late rebound cannot be ruled out, however, amid speculation the United States may carry out attacks on Iran-backed proxies in the Middle East over the weekend following the recent killing of three American soldiers in Jordan.

Oil futures, meanwhile, edged higher, buoyed by the overall risk-on tone in the markets. Prices came under pressure on Thursday as the OPEC+ meeting ended with no change in production and no clarity on whether the latest cuts will be extended at the next gathering in March.

.jpg)