UK Inflation distanced the expected rate cut

Inflation in the UK exceeded forecasts, making traders and investors cautious about the prospects for policy easing in the coming months.

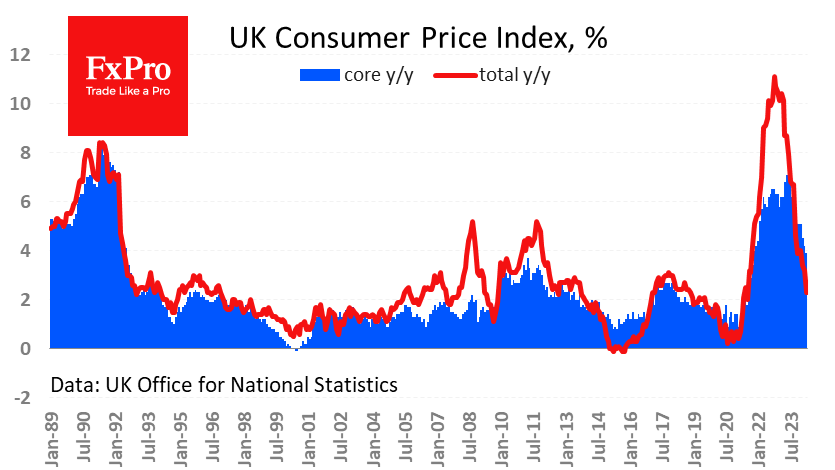

Consumer prices rose by 0.3% m/m vs. 0.2% expected. Annual inflation slowed to 2.3% last month from 3.2% in March. This is the lowest level in two years, comfortably close to the Bank of England's target but above the forecast of 2.3%.

Core inflation has been gently slowing over the past 12 months but has only fallen to 3.9% y/y from a peak of 7.1% y/y. Meaningful progress, but quite far from the desired level. In our view, the high growth rate of the core price index is the most important factor pushing forward the date of policy easing.

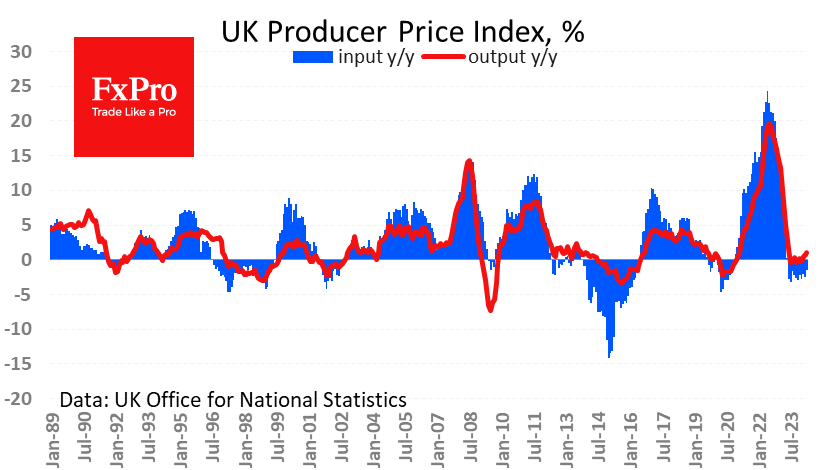

At the same time, producer prices have been at comfortably low levels for an extended period. The producer price index loses 1.5% y/y on entry, having remained in negative territory for the past 11 months. The Output Price Index is rising at a rate of 1.1% y/y, accelerating over the past three months from a low of -0.2% in February. Nevertheless, this is a relatively low rate that does not prevent policy easing.

Thus, the most intense inflationary pressure is centred on the retailers' stage. This is probably the result of rising labour costs or an attempt to compensate for narrow margins in previous years.

The persistence of inflation translating into tighter monetary policy is causing pressure on the UK equity market. The FTSE100 is losing around 0.75%, smoothly forming a peak during the previous week. Inflation data looks like a worthwhile reason to start a correction that could take the index back to 8200 or even 8000 from the current 8360 before we see buying activity.

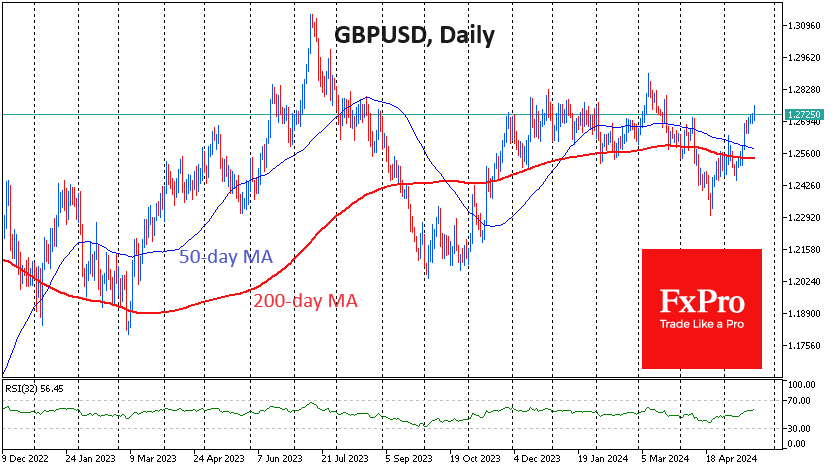

At the same time, this is good news for the pound, which hit a 2-month high against the dollar, rising above 1.2750 shortly after publication. This is an important area of resistance for the past 11 months. A further continuation of inflation higher than G10 currencies has the potential to lift GBPUSD to the next leg up to the 1.30-1.40 area. Should the economy stumble, and with it inflation, this would remove the divergence in monetary policy and put pressure back on the pound, leaving it in the 1.20-1.27 range.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)