UK inflation has not inspired Pound buying

UK inflation has not inspired Pound buying

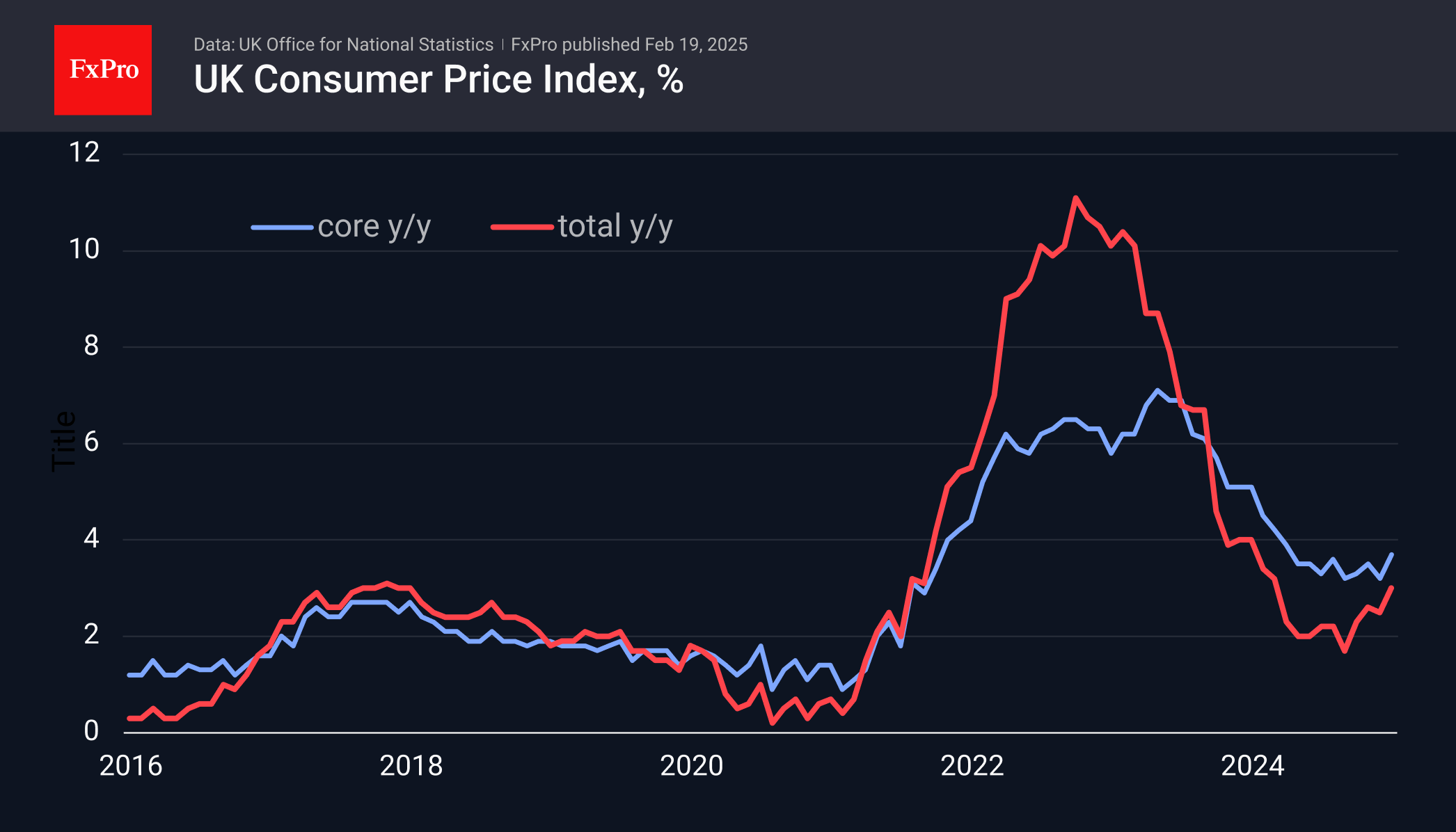

UK inflation is accelerating, reducing the scope for the Bank of England to ease monetary policy to support economic growth. Headline price growth accelerated to 3.0% in January, up from 2.5% at the end of last year and 1.7% in September - a couple of months after BoE’s rate cut kick-off. Even more striking was the acceleration in the core price index, which excludes volatile food and energy. Its annual rate of growth accelerated to 3.7% from 3.2% the previous month.

UK inflation has been above the 2% target for more than 40 months, which has entrenched elevated inflation expectations, and the monetary easing of recent months has added further fuel to the inflationary fire.

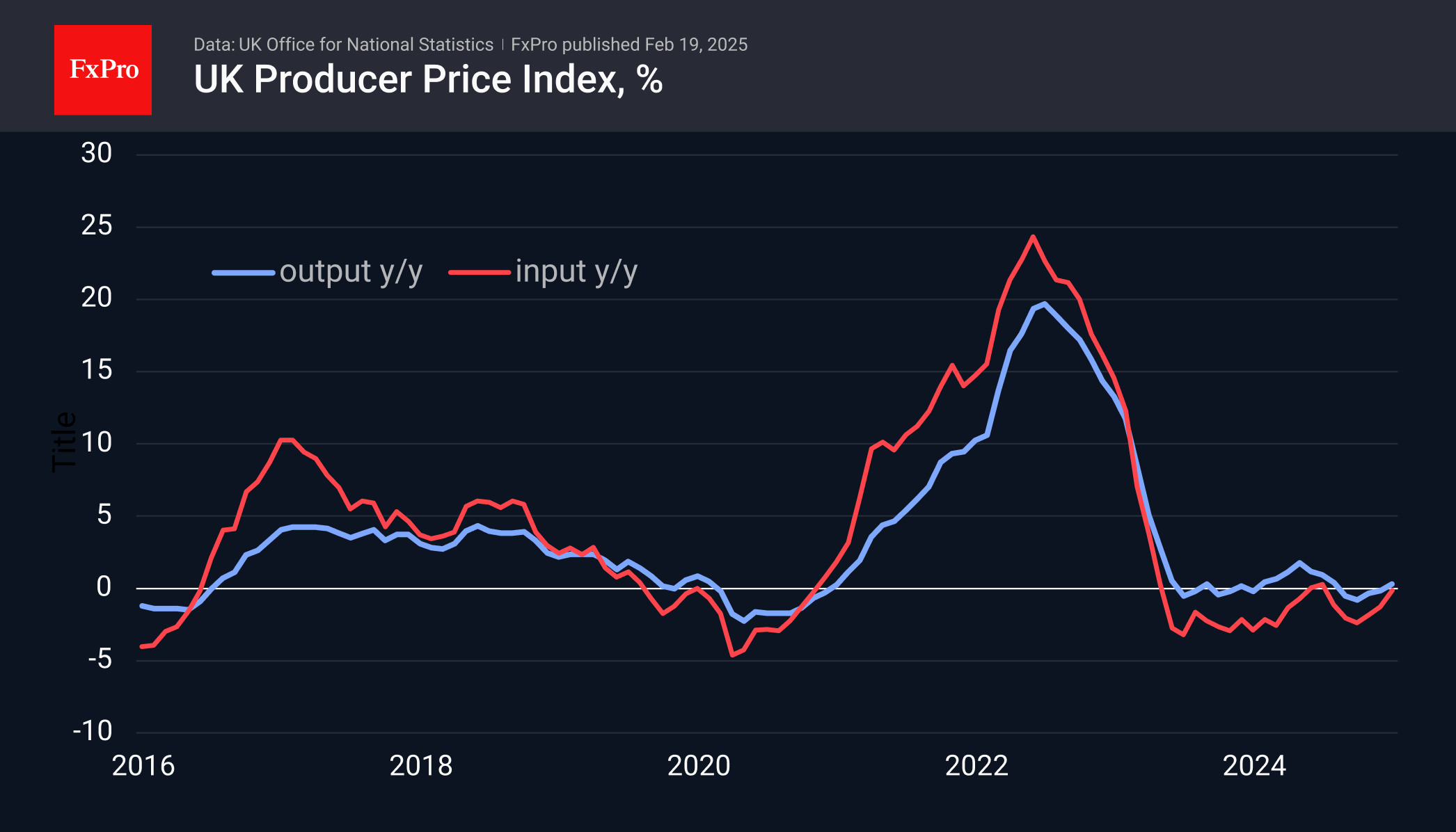

However, the acceleration in inflation has mainly been in final prices. The producer input price index has been in contractionary territory year-on-year in 19 of the last 20 months. Producer output prices are showing some increases but have also generally been barely above zero for a year and a half. They are clearly not the cause of the acceleration in final prices.

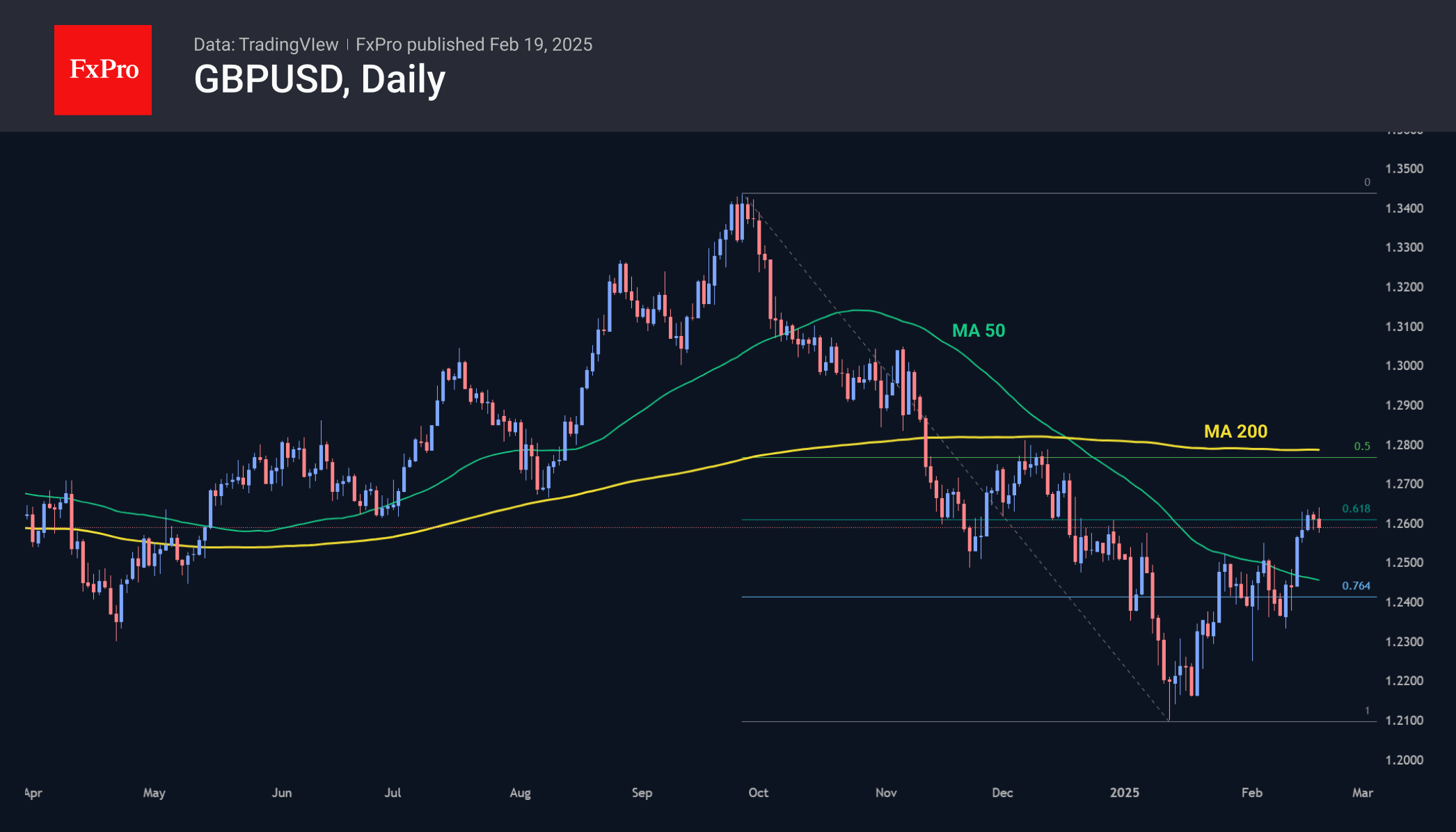

At first glance, the GBPUSD's reaction to the better-than-expected data was unusual, with the pound falling below 1.2590 and testing the lows of this week's range. But this dynamic is explained by the fact that the fresh data is unlikely to turn the Bank of England off the path of policy easing, as we can see in the US, where the Fed dramatically changed its rhetoric in response to signs of accelerating price growth. This means a reduction in the purchasing power of the pound, which hurts its exchange rate.

Technical factors are also working against the British currency these days. The 550 pips of appreciation in the GBPUSD over the past six weeks has resulted in a classic Fibonacci retracement of 61.8% of the decline since the end of September. A status quo in economic data increases the chances of a retest of the 1.2100 area in the coming weeks. Should the bears succeed, it opens the path to 1.13, where we have not seen the pound since late 2022.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)