UK inflation sets up a marathon for BoE

UK consumer inflation has come in slightly weaker than expected, but this does not significantly bring the interest rate cut date any nearer.

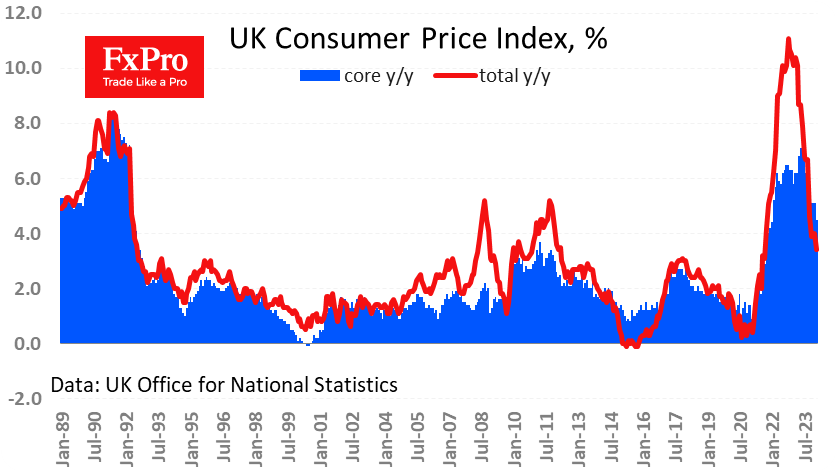

The consumer price index (CPI) rose by 0.6% in February after a similar fall in January. Annual inflation slowed to 3.4% from 4.0%, against expectations of 3.5%. The core CPI slowed its year-on-year rise to 4.5% in February after three months of stabilising at 5.1%.

Rising prices for services are driving core inflation. This is a very sluggish component, making it a marathon rather than a sprint for the Bank of England.

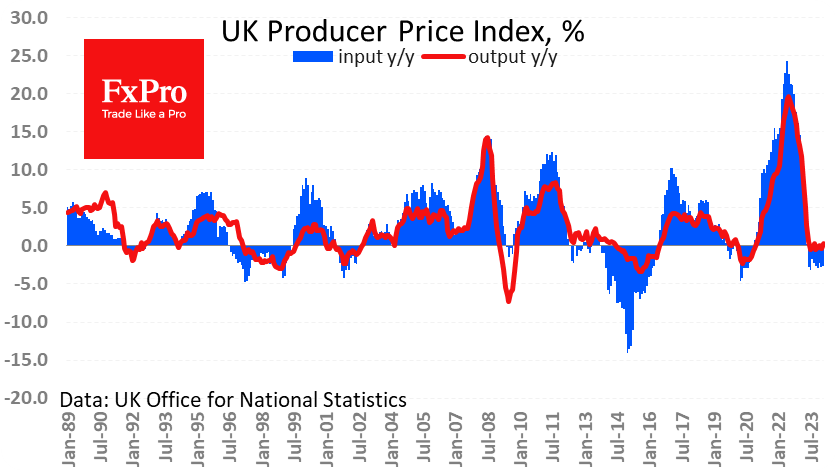

Producer input prices fell 0.4% in February and are down 2.7% year-on-year. The index has retreated to May 2022 levels thanks to lower prices for energy, metals, and a range of agricultural products.

Output prices have not shown much momentum over the past three quarters. Rising wage costs have offset the fall in input prices. The generally strong labour market is allowing manufacturers to regain profitability.

This is not bad news for the economy as it indicates business confidence, which is often self-sustaining.

Sterling rose by 0.1% against the general downtrend following the inflation release but very quickly returned to the general downtrend against the dollar.

Inflation is one of the variables that influences central bank decisions. Now, the markets are in a wait-and-see mode for the outcome of the FOMC meeting on Wednesday night and the Bank of England meeting on Thursday afternoon.

GBPUSD has lost ground over the past two weeks, failing to make gains after a long period of consolidation. Cable has now erased the recent gains and is back near 1.27.

In the weekly timeframe, GBPUSD is near the upper boundary of a descending corridor that has been in place since 2008. A break above would be a significant event, but the basic scenario in such cases is a reversal to the downside with a hold within the range. This week's events have enough potential to put an end to this consolidation.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)