UK labour market deteriorates despite falling unemployment rate

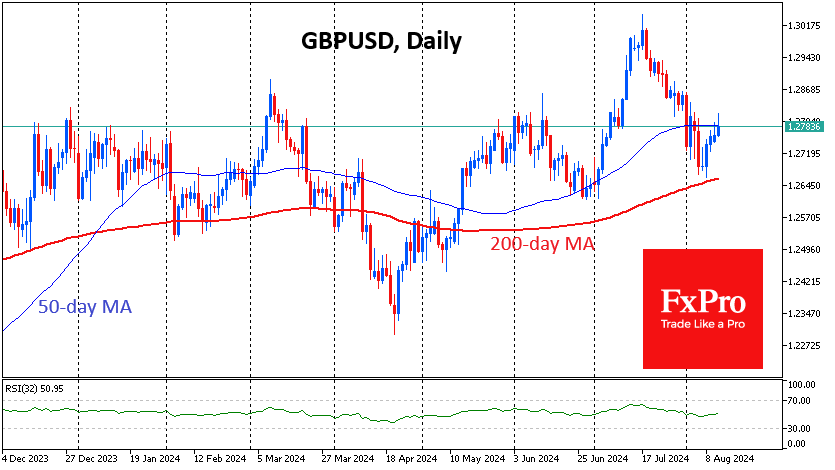

The British Pound jumped 0.25% against the Dollar and 0.33% against the Euro due to the employment data. Although key parameters of the report exceeded market expectations, the overall negative trend remains.

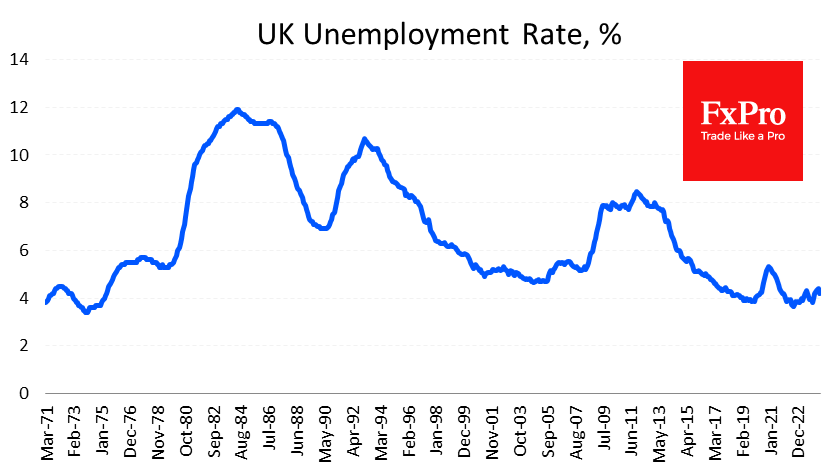

In the three months to June, the unemployment rate fell to 4.2%, in sharp contrast to the previous two months (4.4%) and beating the expected rise to 4.5%. Although the current data are well above the low of 3.6% recorded two years ago, markets have taken a positive view of the turnaround.

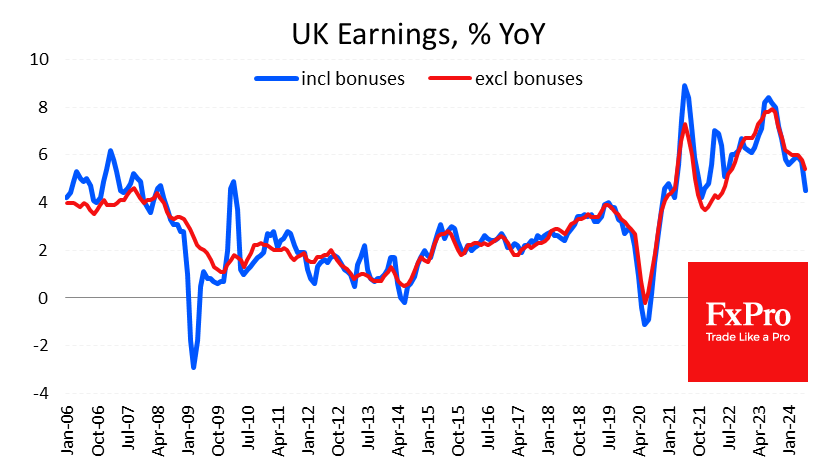

Wage growth excluding bonuses also beat expectations, rising 5.4% year-on-year in the three months to June, well above the 4.6% expected.

However, in our view, the market is too focused on looking for positives to confirm a general recovery in risk appetite. At the same time, negative signals from the labour market remain unaddressed.

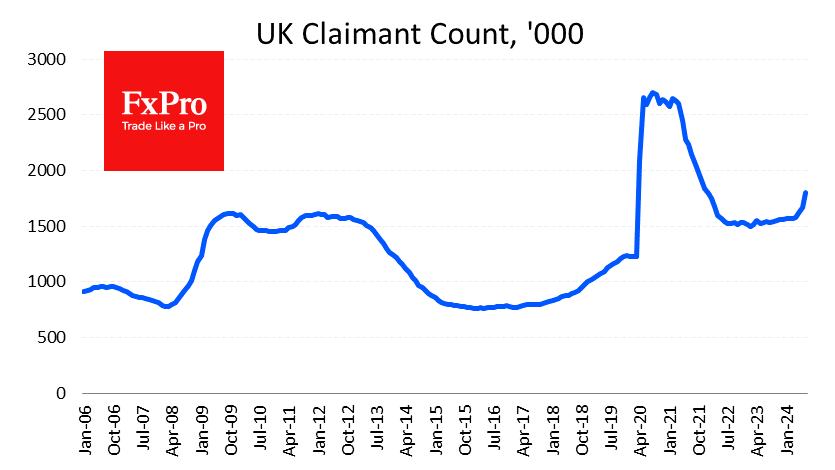

Applications for unemployment benefits rose by 135,000 in July. Month-on-month increases were higher only during the pandemic and at the beginning of 2009 as a result of the financial crisis.

Total wages and salaries (i.e. including bonuses) rose by 4.5% year-on-year, the slowest pace since late 2021. We see the slowdown in this figure as a more important driver of spending pressures than payouts, excluding bonuses.

GBPUSD managed to hold above the 200-day moving average at 1.2650 early last week and is still trying unsuccessfully to break above the 50-day moving average at 1.2780. The key technical level for us is the 1.2850 area, which is the 200-week moving average that has acted as resistance for the past 13 months. The latest macroeconomic data tilts the scales towards the sellers.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)