Upbeat Job Data Fuels Dollar Strength

Upbeat Job Data Fuels Dollar StrengthThe U.S. ADP Nonfarm Employment Change exceeded expectations, reaching 164k, signalling the resilience of the job market. Simultaneously, Initial Jobless Claims dropped to 202k, indicating a robust labour market. U.S. equity markets responded by trading with downward pressure, and the dollar stabilised as investors perceived that the Federal Reserve might maintain the current interest rate level due to the strength of the labour market. However, the Japanese Yen faced continued weakness, partly attributed to the tragic earthquake at the beginning of the year, leading to speculation that the Bank of Japan might delay any shift in monetary policy, causing a softer Yen. Additionally, oil prices settled nearly 1% lower as U.S. crude oil stockpiles reached their highest level in decades, suggesting pessimism about demand in the U.S.

Current rate hike bets on 31 January Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (93.8%) VS -25 bps (6.2%)

Market Movements

DOLLAR_INDX, H4

DOLLAR_INDX, H4

The Dollar Index climbed against a basket of major currencies, fueled by robust U.S. economic indicators that tempered expectations of Federal Reserve interest rate cuts. Key data from the ADP National Employment Report revealed a notable uptick in U.S. private payrolls, surpassing market forecasts with a 164,000 job addition in the previous month. Concurrently, initial jobless claims exhibited a decline, falling by 18,000 to a level of 202,000—underscoring the dollar's bullish sentiment.

The Dollar Index is trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 64, suggesting the index might enter overbought territory.

Resistance level: 102.60, 103.45

Support level: 101.75, 101.30

XAU/USD, H4

Gold prices experienced marginal depreciation following the release of favorable U.S. economic data. The commodity's trajectory remains ambiguous, prompting market participants to closely monitor pivotal U.S. employment metrics—including the Nonfarm Payrolls and unemployment rate—to ascertain potential price movements and market sentiment.

Gold prices are trading flat following the prior breakout below the previous support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 42, suggesting the commodity might experience technical correction since the RSI rebounded sharply from oversold territory.

Resistance level: 2055.00, 2090.00

Support level: 2020.00, 1985.00

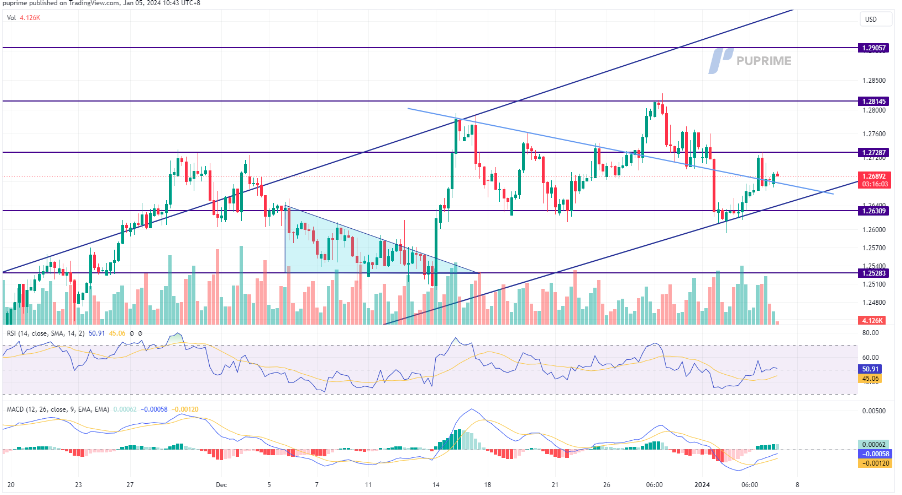

GBP/USD,H4

The GBP/USD pair faced challenges in maintaining its position above the psychological level of 1.2700, with the upcoming U.S. Nonfarm Payroll data adding to the pressure. The British Pound's earlier bullish momentum was impeded by robust U.S. job data released recently, fueling expectations that the Federal Reserve might maintain interest rates at a restrictive level for an extended period.

The GBP/USD price movement was steadied yesterday as the strengthening of the dollar hindered the bullish momentum. The RSI remains in an upward trajectory while the MACD approaches the zero line from below, suggesting that bullish momentum is forming.

Resistance level: 1.2728, 1.2815

Support level: 1.2528, 1.2437

EUR/USD,H4

The EUR/USD pair remains under substantial downward pressure as the U.S. dollar continues to strengthen. Robust U.S. job data has bolstered the dollar, with market expectations leaning towards the Federal Reserve maintaining the current interest rate level for an extended period. Traders are now eagerly awaiting the Euro's Consumer Price Index (CPI) reading to assess the euro's strength.

The EUR/USD has broken below its uptrend channel and is trading with intense downward pressure. The MACD has been hovering below the zero line while the RSI flowing at below 50 level suggests the bearish momentum remains.

Resistance level: 1.1041, 1.1138

Support level: 1.0866, 1.0775

USD/JPY,H4

The Japanese Yen experienced depreciation as the USD/JPY pair successfully breached its long-term downtrend resistance level, in place since mid-November. The Yen's continued decline is attributed to market perceptions that the Bank of Japan (BoJ) may postpone its anticipated monetary policy shift due to a tragic earthquake that occurred on the first day of the new year.

USD/JPY broken above its long-term downtrend resistance level suggests a bullish bias for the pair. The RSI has broken into the overbought zone while the MACD continues to diverge above the zero line, suggesting the bullish momentum is strong.

Resistance level: 145.35, 146.88

Support level: 143.82, 141.64

Dow Jones, H4

U.S. equity markets continued their descent, extending losses into 2024 amidst escalating market volatility and anticipation surrounding the inaugural 2024 U.S. employment data release. A modest uptick in U.S. Treasury yields, subsequent to the positive economic data announcement, further eroded the appeal of the equity market, prompting investors to reallocate capital from high-risk assets.

The Dow is trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 54, suggesting the index might extend its losses since the RSi retreated sharply from overbought territory.

Resistance level: 37850.00, 39275.00

Support level: 36735.00, 35950.00

CL OIL, H4

Oil prices retracted from resistance levels, influenced by technical adjustments and lingering apprehensions regarding the global economic landscape. The market observed significant gasoline and distillate stock accumulations, notably with gasoline stocks surging by 10.9 million barrels to 237 million barrels—the most substantial weekly increase in over three decades. Contrarily, U.S. crude inventories registered a decline of 5.503 million barrels, surpassing market expectations of a 3.200 million barrel drawdown, which mitigated downward pressure on oil prices.

Oil prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 54, suggesting the commodity might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 72.85, 78.65

Support level: 68.00, 64.85