USDCAD bounce proves unsustainable

USDCAD has surrendered much of its May gains after repeated attempts to break above the 1.4000 mark faltered, pushing the pair back into negative territory this week.

Adding to the pressure, Trump’s narrowly passed tax-cut bill in the House on Thursday is expected to significantly increase the already ballooned federal debt. This development raises concerns about a potential default and threatens the dollar’s safe-haven feature.

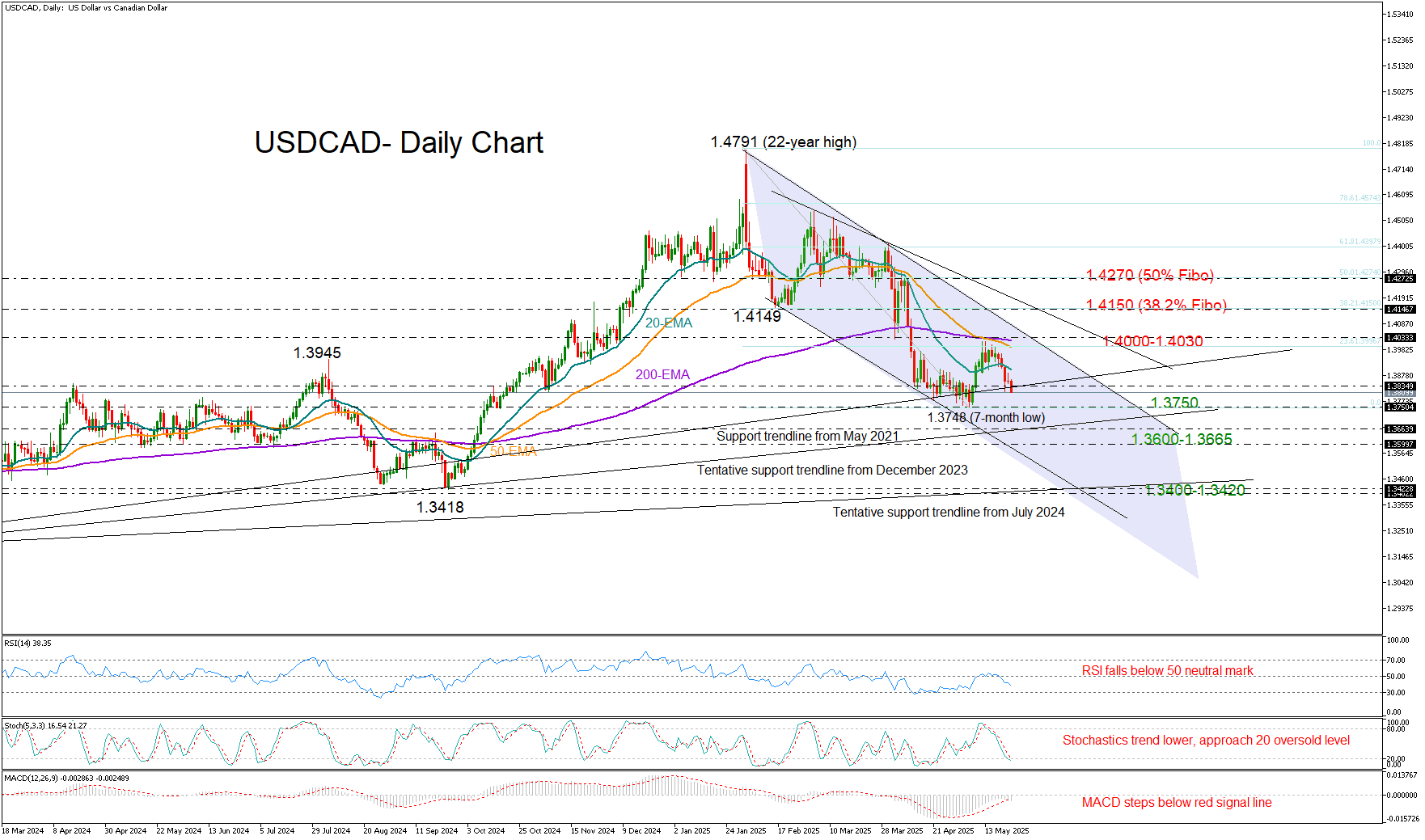

From a technical perspective, the pair is now seeking support near the familiar trendline at 1.3827, drawn from the 2021 low, after failing to convincingly surpass the 23.6% Fibonacci retracement level of the February–May downtrend. If this support level also gives way, attention will shift to the April low of 1.3748, and then towards a more critical support zone between the tentative trendline at 1.3663 and the lower boundary of the descending channel at 1.3600. A break below this region could worsen the medium-term outlook, potentially driving the pair down to the September 2024 double-bottom area around 1.3420.

Technical indicators suggest continued downside potential. The RSI remains above the oversold threshold of 30, and the stochastic oscillator has yet to bottom out below 20, indicating that selling interest may persist.

For the outlook to improve, bulls would need to push decisively above 1.4000 and overcome both the 50- and 200-day exponential moving averages (EMAs), which have recently formed a death cross. The upper boundary of the descending channel lies nearby as well. A bullish breakout from this zone could open the door to test the 38.2% Fibonacci retracement level at 1.4150, followed by the 50% level at 1.4270.

In summary, USDCAD remains under bearish pressure and may continue to struggle unless the 1.3835 region can effectively stem halt the current selling momentum.

.jpg)