USDCAD slows down before BoC rate decision

USDCAD opened with mild losses on Wednesday after Tuesday’s remarkable rally stalled near last week’s resistance of 1.3593. Traders were also in a wait-and-see mode ahead of the Bank of Canada’s rate decision at 15:00 GMT.

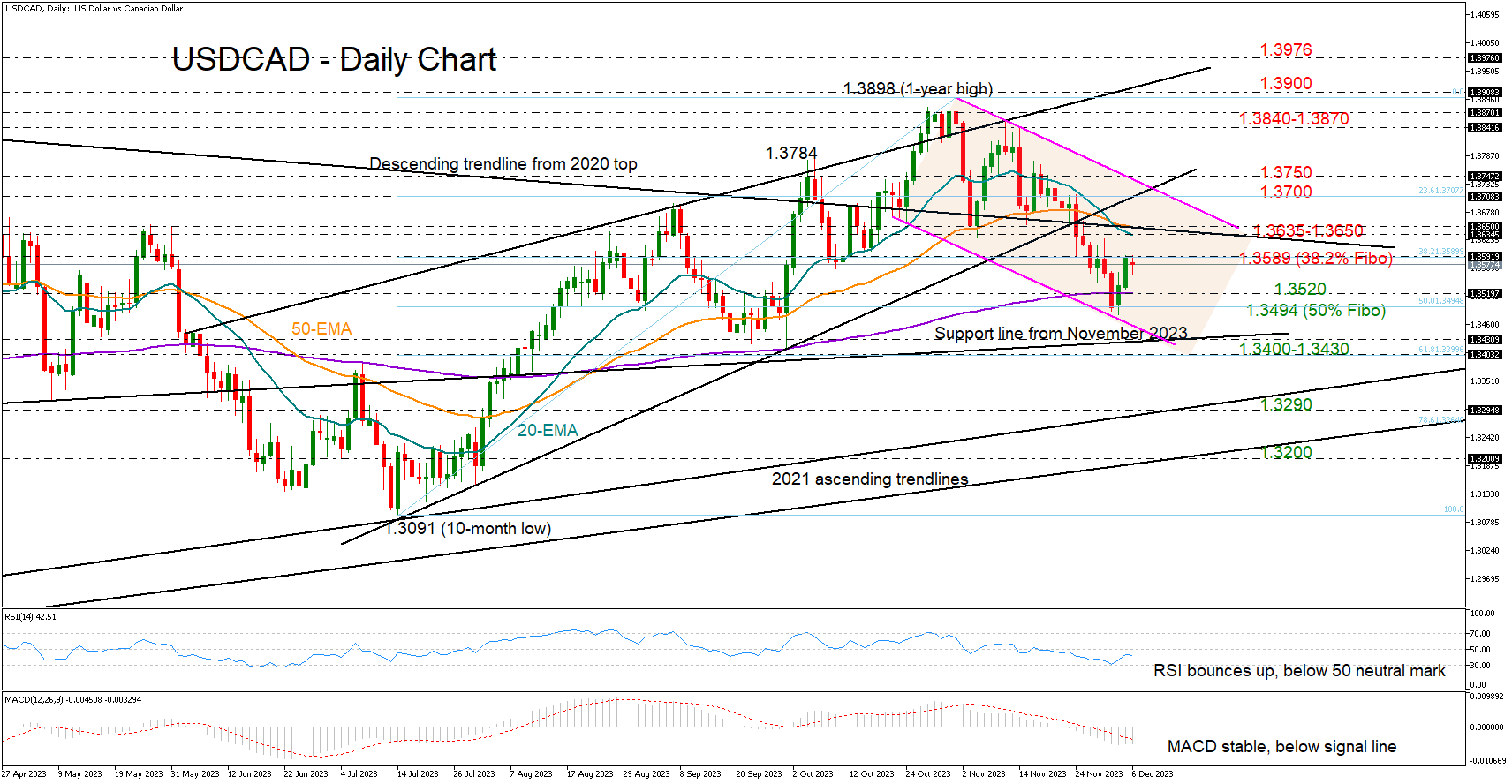

The 1.3593 bar overlaps with the 38.2% Fibonacci retracement of the July-October uptrend, making a pullback likely. Yet, the RSI has yet to crawl above its 50 neutral mark despite bouncing off oversold levels and the MACD is still flattening below its red signal line, suggesting that the latest rebound has not boosted buying confidence yet.

The 20- and 50-day simple moving averages (SMAs) and the descending trendline from the 2020 top could also cap any potential increases around 1.3650. If the bulls manage to breach that border, the 23.6% Fibonacci of 1.3700 and the 1.3750 restrictive region could create new risks, delaying a forceful rally to 1.3840-1.3870.

A bearish correction could initially stabilize somewhere between the 200-day SMA and the 50% Fibonacci mark of 1.3494. Should sellers dominate there, the price could slide towards the constraining line from November seen at 1.3425 or lower around the 61.8% Fibonacci of 1.3400. Additional losses could persist until the 2021 ascending trendline comes under examination within the 1.3290-1.3300 area.

In brief, USDCAD has not escaped downside risks despite regaining some ground this week. A durable recovery above 1.3700-1.3750 might be necessary for an upward outlook revision.

.jpg)