USDJPY Eyes 1990 Highs: Intervention or Reversal?

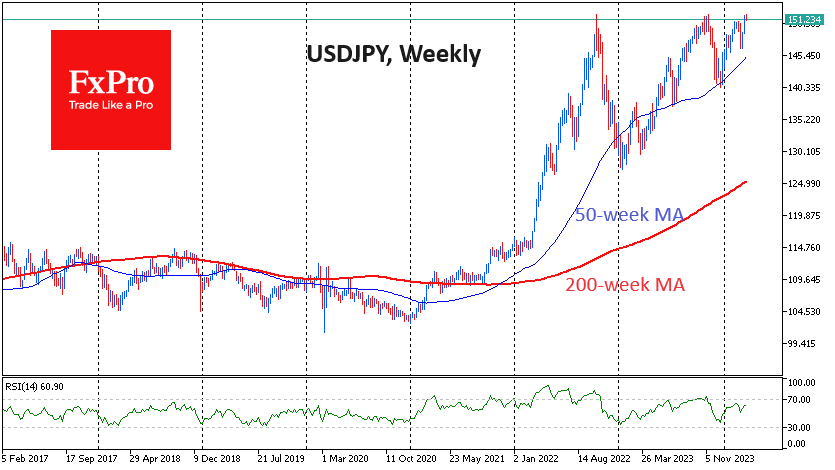

The reversal of the Bank of Japan's monetary policy tightening at the beginning of March not only failed to reverse, but also added to the Yen's weakening trend. The systematic pressure on the Japanese currency raises even more questions, given that the Fed and ECB are less than three months away from widely expected rate cuts.

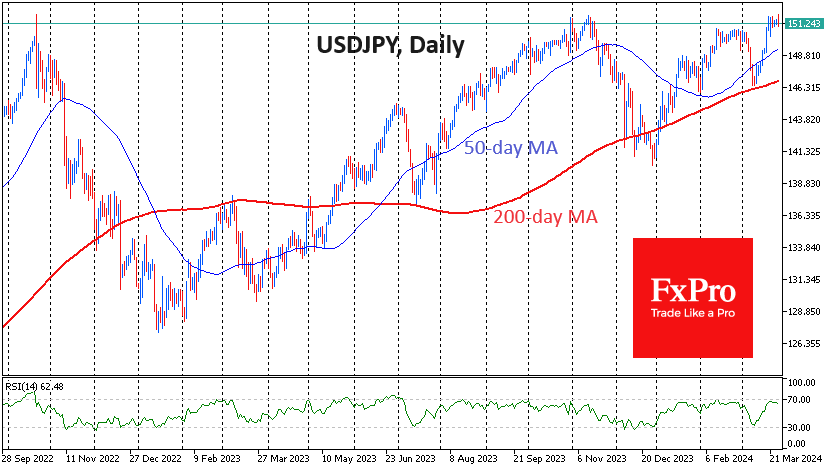

The USDJPY rose to 151.97 on Wednesday morning, seven pips above the November 2022 high and four pips above the October 2022 high, when intervention reversed the rate sharply. Wednesday's high was the highest since 1990.

The 152 level looks like a tried and tested intervention zone to prevent the Yen from weakening. In recent days, we have heard repeated statements from government and central bank officials that there is no fundamental reason for the Yen to weaken. Such signs sound like the threat of intervention, which is dangerous for short-term speculators.

Moreover, this is the third time in two years that the Yen has approached this level. On the previous two occasions, we saw a strong and sustained reversal, and the market is close to forming a reflex against this level.

However, the bulls also have a strong argument on their side.

Corrections are becoming increasingly shallow. USDJPY lost 16% in three months after approaching 152 in 2022. In 2023, however, the decline was around 7.5%. At the end of February, the pair rose gently towards 151 and turned sharply lower but rallied again after a 3.5% decline.

The initial USDJPY spike in 2022 made an impressive contribution to inflation, as, at its peak, the pair was over 33% higher than a year earlier. Long-term yen volatility is falling, and inflation is on track to stabilise around the target of 2%. Therefore, it makes no sense for the Ministry of Finance and the Bank of Japan to continue making 152 a red line. We are likely to see more rhetoric and possibly more policy rate hikes in the coming months, but not as dramatic FX interventions as in 2022 or late 2023.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)