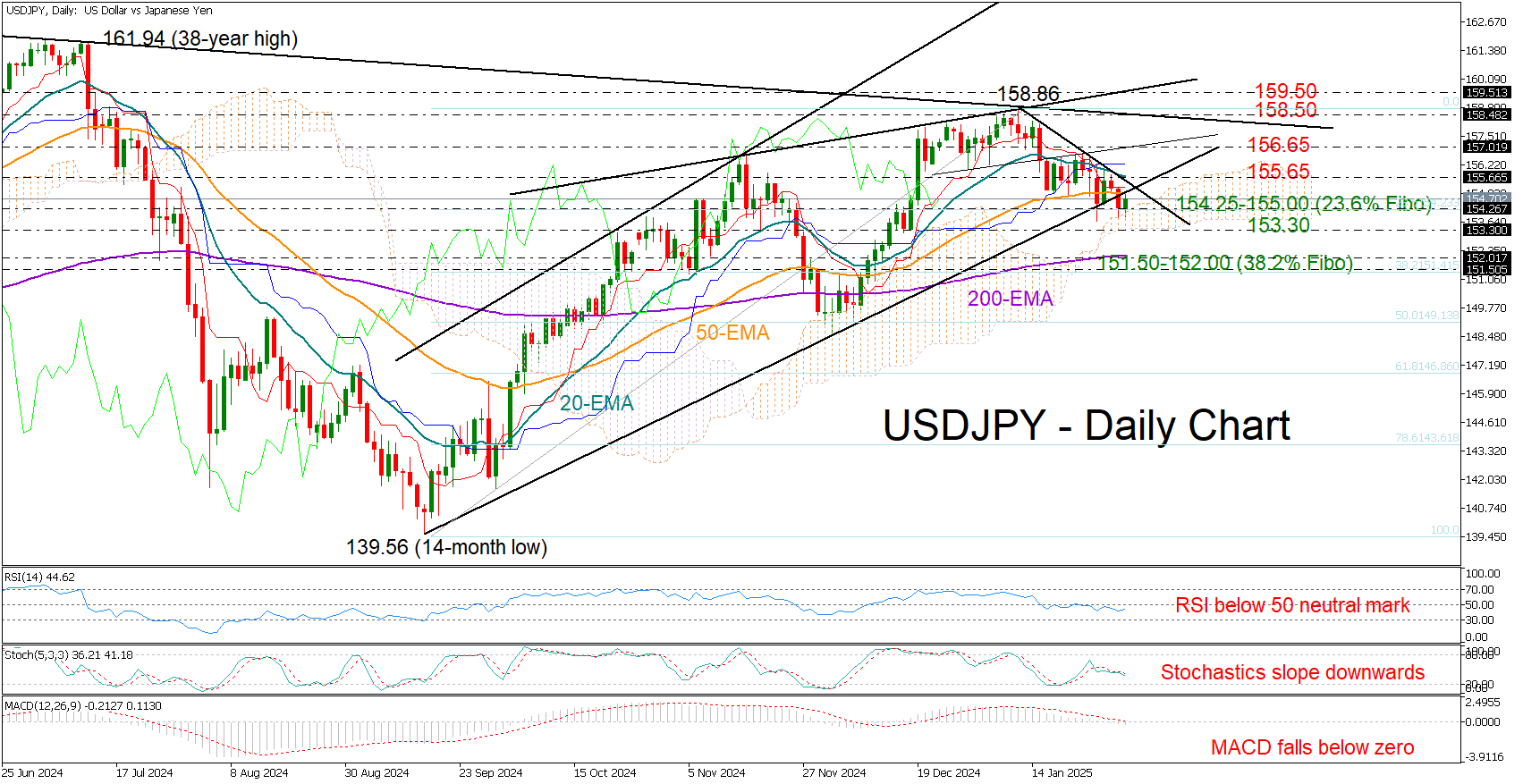

USDJPY holds support, but downside risks linger

USDJPY has held above the 154.25 floor for the fourth consecutive trading day despite Thursday’s downside pressures. However, this stability may not be enough to reignite buying interest.

Bearish risks remain in play as the RSI continues to hover around its 50 neutral mark, the Stochastic oscillator is decelerating, and the MACD is stepping into the negative region.

The 50-day exponential moving average (EMA) is currently keeping a lid on bullish attempts near 155.00 ahead of the US Core PCE inflation data. A break above it could attract buyers' attention, but the real test could come around the 20-day EMA at 155.65 –a key hurdle that bulls must clear to set the stage for a climb toward the 157.00 resistance zone. If momentum builds, traders could see a brief pause around 158.50 before the door opens to the critical 159.50 resistance line, where sellers may attempt to regain control.

If the 154.25 base –aligned with the upper band of the Ichimoku cloud –cracks, the pair could retest the 153.30 constraining zone before diving to 151.40-152.00. Additional losses from there could squeeze the price towards December’s base around 149.00, where the 50% Fibonacci retracement of the September-January upleg is sitting.

Overall, USDJPY remains under bearish pressure, with sellers watching for a sustained drop below 154.25 to accelerate downside momentum.