USD/JPY surges to 8-month high; is a pullback on the horizon?

USD/JPY has extended its bullish momentum, reaching fresh multi-month highs above the 153.00 mark. This rally was ignited by Monday’s bullish gap, triggered by the outcome of Japan’s LDP leadership election, and marks the sixth consecutive day of gains, reinforcing the medium-term uptrend that began in April.

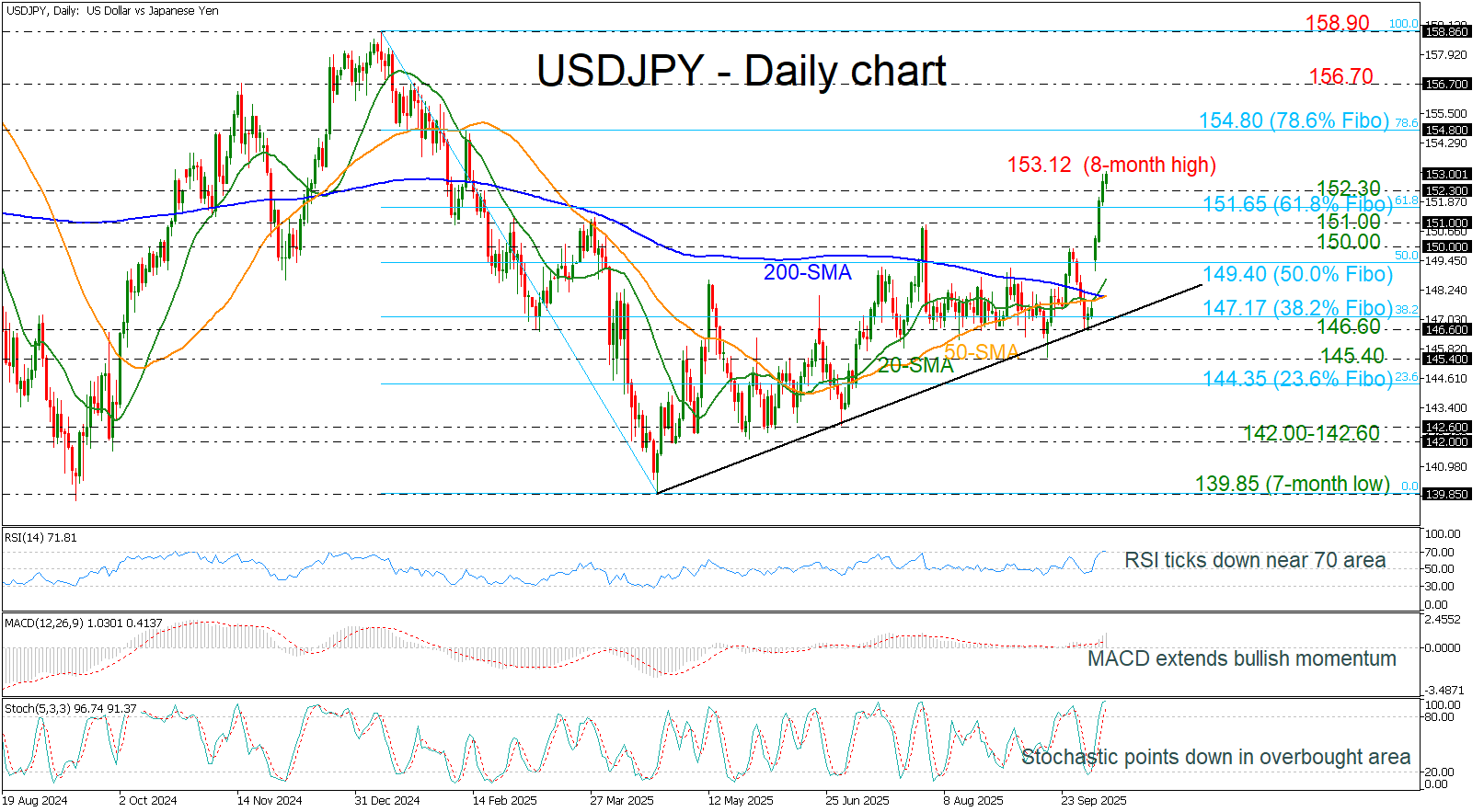

From a technical standpoint, momentum indicators present a mixed picture. Both the RSI and the stochastic oscillator are hovering in overbought territory, suggesting the potential for a short-term pullback. However, the MACD continues to build bullish momentum above both its trigger and zero lines, supporting the case for further upside.

Should buying interest persist, the pair could target the 78.6% Fibonacci retracement level of the 158.90–139.85 decline, located at 154.80. Nonetheless, psychological resistance around the 154.00 handle may act as a temporary barrier.

On the downside, a corrective move could be triggered by weakening momentum signals. Initial support is seen at 152.30, followed by the 61.8% Fibonacci level at 151.65. A deeper retracement could bring the 150.00–151.00 support zone into focus.

As USD/JPY remains firmly in bullish territory, technical indicators suggest caution may be warranted in the short term. A sustained break above 154.00 could open the door to further gains, but traders should remain alert to potential corrective moves, especially as momentum begins to fade.