USDJPY sustains its 2024 bullish setup

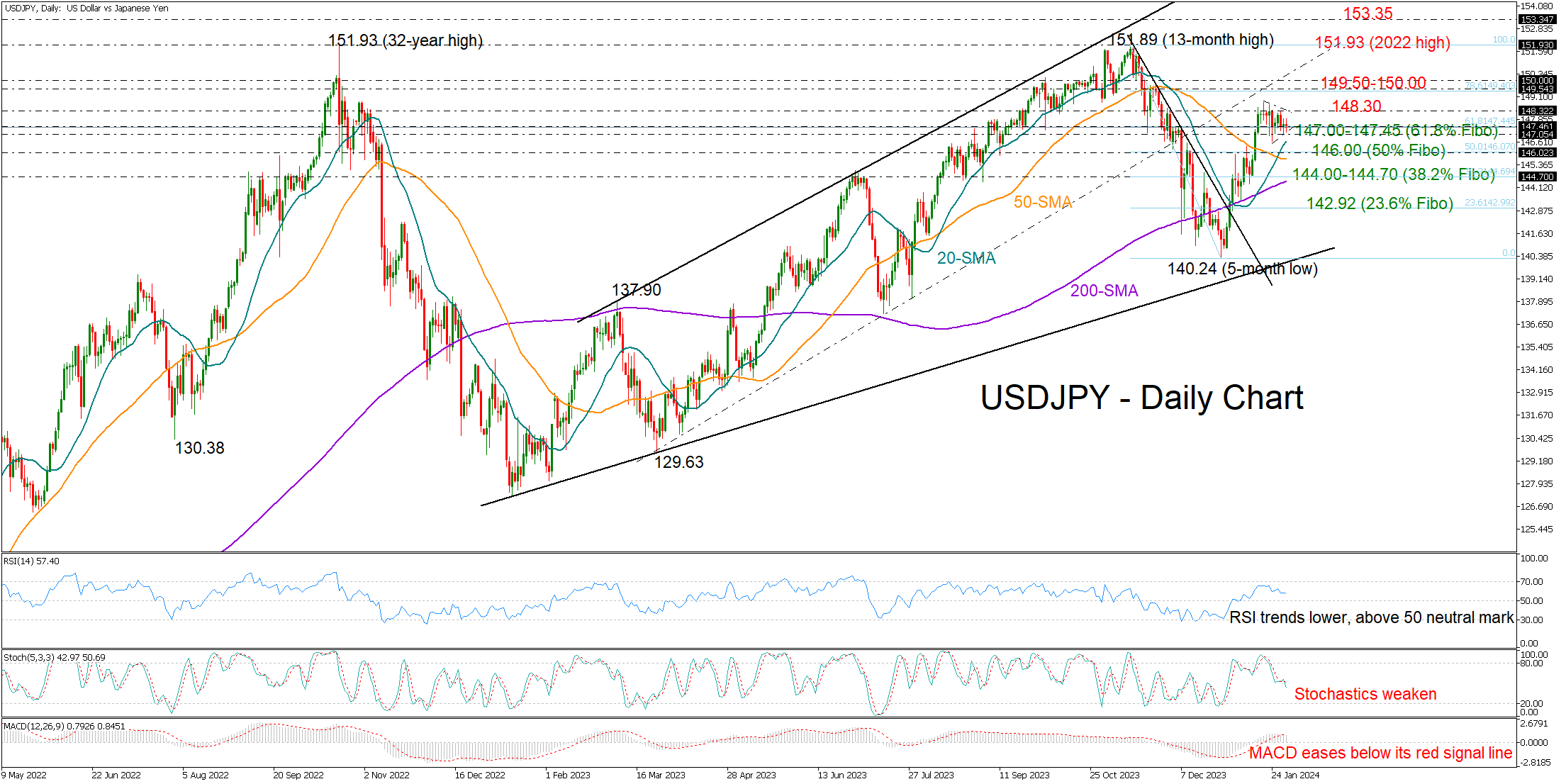

USDJPY has been facing difficulties in surpassing the 148.30 region for almost two weeks, but the 147.45 region, which coincides with the 61.8% Fibonacci retracement of the November-December downleg, kept bearish forces in control, sustaining January's almost 5% rally.

The momentum indicators have shifted southwards, pointing to more losses ahead as investors are hoping to get more details about the timing of rate cuts when the Fed announces its policy decision today at 19:00 GMT. On the other hand, the trend signals are more encouraging. The 20-day simple moving average (SMA) crossed above the 50- and 200-day SMAs, providing some optimism that the 2024 upleg has not peaked yet.

A close above the nearby 148.30 resistance is required for an acceleration towards the 149.50-150.00 territory. If the latter proves easy to pierce through, the door will open for the 13-month high of 151.89 registered in November and the 2022 top of 151.93. Additional gains from there could face some congestion near the 153.35-153.60 barrier last seen during 1990 and 1987.

On the downside, a slide below 147.00 and the 20-day SMA could immediately pause around the 50% Fibonacci level of 146.00. Breaking lower and beneath the 50-day SMA, the bears could head for the 200-day SMA currently converging towards the 38.2% Fibonacci mark of 144.70. If the 144.00 bar fails to stop the decline too, the next stop could be around the 23.6% Fibonacci of 142.92.

In brief, USDJPY is sending mixed signals. An extension above 148.30 or below 147.00 could provide new direction to the market.

.jpg)