XAUUSD Analysis: Safe-Haven Correction on Short-term Recovered Optimism

Fundamental Analysis of XAUUSDXAUUSD Key Takeaways

- Stronger-than-expected U.S. corporate earnings have boosted investor optimism, fueling a rally in risk assets such as the U.S. and global stock markets on Tuesday. In response, safe-haven assets—including gold, the Japanese yen, and the Swiss franc—experienced a pullback.

- However, this optimism may prove short-lived. Macro headwinds, including uncertainty over President Trump’s trade policies and the escalating U.S.-China trade war, continue to pose significant risks to market sentiment.

- While markets are pricing in potential Fed rate cuts later in 2025, the Federal Reserve has yet to provide clear guidance. If inflation fails to ease—particularly as the impact of the recent “reciprocal tariffs” becomes more evident in upcoming inflation data—hopes for rate cuts could fade, potentially leading to renewed market volatility and further downside in both risk assets and gold.

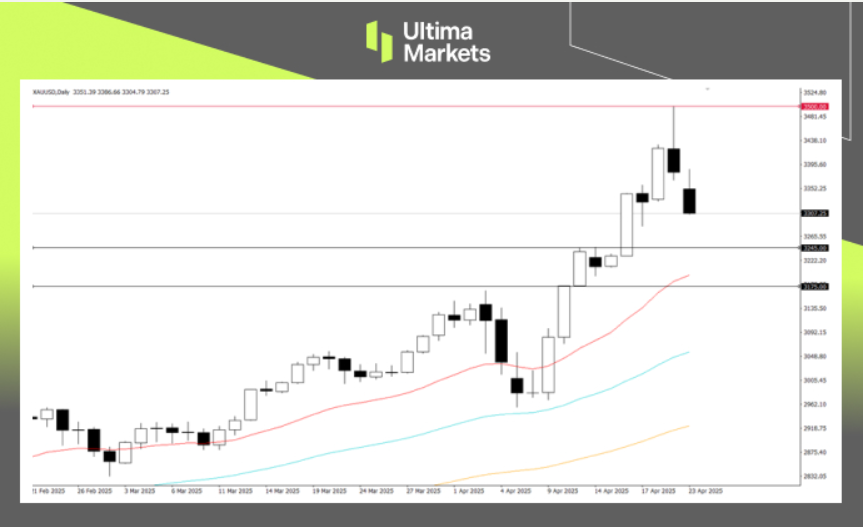

Technical Analysis of XAUUSD Daily and Hourly ChartsXAUUSD Daily Chart Insights

(XAUUSD Daily Price Chart, Source: Ultima Markets MT5)

- Candlestick Analysis: A strong upper-wick bearish candlestick formed on the daily chart after gold tested the key psychological level of $3,500. This pattern signals notable selling pressure and profit-taking following the recent sharp rally, suggesting a potential short-term corrective move.

- Trend Direction: The broader bullish trend remains intact, but the recent price action may indicate the beginning of a corrective phase after nearly two weeks of strong gains. This could develop into a short-term bearish retracement within the context of a larger upward trend.

XAUUSD 1-hour Chart Analysis

(XAUUSD, H2 Price Chart, Source: Ultima Markets MT5)

- Corrective Wave: The recent sharp sell-off indicates that gold has entered a confirmed short-term corrective phase, following an extended bullish run. Current price action reflects a bearish setup in the short term.

- Consolidation Range: Immediate support lies at $3,290, where a technical rebound may occur. However, with the correction likely to persist, upside potential may be limited toward the $3,350 or $3,380 resistance levels.

How to Navigate the Forex Market with Ultima Markets To navigate the complex world of trading successfully, it’s imperative to stay informed and make data-driven decisions. Ultima Markets remains dedicated to providing you with valuable insights to empower your financial journey.

For personalized guidance tailored to your specific financial situation, please do not hesitate to contact Ultima Markets.

Join Ultima Markets today and access a comprehensive trading ecosystem equipped with the tools and knowledge needed to thrive in the financial markets.

Stay tuned for more updates and analyses from our team of experts at Ultima Markets.

Learn more: https://bit.ly/4gWTyEA

—–

Legal Documents

Ultima Markets, a trading name of Ultima Markets Ltd, is authorized and regulated by the Financial Services Commission “FSC” of Mauritius as an Investment Dealer (Full-Service Dealer, excluding Underwriting) (license No. GB 23201593). The registered office address: 2nd Floor, The Catalyst, 40 Silicon Avenue, Ebene Cybercity, 72201, Mauritius.

Copyright © 2025 Ultima Markets Ltd. All rights reserved.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.