Yen awaits BoJ decision, stocks hit new records

US equities set another record

Shares on Wall Street reached a new all-time high last week, as the enthusiasm surrounding artificial intelligence went into overdrive and another round of solid economic data reinforced hopes that the US economy can avoid a recession.

Companies with direct exposure to artificial intelligence such as Nvidia spearheaded the rally. Investors increasingly view these stocks as ‘bulletproof’ because even if the global economy loses steam, demand for AI products will still remain elevated, shielding corporate profits from any macroeconomic headwinds.

Another element behind the blistering market rally was the Michigan consumer survey, where inflation expectations declined while consumer confidence improved significantly, painting a rosy picture of the American economy. The S&P 500 gained 1.2% to eclipse its previous record high, set in early 2022.

One interesting twist is that rising bond yields did not put the brakes on the stock market. Equities reached new records even as investors unwound some bets of rapid-fire Fed rate cuts, with the implied probability for a cut in March falling to 43%, down from nearly 90% last month.

Therefore, good news on the economy also proved positive for stocks, demonstrating that equities can handle higher bond yields, if the rise in yields is driven by healthy factors.

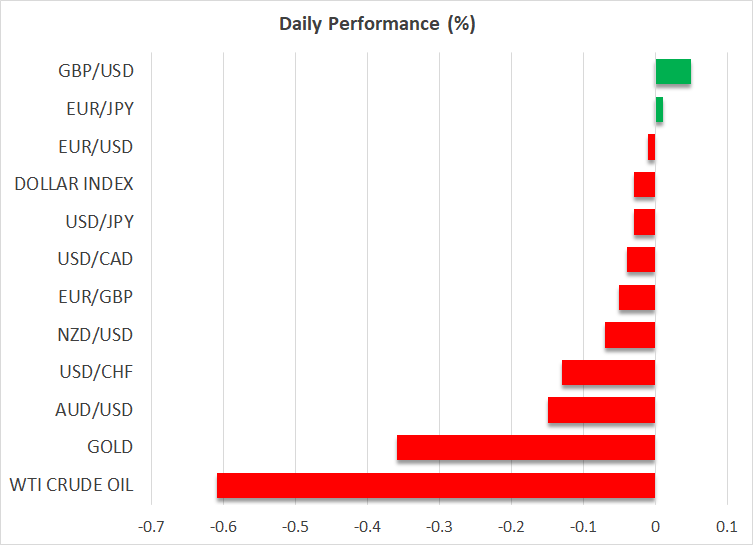

Dollar treads water, gold trades heavy

In the FX arena, the dollar was unable to capitalize on the encouraging US data and fading Fed rate-cut bets. It appears that the euphoria in riskier assets dampened demand for safe haven instruments such as the dollar, negating the boost from the interest rate channel.

The next major event for the dollar and equities will be the release of US GDP data for Q4 on Thursday, where there is some scope for an upside surprise considering that the estimate of the Atlanta Fed GDPNow model is much higher than official forecasts.

Gold prices have struggled so far this year, losing about 2% over the last three weeks as the resurgence in US yields and a firmer dollar overpowered safe haven flows stemming from geopolitics. A stronger-than-expected US GDP print on Thursday could keep the precious metal under pressure, turning the spotlight towards the recent lows near $2,000.

Chinese stocks sink, Bank of Japan decision next

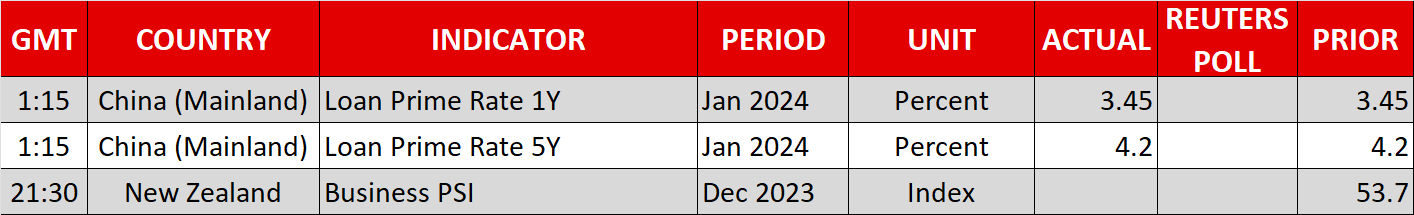

Over in China, the central bank kept rates unchanged today, despite mounting pressure to stimulate an economy that is battling deflation. The decision suggests Chinese authorities want to avoid further increases in private debt, which is prudent from a financial stability perspective, but suggests that growth could remain stuck in slow gear for some time. This helps explain why local stocks tanked, with Hong Kong shares reaching their lowest levels since November 2022.

Looking ahead, the Bank of Japan will announce its next decision early on Tuesday. The yen has lost 5% of its value against the US dollar already this year and the BoJ is unlikely to throw the battered currency a lifeline, as cooling inflation and a sharp slowdown in wage growth have convinced investors the central bank will delay its plans to exit negative interest rates.

The rest of the week is equally busy, featuring central bank decisions in the Eurozone and Canada, a flurry of data releases, as well as corporate earnings from iconic names such as Netflix, Tesla, Intel, and Visa.

.jpg)