Yen keeps sinking after Bank of Japan decision

Yen plummets - how close is FX intervention?

The Japanese yen continues to melt down, hitting new multi-decade lows against the US dollar after the Bank of Japan refrained from providing any concrete signals on further rate increases and following some disappointing inflation data from Tokyo.

Even though the BoJ revised its core inflation forecasts up a notch and dropped a reference to the amount of bonds it is buying, it stopped short of signaling it is prepared to raise rates again in the near future, dealing another blow to the devastated yen.

A sharp slowdown in Tokyo inflation did not help matters either. Dollar/yen sliced higher in the aftermath, surpassing the 156.50 zone in a move that will test the nerves of Japanese officials.

What is striking is how quiet the government has been on FX intervention. While officials have signaled readiness to act, they haven’t used language that would suggest intervention is truly imminent, such as describing yen moves as “excessive” or “one-sided”.

This ‘silence’ from Japanese officials speaks volumes in itself. It implies the real intervention threshold might still be some distance away, perhaps close to the 158 - 160 region in dollar/yen.

That said, being short the yen as the pair approaches this region is the equivalent of picking up pennies in front of a steamroller. The risk/reward does not appear attractive anymore, as intervention becomes increasingly realistic.

Dollar loses ground after mixed GDP report

Meanwhile in the United States, GDP growth was weaker than expected in the first quarter but inflation surprised on the upside, painting a picture of ‘light stagflation’ in the world’s largest economy that is a nightmare scenario for Fed officials.

Economic growth came in at an annualized 1.6% instead of the anticipated 2.4%, although a closer look at the GDP report reveals the miss was driven mostly by net trade and falling business inventories. On the bright side, domestic demand and investment remained healthy, so the GDP print wasn’t as bad as it seemed at first glance.

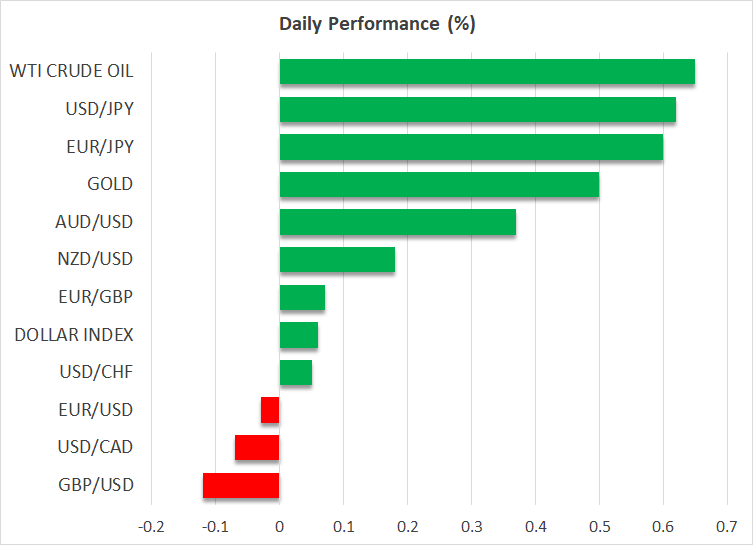

The dollar initially spiked higher as the hot inflation readings saw traders unwind more bets of Fed rate cuts, but surrendered those gains to ultimately trade lower as risk appetite improved, clipping the reserve currency’s wings.

Stocks and gold bounce back

The GDP report frightened equity markets as it pointed to softer growth but persistent inflation that could prevent the Fed from slashing rates. However, investors calmed down once they dissected the GDP details, and quickly piled back into stocks.

Solid earnings from Microsoft and Google spread more cheer after the closing bell, as both tech giants knocked it out of the park, pushing Wall Street futures higher.

In another deafening show of force, gold prices cruised higher once the GDP dust settled, defying the gravity exerted by rising bond yields once again. Central bank purchases and Asian retail demand seem to be the main drivers behind this extraordinary resilience.

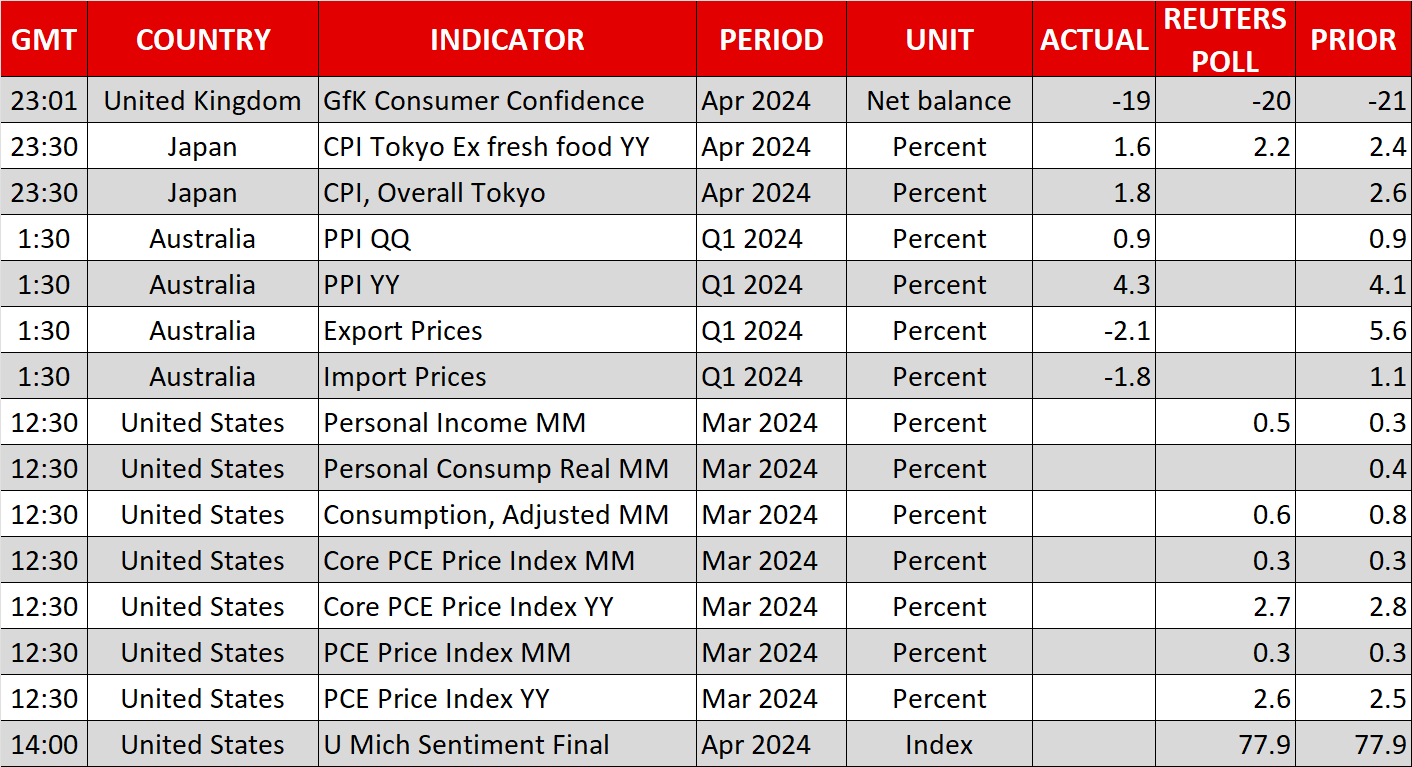

Finally, the spotlight today will fall on US core PCE inflation for March. Traders seem to be leaning towards a hotter-than-expected print, following the upside surprise in the quarterly PCE reading yesterday.

.jpg)